Data on eurozone manufacturing activity and services provided only temporary support to risky assets, while all attention remains on the US-China trade relationship. Today, Chinese leader Xi Jinping said that he is ready to work with the United States on a first-phase trade agreement, but this work should be carried out based on mutual respect and equality. Xi also stressed that China did not start this trade war and it is not his responsibility. The Chinese President also noted that China and the United States should strengthen communication on strategic issues and avoid misunderstandings and incorrect conclusions.

The preliminary purchasing managers' index (PMI) for the French manufacturing sector in November this year rose to the level of 51.6 points, while it was predicted at the level of 50.9 points. In October, the index was 50.7 points. The preliminary purchasing managers' index (PMI) for France's services sector in November remained unchanged at 52.9 points, with growth forecast to 53.0 points.

The data on Germany attracted the most attention. According to the report, business activity in Germany remains weak in November this year. According to IHS Markit, the preliminary composite purchasing managers' index for Germany in November was 49.2 points against 48.9 points in October.

Thus, the preliminary purchasing managers' index (PMI) for the German manufacturing sector in November rose to 43.8 points against 42.1 points in October, while it was forecast at 42.8 points. The services sector showed less active growth, but the reduction was avoided. According to the report, the preliminary purchasing managers' index for Germany's services sector in November was 51.3 points against 51.6 points in October, with growth forecast at 52.0 points.

In the first half of the day, data on German economic growth in the 3rd quarter of this year were also published, which signaled a slight recovery thanks to the support of consumption. According to the Federal Bureau of Statistics Destatis, in the 3rd quarter of this year, GDP grew by 0.1% compared to the previous quarter and by 0.5% compared to the 3rd quarter of the previous year. Household spending rose by 0.4% from the previous quarter, while government spending increased by 0.8%. The data was better than economists' forecasts.

As for activity in the eurozone, the preliminary purchasing managers' index (PMI) for the eurozone manufacturing sector in November rose to the level of 46.6 points, being slightly above the forecast of economists and above the data for October, when the index was 45.9 points.

Separately in the directions. The purchasing managers' index (PMI) for the eurozone services sector in November was 51.5 points with a forecast of 52.5 points. But the preliminary purchasing managers' index for the eurozone manufacturing sector in November was at 46.6 points against 45.9 points in October.

As for the technical picture of the EURUSD pair, despite all these data, it remained unchanged. All attempts of buyers of risky assets to get beyond the resistance of 1.1090 failed again. The bullish scenario can still be implemented only after the level of 1.1090 is breached. This will continue the upward correction to the highs of 1.1110 and 1.1140. However, we should not exclude the possibility of a downward correction, as the breakthrough of large support of 1.1050, which the bulls managed to hold yesterday, can push the pair even lower and return it to the lows of 1.1020 and 1.0990.

GBPUSD

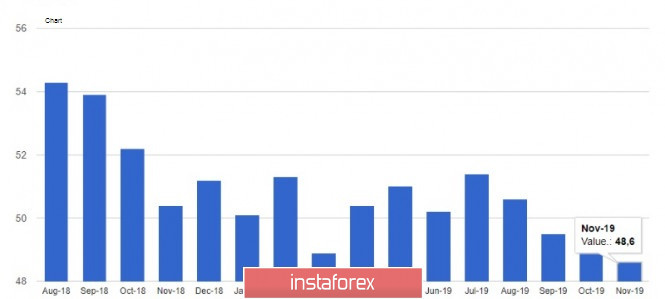

The British pound continued to decline after the release of a disappointing report, which indicated a reduction in activity in the private sector in the UK. According to IHS Markit, the index for the services sector fell to a 40-month low of 48.6 points, showing reduction after falling to 50.0 points in October this year. The PMI for the manufacturing sector fell to 48.3 points from 49.6 points in October. The composite index fell to 48.5 points in November. The main pressure was created by the lack of clarity of the situation with Brexit, as well as the general election in the UK, which is scheduled for December 12.