As expected, the Federal Reserve reduced the refinancing rate for the third time in a row. This time, from 2.00% to 1.75%. It should be noted that the decision was not unanimous, as two members of the Federal Committee for Open Market Operations voted to keep the refinancing rate at the current level. No less curious is the fact that the contents of Jerome Powell's subsequent speech, almost to the point, coincided with the press release published at the end of the meeting. Usually, the speech of the head of the central bank reveals much more in detail the policy of the monetary authorities. This time, everything is slightly different. Due to this, the Federal Reserve justifies its decision with external factors, in the form of worsening growth prospects for the global economy. In addition, it was noted that the labor market is in excellent condition once again, and employment continues to grow despite the extremely low unemployment rate. However, it is also stated that this still does not lead to a significant increase in investment in fixed assets, which inhibits inflation, which remains below the target level of 2.0%. It is extremely interesting that both in the official press release and during the press conference, 1.8% was called the current inflation rate, while inflation is 1.7%. Apparently, in this way, the Federal Reserve hinted that it was waiting for the resumption of inflation growth, and did not even doubt such a development. Thus, you should not rely on the fact that the Federal Reserve System will continue to go on about the financial sector, and reduce the refinancing rate. Since inflation is growing, then you rather need to think about raising the refinancing rate.

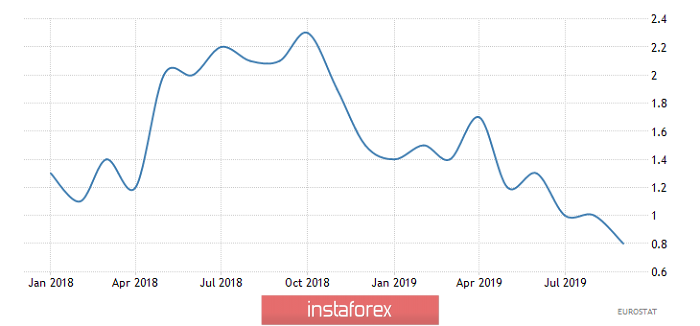

Today, all the attention of market participants will be focused to Europe, where a whole heap of extremely significant data is published. Moreover, such that no one will look at the published data on the labor market. At the same time, the unemployment rate should remain unchanged. Now, of its great importance, the first estimate of European GDP for the third quarter, which should show a slowdown in economic growth from 1.2% to 1.1%. However, the bad news does not end there, as preliminary data on inflation should demonstrate its decline from 0.8% to 0.7%. To simply put it, in Europe, everything indicates that the refinancing rate of the European Central Bank will be in the negative zone before the end of this year.

Inflation Rate (Europe):

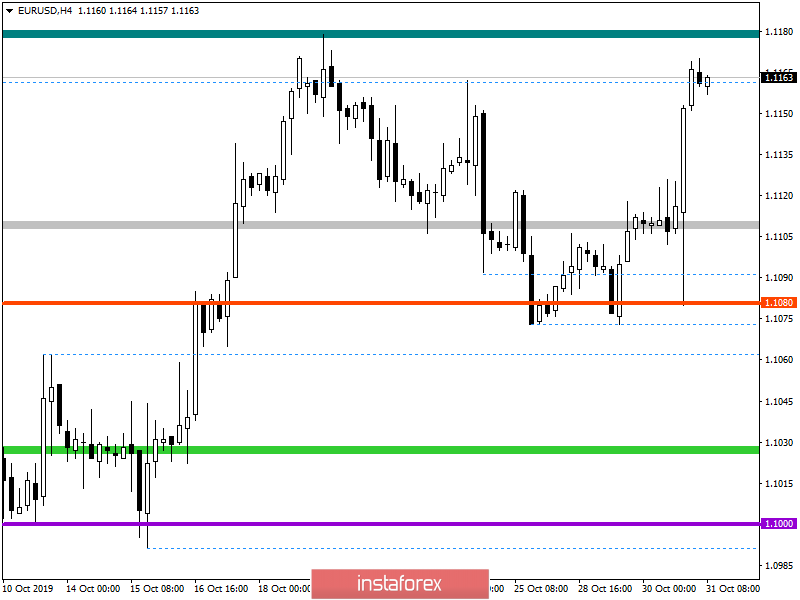

The EUR / USD pair was able to surprise by the impulsive upward movement, where the level of 1.1080 was affected at first, but according to the results, a jump to 1.1152 was formed. We described the cause and effect above. Now, we will talk about the fact that the recovery phase, which many had hoped for, did not happen on the scale that was expected. In fact, we got a 100% return to the point of resistance, where it all began, and thus, the question arises, what's next? In terms of a general review of the trading chart, we see that an oblong correction in the structure of the downtrend continues to exist.

It is likely to assume that no matter how strong the emotions were, common sense prevails and in this case, we just need a pullback. Thus, we consider the recovery in the direction of the level of 1.145-1.1140, as the first step. Then we follow the price fixing points.

Concretizing all of the above into trading signals:

- We consider long positions, in the case of a clear price fixing higher than 1.1185.

- Short positions, looking towards 1.1145-1.11140.

From the point of view of a comprehensive indicator analysis, we see that due to the next growth in long positions, indicators on the intraday and medium term take the upside. Short-term periods, on the other hand, are in the recovery phase, signaling sales.