The reaction of the market to the Fed's decision to cut the key interest rate by 0.25% with a decrease in the range to 1.50% -1.75% was expected by the markets.

The regulator decided to lower rates and, most importantly, announced that it would "monitor the incoming information and its impact on the forecast for the economy." In fact, he also made it clear that he is stopping, at least for now, since the decline in rates and their dynamis will be fully influenced by the incoming economic data.

At the same time, the market initially reacted to the published communique of the bank by a sharp increase in the US dollar, but then the comments of J. Powell, the head of the Federal Reserve, served as the basis for a sharp reversal of sentiment and the same rapid weakening of the US dollar. Today, as they say, after the fact, explanations of this appear as a slight change in the assessment of the situation by the markets in favor of the fact that now all attention will be fully focused on the emerging economic data and they just also can appear not strongly cheerful.

In our opinion, there is one more explanation of yesterday's "meat grinder" in the currency exchange market. It can be attributed to conspiracy theological, but, unfortunately, this is not so rare. It is likely that on Wednesday, major players "played" against the market. It should be understood that everyone expects the Fed's decision to actually suspend the process of cutting rates, which could clearly support the dollar. On the other hand, at Powell's controversial performance, these "players" began to play against the market, reaping a bountiful harvest. In any case, the dynamics of the euro / dollar pair clearly demonstrates this. Thus, the single European currency has no reason for growth amid the expected broad incentives, a more noticeable slowdown in the European economy, and what else should be noted that the ratio of interest rates of the ECB and the Fed is not in favor of the euro, although it grew upwards.

Now, after the "bloodbath", the attention of the market will be focused on the publication of data on employment in the United States, and if it turns out to be at least not much better, this could lead to a local reversal of the dollar and its active intraday growth in the currency exchange markets.

Forecast of the day:

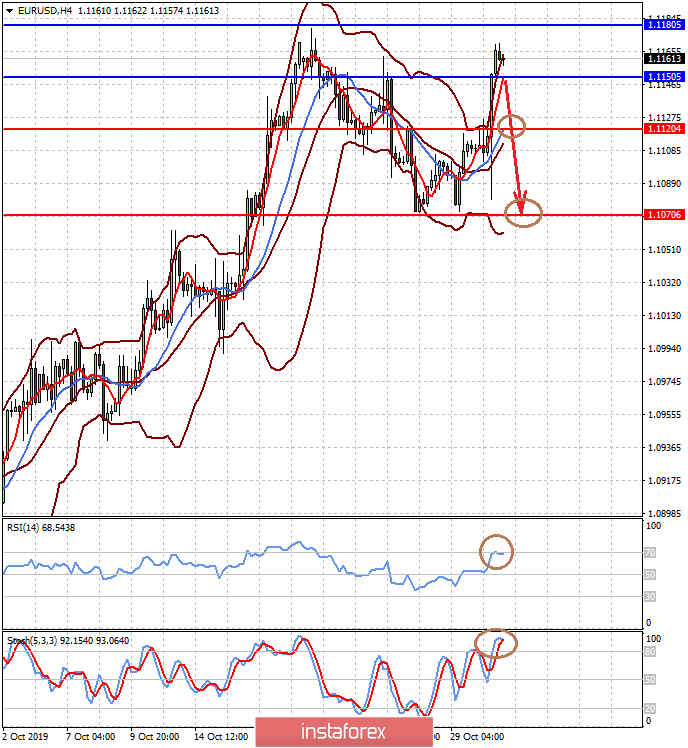

The EUR/USD pair is trading above the level of 1.1150. If it does not grow above 1.1180, there is a risk of it falling below 1.1150, which could lead to its correction to 1.1120. In addition, on Friday, if the data on employment in the States are higher than expected, this fall may continue to 1.1070.

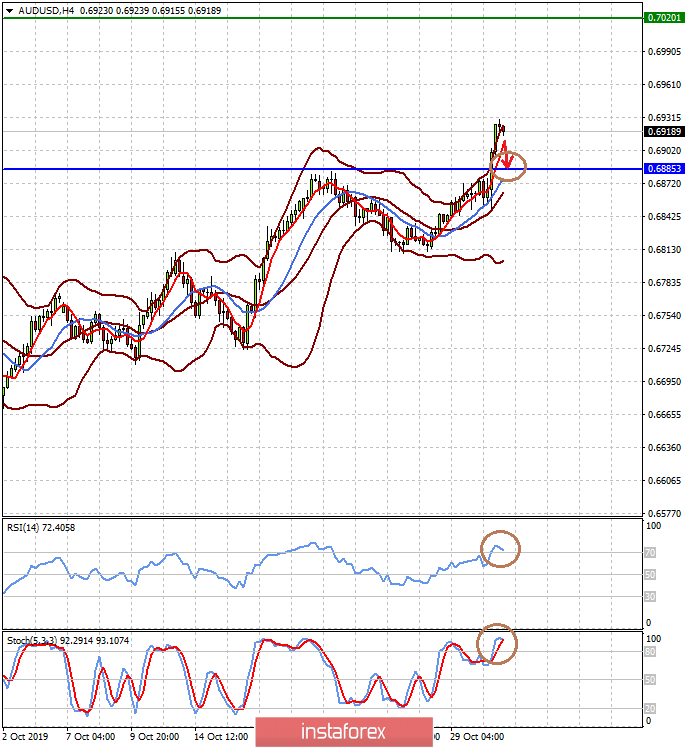

The AUD/USD pair began to implement a double bottom reversal pattern. However, before price growth resumes, it can adjust to the level of 0.6885 and stay above this level.