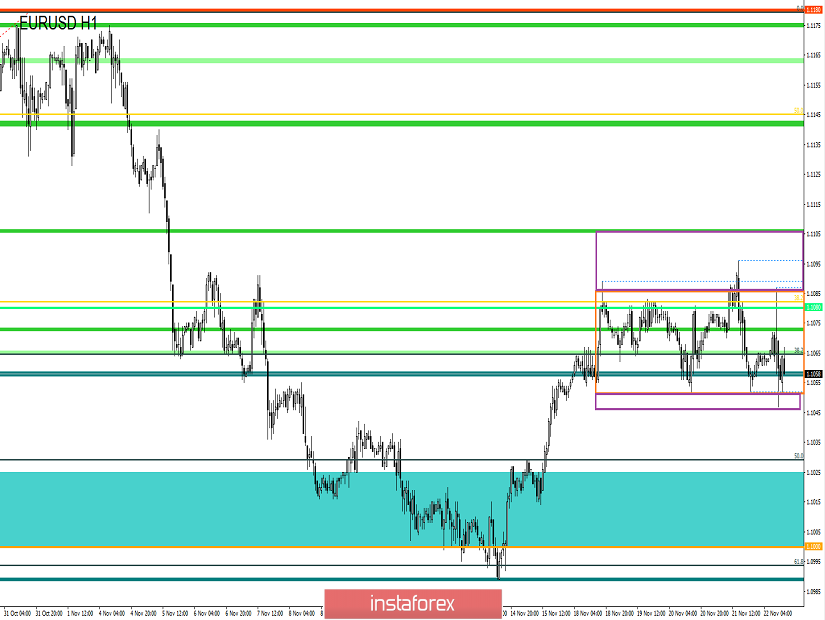

From technical analysis, we see an extremely tedious and intriguing accumulation along with the range level of 1.1080, which stretches for the fourth day in a row. The breakdown points of the control values of 1.1055/1.1100 have not been recorded, local shooting shadows - that's what we had all the time. In this situation, traders began to arise a variety of theories that explain the essence of what is happening. So, one of the most interesting theories is that the stagnation in the composition of the course 1.1000-1.1080 carries a change in the recovery process, a temporary correction in the composition of the recovery 1.1180-1.1000-1.1080-1.1000-(...). Common sense is here since the move 1.1180-1.1000 could locally overheat short positions, and the fact of convergence with the platform of the second stage produced a flurry of fixation of trading positions. The subsequent upward move and the slowdown within the first stage (1.1080) confirm the fact that the market still has a proper number of sellers, which do not allow to confidently continue the upward move higher than 1.1100.

Analyzing the hourly past day, we see the cycle of the course inside the accumulation, where within the coordinate 1.1100, the resistance point was found again, which returned us to the lower frame with the control point 1.1055, and the cycle repeated.

As discussed in the previous review, traders are closely watching the coordinates 1.1055 (sell) / 1.1100 (buy) for clear breakdowns, but over the past period, such cases have not yet been recorded.

Looking at the trading chart in general terms (daily period), we see a downward trend, in the structure of which there is an oblong correction, which at this time is trying to close, being at 33% recovery.

News background of the past day had data on applications for unemployment benefits in the United States, originally predicted a decrease of 4 thousand, but after reviewing the previous data, the actual ones were worse than expected, as a result, we received an increase in applications by 3 thousand. At the same time, the publication of the text of the minutes of the ECB October meeting, which was the last under the leadership of Mario Draghi, can be distinguished from the remarkable events of the past day. And so, in the protocol, there was a discussion concerning the slowdown of rates of inflation and delay of the process of achievement of earlier established target levels on it. Something extraordinary from the ECB report was not noticed, we already heard it all before the protocol.

In terms of the information background, there was a kind of refutation of the previously raised noise in the media sources, regarding the fact that the US Senate passed a bill on the protection of democracy in Hong Kong, the trade deal between the two countries could be undermined. Chinese Commerce Ministry spokesman Gao Feng responded to the uproar: "External rumors about the first phase of the deal and trade negotiations, in general, are not accurate. Beijing is ready to cooperate with Washington to eventually conclude an agreement and end the trade war."

Today, in terms of the economic calendar, we had data on Europe, where we first published German GDP figures for the third quarter, confirming the level of 0.5%. After that, weak composite PMI data for November (EU) was published, which affected the dynamics of the single currency in terms of depreciation. The most interesting event was the speech of the new ECB head Christine Lagarde, who has remained silent on monetary policy since the day of her election. So, the head of the ECB began her speech with the fact that she urged the EU government to pay attention to the new order of the world economy, to which it is necessary to react.

