Yesterday's minutes of the European Central Bank from its meeting, which took place in October this year, did not shed light on the further policy of the bank, which did not allow risky assets to strengthen their positions against the US dollar. The Central Bank's leadership expressed concern about the slow growth of eurozone GDP, saying that the acceleration of inflation in the eurozone may not happen, given the deteriorating prospects for the economy. In this regard, the leaders urged to wait some time to assess the prospects of the economy and the effects of monetary stimulus. Let me remind you that the asset repurchase program was launched again in November this year. The ECB also said that it is necessary to assess the potential negative effects of monetary stimulus and negative interest rates.

The data that came out on the American economy in the second half of the day was versatile, so it is impossible to say unequivocally that it was the reports that returned the demand for the dollar. Most likely, the aggravation of trade relations between the US and China constrains the demand for risky assets.

According to the US Department of Labor, the number of initial applications for unemployment benefits for the week of November 10-16 remained unchanged at 227,000. Economists had forecast the number to be 217,000. It should be noted that over the past few weeks, the number of applications shows an increase, but a number of economists attribute this to seasonal volatility associated with the celebration of Veterans Day and Thanksgiving. The moving average of applications for four weeks rose by 3,500 and reached 221,000. The number of secondary applications for unemployment benefits for the week from November 3 to 9 amounted to 1.695 million.

Good indicators of industrial activity in the area of responsibility of the Federal Reserve Bank of Philadelphia pleased traders. According to the report, the Fed-Philadelphia PMI for November 2019 rose to 10.4 points from 5.6 points in October, while economists had expected a decline to 5.0 points. The index of new orders in November fell to 8.4 points, and the index of deliveries fell to 9.8 points.

Today, data on activity in the services sector and manufacturing activity of the United States are expected, which can provide significant support to the dollar, provided that the data will come out better than economists' forecasts. The manufacturing PMI is forecast at 51.5 points and the services PMI at 51.2 points.

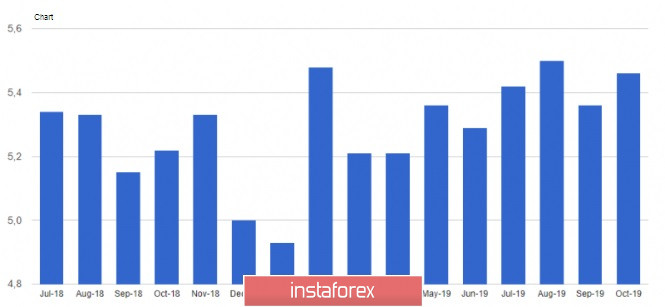

Home sales in the US secondary housing market rose in October. This happened after the decline in September this year. According to the National Association of Realtors, sales in the secondary housing market in October 2019 increased by 1.9% and amounted to 5.46 million homes per year. Economists had expected sales growth of 1.5%. Compared to the same period the previous year, sales increased by 4.6%. Data for September were revised downward, to 5.36 million homes a year.

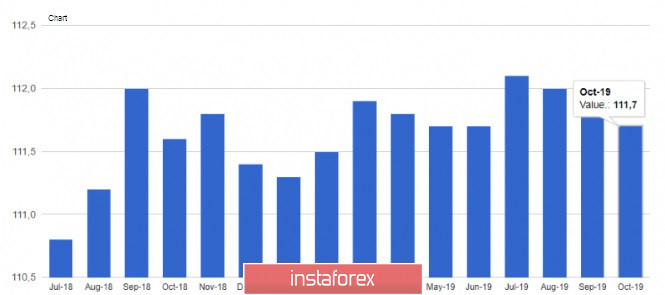

The data on the indicator of economic trends in the United States, which declined in October this year, did not allow the US dollar to break below the level of 1.1055 in pair with the euro. According to the report, the Conference Board index of leading indicators in October this year fell by 0.1% to 111.7 points, after falling by 0.2% in September and August. Economists had expected the index to rise by 0.2%. It is not surprising that the most negative contribution was made by orders in the manufacturing sector.

As for the technical picture of the EURUSD pair, it remained unchanged. All attempts of buyers of risky assets to get beyond the resistance of 1.1090 failed again. The bullish scenario can still be implemented only after the level of 1.1090 is breached. This will continue the upward correction to the highs of 1.1110 and 1.1140. However, we should not exclude the possibility of a downward correction, as the breakthrough of large support of 1.1050, which the bulls managed to hold yesterday, can push the pair even lower and return it to the lows of 1.1020 and 1.0990.