If even after the publication of the decision of the US Federal Reserve System, the dollar tried to strengthen its position against the euro and the pound, even despite the reduction in rates, then the Fed Chairman's speech led to its sale, as traders did not hear statements that rates would no longer be reduced in this year.

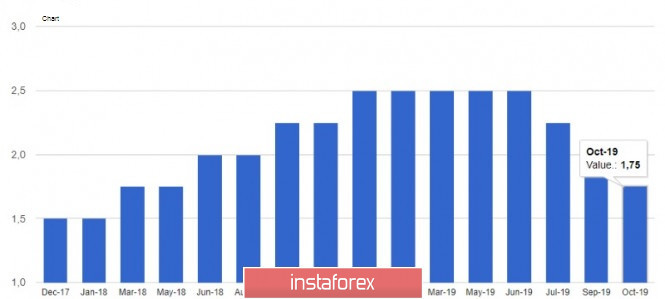

Yesterday, it was reported that the Fed has set the range of interest rates on federal funds between 1.50% and 1.75%. For such a decision, the Fed Open Market Committee voted 8 against 2. The discount rate was also lowered by 0.25 percentage points to 2.25%. The main reasons for lowering rates were the events in the world, as well as weak inflation in the United States. The hint of a pause after the third rate cut in 2019 led to the strengthening of the dollar, however, as I noted above, Powell ignored this topic, which frightened off buyers of the American dollar. The Fed said it would continue to closely monitor incoming information and on its basis to determine the appropriate policy course.

At a press conference, Fed Chairman Jerome Powell said the Fed had lowered rates to help create insurance against continued risks, but the current monetary policy is in good shape. Inflation is expected to rise to 2%, as well as a moderate economic recovery.

As for the prospects, Powell noted their movement in a more positive direction since the last meeting, but to change the position of the Fed, and it is about ending the cycle of lowering interest rates, which traders were waiting for, a significant reevaluation of the economy's prospects will be required. Among the favorable factors, the head of the Fed referred to a steady decline in trade tension, which would be favorable for business sentiment and, ultimately, for economic activity.

At the end of the meeting, it was not clear whether the Fed plans to lower interest rates further or this year changes in policy can no longer be expected. According to quotes for futures on US Federal Reserve rates, traders estimate the probability of a December decrease in federal funds rates at 21%. However, this will happen only if the US economic data deteriorates more rapidly than expected.

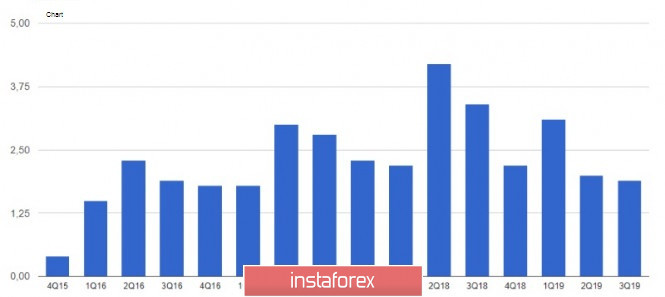

Yesterday's report on the growth rate of US GDP was better than economists' forecasts, however, it indicated a slowdown in the 3rd quarter compared to the 2nd. This happened due to a reduction in companies' investments, which were partially offset by strong indicators of consumer spending.

According to the Department of Commerce, US GDP for the 3rd quarter of 2019 grew by only 1.9% per annum, after a growth of 2.0% in the 2nd quarter of this year. Economists had expected growth of 1.6% per annum. As noted above, it was precisely the sharp drop in investment by companies in the 3rd, against the backdrop of a trade war with China, which led to a slowdown in GDP growth. Compared to the 3rd quarter of the previous year, GDP growth amounted to 2.0%.

Data on the number of jobs in the US private sector was slightly better than economists' forecasts. A report from ADP said that the number of jobs in the US private sector in October 2019 increased by 125,000, while economists forecasted growth by only 100,000. A decrease was observed only in the manufacturing sector, against the background of its decline. There, the number of jobs decreased by 13,000.

As for the current technical picture of the EURUSD pair, further growth depends on whether buyers of risky assets will be able to break above the highs of this month or not. The breakdown of the range of 1.1180 will lead to new purchases of the euro, and the target will be highs in the area of 1.1220 and 1.1260. But do not forget that today a number of important fundamental statistics on the eurozone are published – starting from inflation data and ending with a report on GDP growth. Weak macroeconomic indicators can harm the bullish trend, which will lead to a downward correction of the trading instrument to the support area of 1.1140 and possibly push the pair to a minimum of 1.1110.

The Canadian dollar yesterday fell against the US dollar after the Bank of Canada left the key interest rate unchanged at 1.75%. The statement said that Canada's economy is not protected from the effects of disputes in world trade and its sustainability will continue to be pressured.