"We are starting to see a global shift mainly due to emerging markets, from external demand to domestic demand, from investment to consumption and from production to services," Lagarde said.

Christine Lagarde also noted that monetary policy will continue to support the economy, but that higher government spending, especially on investment, is key.

Lagarde continues where her predecessor, Mario Draghi, left off, in his closing speech, he called for financial support for the eurozone.

The upcoming trading week in terms of the economic calendar has several statistics for the United States, which will publish the next estimate of GDP. At the same time, the end of the week is expected to be with reduced trading volumes due to the celebration of Thanksgiving in the United States.

The most interesting events displayed below:

On Tuesday, November 25th

USA 15:00 London time - Composite housing price index S&P/CS Composite - 20 seasonally adjusted (y/y), for September: Prev. 2.0% - Forecast 2.1%

USA 16:00 London time - New home sales, October: Prev 701K - Forecast 707K

On Wednesday, November 26th

USA 14:30 London time - Basic orders for durable goods, October: Prev -0.4% - Forecast 0.2%

USA 14:30 London time - GDP (preliminary): Prev 1.9%

On Thursday, November 27th

USA - Thanksgiving

On Friday, November 28th

USA - Thanksgiving - Early closing at 11:00

EU 11:00 London time - Unemployment rate: Prev 7.5%

EU 11:00 London time - Consumer price index (preliminary): Prev 0.7%

Further development

Analyzing the current trading chart, we see that during the publication of statistical data on the EU and at the time of the speech of the head of the ECB, there was an attempt to break the lower frame in the face of the mark of 1.1055, but once again we had only punctured with shadows, no more. We have a shaky position, where the lower frame has almost fallen and many market participants still hope that the quote will still be able to move forward. In terms of volatility, we cannot say that there are cardinal shifts, but due to the background and long accumulation, price spikes are present, but still within the daily average.

Detailing the available time interval minute by minute, we see that the surge in activity occurred in the period 10:30-11:00 hours (time on the trading terminal), which coincides with the economic calendar and Lagarde's speech.

In turn, speculators closely monitor the control points, hoping that soon they will enter into trading operations in the flyover phase.

It is likely to assume that the existing accumulation is at the limit of its formation and it needs to either break through the boundaries, sending the quote into motion, or expand the existing framework. If we refer to the previously voiced theory, the probability of a breakdown of the lower coordinate 1.1055 is still high.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in case of price-fixing higher than 1.1100, not a shadow puncture.

- Positions for sale are considered in the case of fixing the price below 1.1055, not a puncture shadow.

Indicator analysis

Analyzing different sectors of timeframes (TF), we see that the indicators are not in the best shape, as the accumulation of rare confused them. So, the short-term period is not taken into account, as it tries to show allegedly working off from the lower border, wagging within the accumulation. Intraday indicators are trying to start a downward trend. Medium-term indicators have the variable interest of neutral/upward.

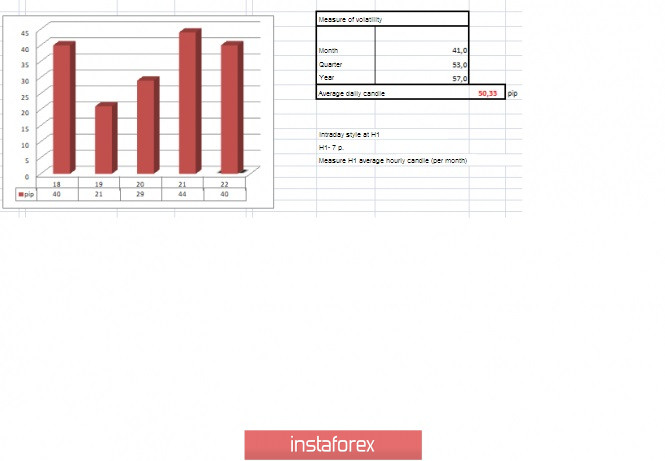

The volatility for the week / Measurement of volatility: Month; Quarter; Year.

Volatility measurement reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year.

(November 22 was built taking into account the time of publication of the article)

The volatility of the current time is 40 points, which is already very good for this section of time but still below the daily average. If we still see the breakdown of the lower frame, then for the first time in a long period, we will be able to contemplate an indicator above the daily average.

Key levels

Resistance zones: 1.1080**; 1.1180* ; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100.

Support zones: 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***.

* Periodic level

** Range level

*** Psychological level

***** The article is based on the principle of conducting transactions, with daily adjustments.