German labor market data, together with a report on the mood index in the eurozone economy, led to a decline in the euro in the morning, after another unsuccessful attempt to grow above the resistance of 1.1120, which was made against the backdrop of growth indicators in France.

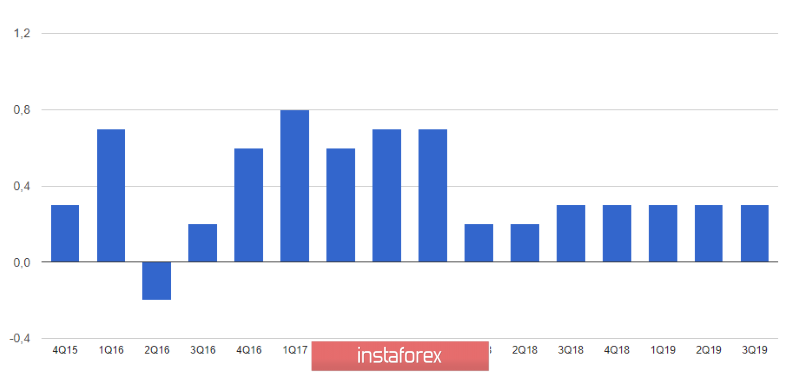

The report indicates that France's GDP for the 3rd quarter of this year grew by 0.3% compared with the 2nd quarter, while economists had forecast growth of only 0.2%. However, weak consumer spending is likely to put pressure on the economy in the future. According to data, consumer spending in France immediately fell by 0.4% in September of this year compared with August and increased by only 0.3% compared to September 2018. Economists had expected growth of 0.3%. In August, expenses were revised upwards to 0.1%.

As for Germany, the jump in the growth of unemployment benefits is direct evidence that the economy is slowly slipping into recession. Against the backdrop of a stagnating manufacturing sector and a sharp drop in exports, German GDP for the 2nd quarter indicated the possibility of a technical recession by the end of this year. Disappointing labor market data are evidence of this.

According to a report by the Federal Employment Agency, the number of applications for unemployment benefits in Germany grew by 6,000 in October this year, while economists expected an increase in applications by 3,000. Unemployment remained unchanged at 5.0%. The number of registered vacancies decreased by 60,000 and amounted to 765,000.

Additional pressure on the euro was provided by the report of the European Commission, which pointed to the growth of pessimism of company leaders. The prospects for the manufacturing sector in the eurozone leave much to be desired, and the spread of weakness in the service sector does not add joy.

According to the data, the sentiment index in the eurozone economy fell to a level of 100.8 points in October from 101.7 points in September. Company executives note a slowdown in external demand for goods in the manufacturing sector of the eurozone, which is directly related to the trade war between the US and China. Not surprisingly, moods have also worsened among service and retail companies.

Spanish inflation data was ignored by the market. The report indicates that Spain's preliminary harmonized by EU standards consumer price index grew by 0.2% in October, as well as in September. Economists had expected growth of 0.3%.

As for the technical picture of the EURUSD pair, all attention will be focused on the decision of the US Federal Reserve on interest rates. Many economists expect the rate to be lowered to 1.75%, while there is talk of a "technical pause" in lowering rates that the committee may take before the final December meeting this year. Most likely, this scenario will support the US dollar.

The bulls have already attempted to rise above the resistance of 1.1120, which again failed, so only a breakthrough of this range will lead to a strong bullish impulse of risky assets, and only the highs of 1.1150 and 1.1180 will limit the growth of EURUSD. If the Fed leaves the rates unchanged, then a break of support of 1.1090 will definitely lead to a test of lows 1.1075 and 1.1050.