Yesterday's comments by Vice President Liu of China added some positivity, but overall, the situation around the trade agreement between China and the United States remains tense. Liu notes that US demands continues to be inconsistent and confusing. As an example, we have the recent unanimous congressional support for Hong Kong protests, despite China's insistence not to do so. The United States is trying to exert pressure where there is no need for it, which means that the American side has less and less real leverage.

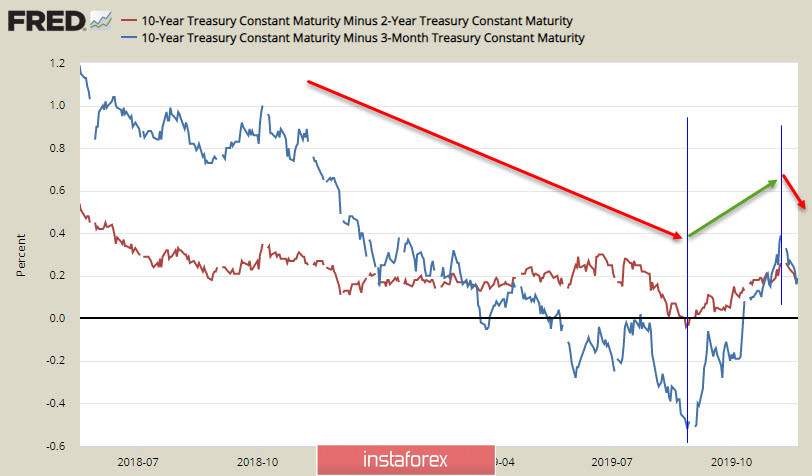

The assumption that the fall has bottomed out and the threat of recession has been pushed back has begun to gain popularity in September amid resumption of the asset buyback programs by the Fed and the ECB. Moreover, short-term yields stopped their growth, but the movement resumed from November 12, and thus, another attempt to invert yields is possible.

If this happens, the panic wave will be much stronger than the one we observed during the summer, because it coincides with the technical readiness of the stock markets to corrective decline. Any significant event, from weak PMIs to negative information about the course of trade negotiations, can trigger decline.

At the same time, the dynamics of returns give reason to believe that the panic explosion is approaching, and therefore, there is reason to prepare for an increase in the demand for protective assets. The key event of the day will be the release of PMI for the US, UK and Eurozone countries. The issue will show whether the world economy is really moving into the stabilization phase, which is assured by the central bank players, or we are only dealing with a temporary lull.

EUR/USD

The ECB's monetary policy report in October confirmed the conclusion that the Governing Council is entering the waiting phase for at least two reasons - it is necessary to assess the effectiveness of the resumption of the asset buyback program. Besides, Christine Lagarde, who took over, must find ways to overcome the split.

There is a little information we know regarding Lagarde's views on monetary policy in the Eurozone, so today's speech at Frankfurt may cause increased attention. So far, the forecasts are that - the ECB will develop to reduce the deposit rate by 0.1% and slightly increase the volume of repurchases by March next year. These expectations generally coincide with the Fed's position, that is, there are no factors on the part of central banks that can indicate the direction of the EUR/USD.

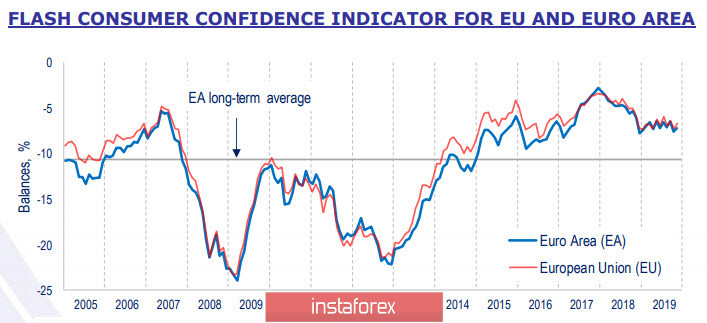

On the other hand, the level of consumer confidence did not change significantly in November and is above the long-term average; on this side, there is no pressure on the euro either.

The absence of the plans by ECB for additional impulse in the near future is providing little support to the euro, but the growth of the euro can help reduce tensions between the US and China. In the short term, the euro looks neutral. The range of 1.1050-1080 is unlikely to be violated before the PMI and Lagarde's speech.

GBP/USD

Amid the lack of significant macroeconomic data, the pound is trading in a range. The pound is supported mainly by the consensus opinion of the market that Johnson will win the election on December 12, but increasingly weaker economic data have an ever-stronger influence on the British currency. The pound, paired with the euro, looks unconvincing. Thus, the growth of EUR/GBP to 0.8750 / 90 in the medium term looks more likely. On the other hand, the pound is neutral against the dollar by the end of the week, although weak bullish outbursts are not excluded.

The range of 1.2885 / 1.2970 is unlikely to release the pound until the end of the week. Therefore, there is no reason for strong movement. Only an unexpected factor that the market does not take into consideration, will be able to withdraw the pound from the consolidation zone.