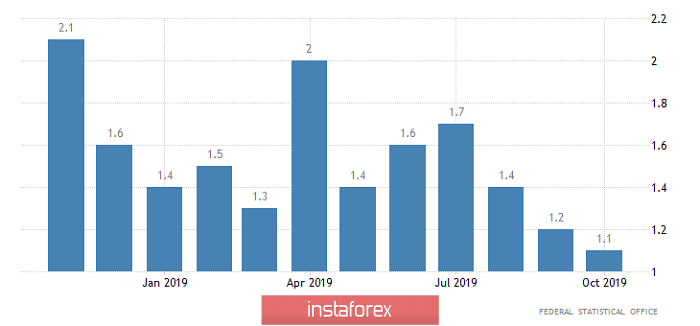

For the third time in a row, the Federal Reserve reduces the refinancing rate, which in itself should be seriously frightening. However, the decision to reduce the refinancing rate from 2.00% to 1.75% did not lead to serious consequences. This is partly due to the predictability of the outcome of the meeting of the Federal Committee on Open Market Operations. Firstly, the decision was not unanimous, as two votes were cast to keep the refinancing rate at 2.00%. Secondly, external factors, such as increasing risks of a slowdown in the global economy, were named the reason for the decline, while the state of the US economy does not cause the Federal Reserve System any concern. On the contrary, it is noted that the labor market continues to be just in excellent condition. Although it is regretted that employment growth, and with it consumer spending, does not lead to a corresponding increase in investment in fixed assets. Moreover, concern was expressed once again that inflation was below the target level of 2.0%. However, it is worth paying attention to the fact that in the press release, the current level of inflation denotes the mark of 1.8%. Jerome Powell repeated exactly the same thing during his press conference. That's only inflation in the United States is 1.7%. In addition, it has been at this level for two months in a row. Given the extreme meticulousness of such structures as the Federal Reserve System, it is difficult to imagine that this is a banal reservation. Most likely, in this way, the Federal Reserve hints that it expects inflation to rise and it does it as if it had no doubts at all. Therefore, we should not wait for further easing of monetary policy.

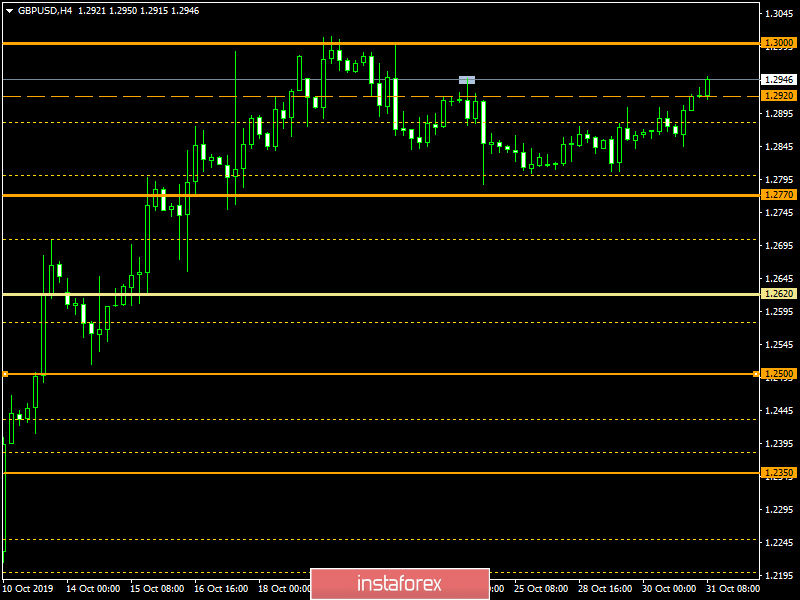

In addition to the meeting of the Federal Committee on Open Market Operations, there were other interesting events yesterday. Which, in many respects, had a beneficial effect on the dollar. Thus, ADP data showed an increase in employment from 93 thousand to 125 thousand, while they predicted growth by only 120 thousand. However, an increase in employment rates was made possible only by revising the previous results, from 135 thousand to 93 thousand. More so, the first estimate of GDP for the third quarter, although it showed a slowdown in economic growth, is still not as strong as expected. The economic growth slowed down from 2.3% to 2.0%, while it was feared that it would fall below 2.0% for the first time since 2016 .

GDP growth rate (United States):

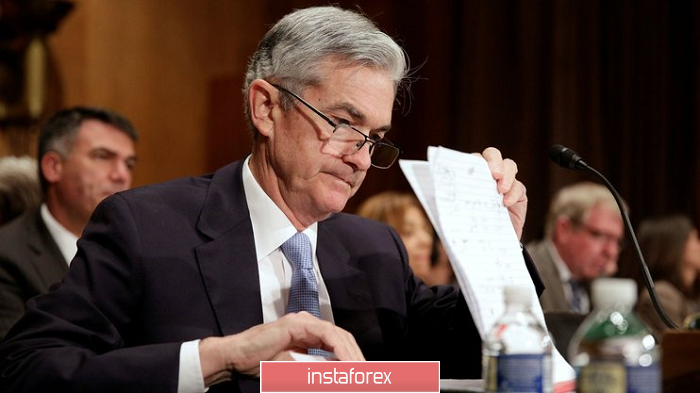

In Europe, a lot of important data was also published. Thus, in Spain, which is the fourth economy of the euro area, inflation remained unchanged, although they expected it to drop from 0.1% to 0.0%. Meanwhile, in France, which is the second eurozone economy, reported a slowdown in economic growth from 1.4% to 1.3%. Although this is a preliminary estimate, but still, it indicates the extremely low economic growth rates of the Old World as a whole. The flagman of Europe, of which Germany is, reported on the stability of the unemployment rate, combined with a slowdown in inflation from 1.2% to 1.1%. To simply put it, you should not even hope for the possibility of rising inflation in Europe.

