The 2019 USD index risks to end in the narrowest trading range since 1976 due to persistent reluctance of EUR/USD to determine the direction of its movement. Throughout the lion's part of the year, the euro does not go beyond $ 1.09-1.14, however, if the short-term prospects of the main currency pair are still covered with fog, then the medium and long-term ones are quite transparent. They will depend on the trade war and the recovery of the global economy.

The US dollar, as a rule, strengthens if the dynamics of US GDP looks better than the dynamics of its global counterpart. A typical example is the current year: international trade and global gross domestic product, under the influence of trade wars, have slowed to their lowest levels since the 2009 crisis, while the US economy has just returned to its usual growth rate. To abnormally high (+ 2.9% in 2018), it was dispersed by tax reform, but the positive effect of the fiscal stimulus could not spread infinitely.

The divergence factor in economic growth has been won back, and a natural question arises - What's next? The IMF is positive about the future: according to an authoritative organization, global GDP will accelerate in 2020 from 3% to 3.4%. OEDS, on the contrary, predicts the same growth rate of 2.9% in the current and next year. Therefore, the EUR/USD pair will behave depending on which scenario will come true. In the first case, I predict its growth to 1.15-1.16, while in the second, I do not exclude a decline to 1.06-1.07.

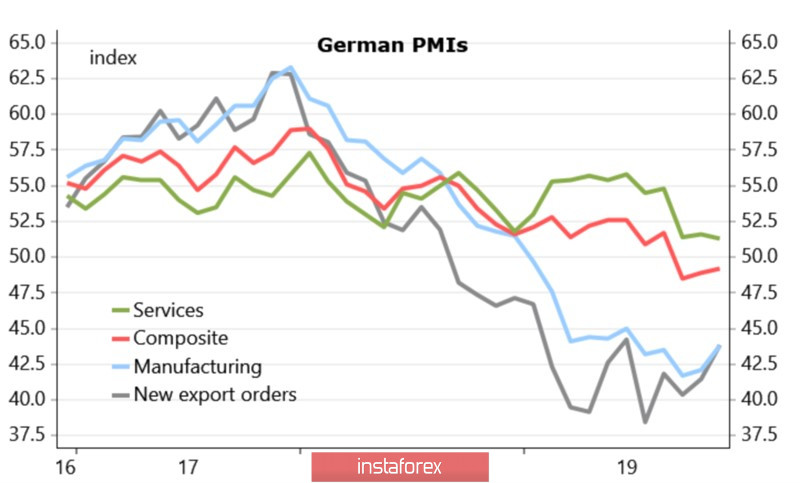

Now, it's obvious that open economies have become the main victims of the US-China trade war due to supply chain disruptions. First of all, we are talking about Germany, where the share of exports in GDP exceeds 40%. The rebuilding of the German car is a sure sign of the euro strengthening. Due to this, it is not surprising that investors are so closely monitoring leading indicators: business activity and the business climate index from IFO. The indices of purchasing managers in November, in turn, showed mixed dynamics: the manufacturing sector managed to push off the bottom, and the services sector, on the contrary, is disappointing. Is the external contagion beginning to spread to domestic demand?

If a trade agreement between Washington and Beijing is signed (and I really want to believe in it), then the chances of accelerating global GDP to 3.4% in 2020 and strengthening EUR /USD to 1.15-1.16 will increase. Moreover, the euro can be supported by the orderly Brexit and the growth of political risks in the USA in connection with the presidential election, which will negatively affect American stock indexes and the inflow of capital to the States. On the other hand, the White House has not yet decided what to do with the tariffs for importing cars from the Old World. Nevertheless, their increase is a clear negative for the single European currency.

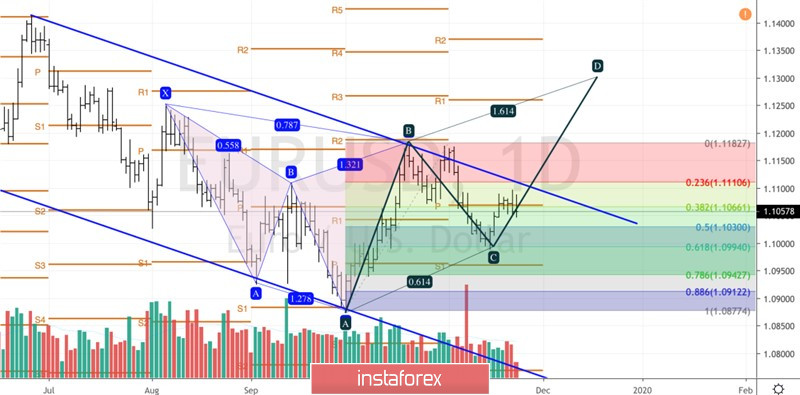

Technically, the EUR/USD pair froze near significant pivot levels, waiting for clues from Christine Lagarde. If the "bulls" manage to gain a foothold above 1.107, the risks of breaking through the upper boundary of the downward trading channel and performing a target of 161.8% (according to the AB = CD pattern), will increase. Otherwise, the ero is expected moved down to 1.096.

Daily chart of EUR/USD