4-hour timeframe

Technical data:

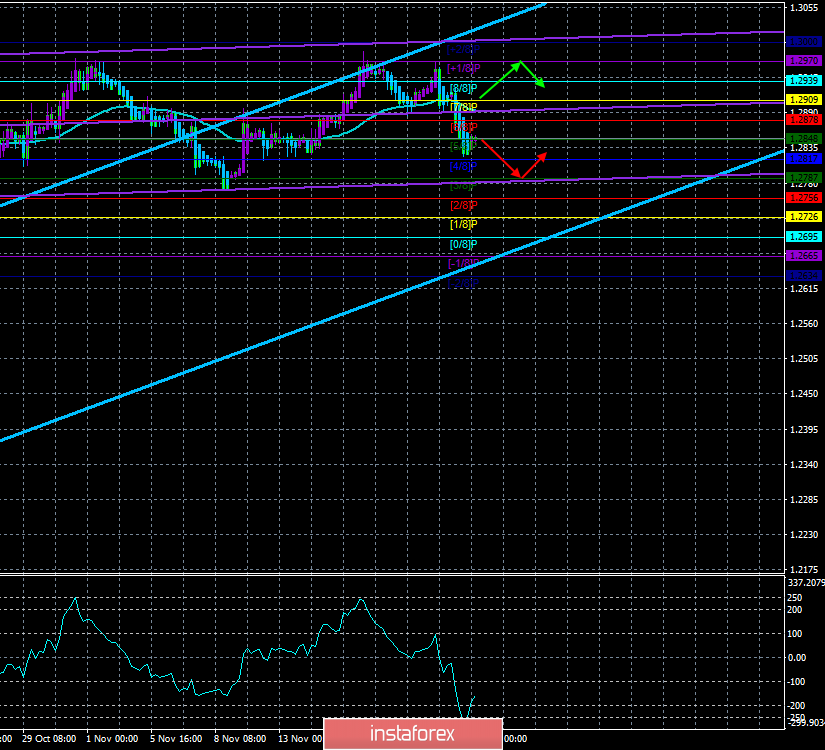

The upper channel of the linear regression channel: direction - up.

The lower channel of the linear regression channel: direction - up.

Moving average (20; smoothed) - sideways.

CCI: -26.6231

The British pound, paired with the US dollar, has not managed to overcome the level of Murray "+1/8" - 1.2970, a total of bounced from it 4 times. Thus, although there are still some chances for the growth of the British currency, we believe that, as in the case of the euro, the most logical and reasonable option now is to drop the pound / dollar pair. We still believe that neither from a fundamental point of view, nor from a technical one, the British pound should not grow now, and its total strengthening by 800 points a few weeks ago is the most that the British currency could have dreamed of in the face of failed macroeconomic statistics, political crisis leading to parliamentary re-election, uncertainty with Brexit, and also in the context of the global trade crisis. All these factors, from our point of view, should have a negative impact on the British economy and, accordingly, significantly reduce the demand for the British pound. Of course, the British currency cannot fall continuously and continuously, so now it can just be one of the time periods when the pound is "resting". However, we examined the question of why in recent articles, even if Brexit is implemented with a "deal" for the UK economy, there will be no dramatic improvements. This option is simply less dangerous for the country's economy compared to the "no deal" option. Pressure on the economy of the Kingdom after the "divorce" with the European Union will still be enormous, and it already has problems, even before Brexit. Thus, now, it may just be one of the time periods when the pound is "resting".

Meanwhile, Prime Minister Boris Johnson is already getting ready to win the election. In what, and in confidence that borders on self-confidence, Johnson cannot be denied. The Prime Minister said that if he wins the election, which will allow him to head the government again, he will submit to Parliament a bill on an agreement on the country's withdrawal from the European Union before October 25. According to Johnson, "the completion of Brexit will create a new UK, and the country's authorities will be able to focus on the priorities of the British people, instead of trying for years to leave the EU."

Therefore, we still believe that the victory for the conservatives is not at all guaranteed, so on December 12, the results can be almost anything. The prospects for the British pound are now extremely difficult to outline, because everything will depend on whether Brexit is ultimately implemented or the whole procedure will be delayed for a few more years. Moreover, we believe that global geopolitical tensions, in particular the US-China trade war, which has a black mark on the economies of many countries, in particular the UK, are having a much greater impact on the British pound. According to the latest macroeconomic data, affairs in the UK are very bad, all the most important indicators are in the red zone. As a trade war escalates rather than moves to an agreement, then we can safely assume a further decrease in world trade and a slowdown in GDP growth. And if so, then indicators of the state of the economy will continue to fall in the European Union and in the UK. Given the fact that the US economy shows much more powerful endurance and resilience to all geopolitical conflicts, and monetary policy in the United States is not "ultra-soft", it is the US currency that can continue to be in demand in pairs with the euro and the pound.

From a technical point of view, the bears managed to overcome the movement, so the trend is now downward. In order to be able to confidently ascertain the beginning of a downward trend, it is recommended to wait until the Murray level is "3/8" - 1.2787, from which there were absolutely two rebounds from before.

The nearest support levels:

S1 - 1.2848

S2 - 1.2817

S3 - 1,2787

The nearest resistance levels:

R1 - 1.2878

R2 - 1.2909

R3 - 1.2939

Trading recommendations:

GBP/USD is trying to move to a new downward trend. The area of 1.2970-1.3010 has remained unsurpassed, therefore, there are great chances of moving down. Thus, today, it is recommended to sell a pair of pound / dollar with the target of 1.2787. A third rebound may occur from this level. It is recommended to buy a pound not earlier than the re-consolidating of the bulls above the moving average line, and ideally - after breaking the level of 1.2970.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanations for illustrations:

The upper channel of the linear regression is the blue unidirectional lines.

The lower channel of the linear regression is the purple unidirectional lines.

CCI - blue line in the indicator regression window.

Moving average (20; smoothed) - a blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movement options:

Red and green arrows.