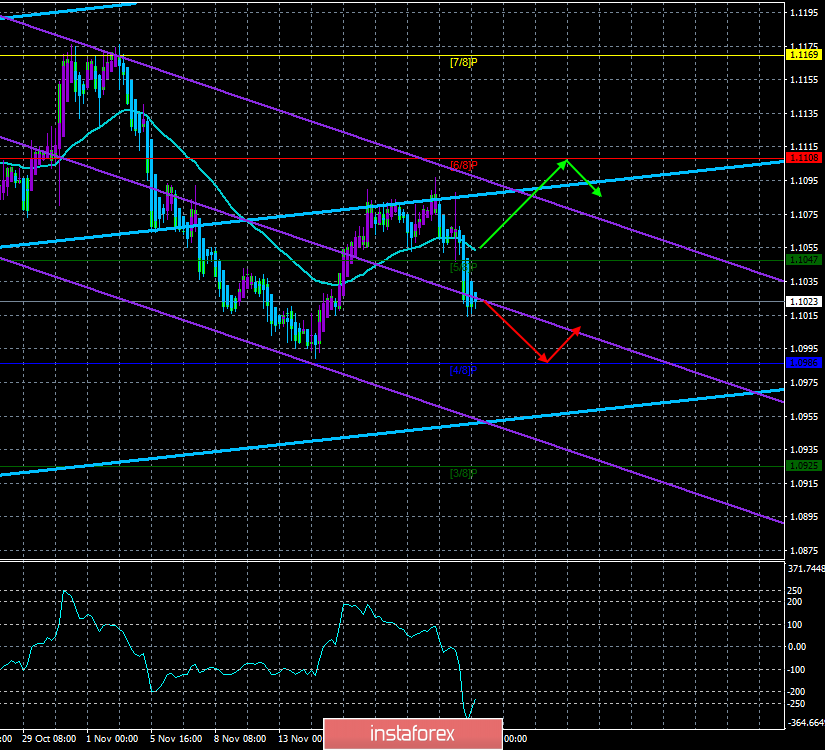

4-hour timeframe

Technical data:

The upper channel of linear regression direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - down.

CCI: -227.3948

On Friday, the EUR/USD currency pair consolidated below the moving average line, which indicates a change in the downward trend. The bulls did not succeed (once again) in developing success, and also once again, we are forced to state that there were no fundamental reasons for the long-term strengthening of the European currency. Thus, from our point of view, the resumption of the downward trend is the most logical and reasonable version of the development of events from all possible. Moreover, taking into account the nature of the speech of the ECB President Christine Lagarde last Friday, it becomes clear: the ECB is preparing to take new measures to stimulate the economy, and Christine Lagarde will not continue the "Mario Draghi case", but intends to subject the monetary policy to a "strategic review". For the euro, it doesn't mean anything good, and the European Central Bank is going to take the measures that any central bank would take in its place. What else remains if macroeconomic statistics continue to deteriorate, global trade conflicts continue to grow, and geopolitical tensions continue? Moreover, the issue with Brexit remains on pause for at least a few more weeks.

Meanwhile, Donald Trump, whose country is in a state of open trade war with China crumbled in compliments to the country and its president Xi Jinping. Trump said in an interview: "We must stand on the same side with Hong Kong, but I also stand on the side of President Xi. He is my friend and a terrific guy." Regarding the trade negotiations, Trump said: "We are in the process of concluding the largest trade deal in history, and if we could carry it out, it would be great." Thus, despite Trump's regular threats to impose new duties, if "China will take time", despite the mass of accusations against China, the US president makes such "friendly" but contradictory statements. We have long been accustomed to this, and we recommend that traders pay attention not to words, but to deeds. And in fact, now, trade tensions between the United States and China are only escalating, and trade negotiations may be continuing, but they have definitely reached an impasse. In addition, the situation with the bill on "human rights in Hong Kong," which China regards as direct US interference in internal affairs, only adds fuel to the fire. At the moment, President Trump seems to have not yet signed this bill, so he has not yet managed to become a law. However, both sides understand that if the law is signed (and it can be signed without Trump's participation, if more than two-thirds of the Senate approves it), this will further complicate US-Chinese relations. Perhaps Donald Trump is going to use the "Hong Kong Law" as a new instrument of pressure on China, because if it is adopted, then Hong Kong may lose a lot of preferences in relations with Washington, which, in principle, is unprofitable for China itself. However, for sure this cannot be announced yet.

On the other hand, Beijing rarely answers Trump with "friendly" messages and prefers to adhere to a policy of honest speaking. For example, Chinese Foreign Minister Wang Yi said: "The United States is taking numerous unilateral and protectionist measures, undermining multilateral mechanisms, including trade. They have already become the largest destabilizing factor in the world." Thus, Beijing clearly does not hide its attitude to America and its displeasure about this.

The euro/dollar, in our opinion, will remain prone to a downward movement. Even the factor of a trade war, in which only the States and China seem to be participating, has a strong indirect effect on the EU economy. Thus, it is the euro currency that suffers more and not the dollar. Based on this, we believe that the downward movement will continue.

The nearest support levels:

S1 - 1,0986

S2 - 1.0925

S3 - 1,0864

The nearest resistance levels:

R1 - 1,1047

R2 - 1,1108

R3 - 1,1169

Trading recommendations:

The pair euro / dollar resumed its downward movement. Thus, sell orders with the target of 1.0986 are currently relevant. The volatility of the pair has also grown slightly. Due to this, trading can be more confident at this time. Now, it is recommended to buy Euro currency no earlier than fixing traders above the moving average line with the first target of 1.1108.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanations for illustrations:

The upper channel of linear regression is the blue unidirectional lines.

The lower channel of linear regression is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - a blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movement options:

Red and green arrows.