To open long positions on EURUSD, you need:

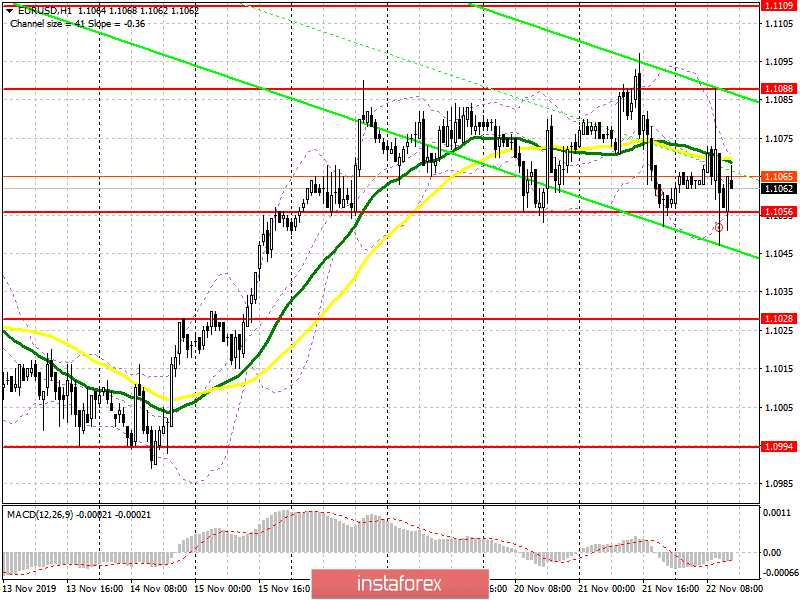

Today's data on the growth of manufacturing activity and the services sector of the eurozone countries supported the European currency, however, the bearish activity from the level of 1.1088, to which I drew attention in my morning review, have limited the growth of the EUR/USD and led to the return of the pair to the support area of 1.1056. An important task for buyers of the euro in the second half of the day remains a breakthrough and consolidation above the maximum of 1.1088, which will resume the upward trend and will lead to an update of the levels of 1.1109 and 1.131, where I recommend taking the profits. However, much will depend on what reports on activity in the US will come out. Good indicators will lead to a breakthrough in the support of 1.1056. In this scenario, it is best to consider new long positions after updating the minimum of 1.1028, and I recommend buying the euro immediately on the rebound from the support of 1.0994.

To open short positions on EURUSD, you need:

Sellers fully coped with the morning task and did not let the pair above the resistance of 1.1088 even on the background of good reports on activity in the manufacturing sector, which is a serious problem for the eurozone economy. In the second half of the day, bears will try to take advantage of the weakness of the euro after the publication of similar data on the US economy, and a breakthrough in support of 1.1056 will lead to a larger sell-off in the area of lows 1.1028 and 1.0994, where I recommend taking the profits. If the demand for the euro returns in the afternoon, it is best to return to short positions only on a false breakdown of the resistance of 1.1088, but you can sell EUR/USD on a rebound from the maximum of 1.1109.

Indicator signals:

Moving Averages

Trading is conducted just below the 30 and 50 moving averages, but we can talk about building a new downward trend only after the breakout of the support of 1.1056.

Bollinger Bands

Breaking the lower border of the indicator around 1.1056 will lead to a larger sell-off of the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. The chart is marked in yellow.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. The chart is marked in green.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period to 26. The 9 periods SMA.

- Bollinger Bands (Bollinger Bands). Period 20.