Inflation (Germany):

As you can see, the lack of desire of the dollar to weaken is not surprising, since the situation in Europe is clearly worse than in the United States. Therefore, the dollar may well resume its growth if an excellent opportunity appears, in the form of regular macroeconomic data. However, the statistics in America today do not please us with abundance. In fact, besides the data on applications for unemployment benefits, there is nothing interesting. The total number of these same applications should increase by 3 thousand. Due to this, the number of initial applications is expected to grow by 5 thousand, while the number of repeated ones will decrease by 2 thousand. On the other hand, data on personal income and expenses may increase by 0.3% and 0.2%, respectively. However, it is worth paying attention that income and expenses increased by 0.4% and 0.1% in the previous month, respectively. In other words, on the face of the acceleration of the growth rate of spending, which should lead to higher inflation. Thus, Jerome Powell did not dissemble when he made a reservation about inflation at 1.8%.

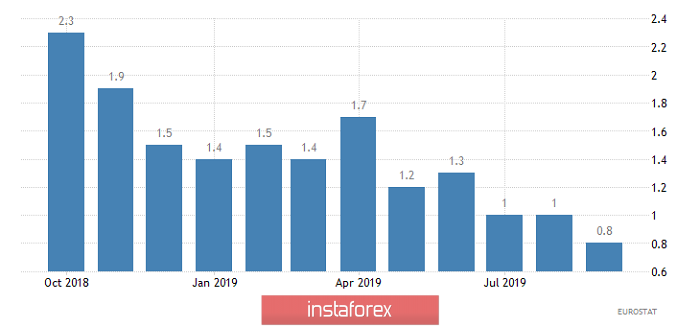

On the contrary, a very, very many extremely important data will be published today in Europe. Some of which are already out. Thus, the growth rate of retail sales in Germany accelerated from 3.1% to 3.4%, which can be considered as a positive factor. However, they expected acceleration to 3.5%, and even reviewed the previous value for the worse, from 3.2% to 3.1%. Thus, the potential growth of inflation in Europe is decreasing every day. And in confirming this topic, France reported a slowdown in inflation from 0.9% to 0.7%, with a forecast of 0.8%. Now, they are waiting for data from Italy, which is the third economy in the euro area, where unemployment is expected to rise from 9.5% to 9.6%. In addition, Italy is forecasting a slowdown in inflation from 0.3% to 0.2%. But the most interesting are the pan-European data. Nevertheless, the only thing that doesn't bother is the unemployment rate, which should remain at the previous level of 7.4%, but everything else makes you tear the hair on your head. The first estimate of GDP for the third quarter may show a slowdown in economic growth from 1.2% to 1.1%, and preliminary data on inflation, its decline from 0.8% to 0.7%. At the same time, given what data are released for the largest countries in the euro area, there are concerns that the data will be worse than forecasts.

Inflation (Europe):

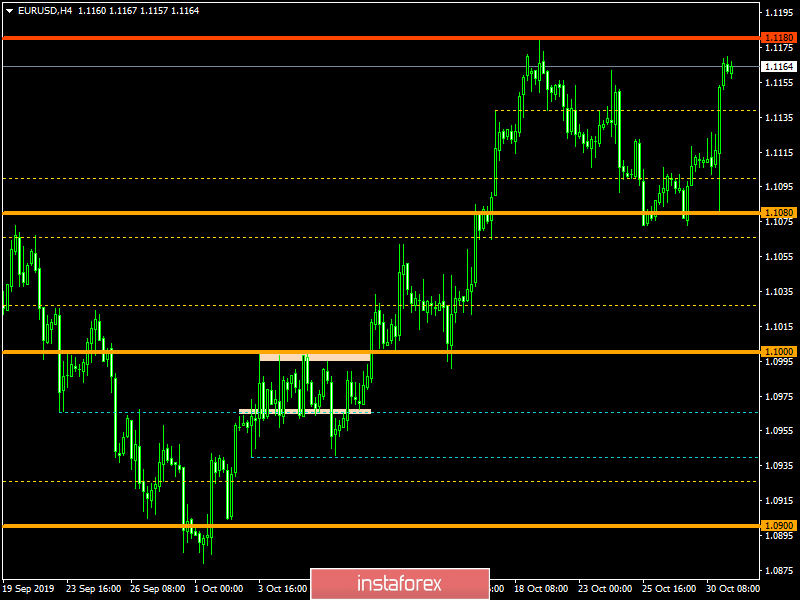

The euro / dollar currency pair, due to the general informational background, managed to draw a remarkable impulse candle, practically returning us to the limits of the previously found resistance level of 1.1180. The subsequent fluctuation reflects a slowdown, but most likely, it is an intermediate point before the pullback, which in this case is very possible.

The pound / dollar currency pair was more measured in action, in comparison with the single currency, but here, there was an upward move. It is likely to suggest that a characteristic slowdown is possible in the absence of an explicit pass of the level of 1.2955. In addition, slowing down with variable boundaries is also possible relative to values.