There is no news on trade negotiations between the US and China, which maintains pressure on risky assets and provides support to the US dollar. Beijing's latest proposal to conduct negotiations on their territory has remained unanswered, which leaves tension. Another threat is Hong Kong's anti-government protests, which, according to the American president, are a complicating factor for a trade deal with China. Whether the law on support of protesters, which is approved by Congress, will be signed is not yet clear. If Donald Trump does this, such a scenario will complicate the situation even more, which will put pressure on risky assets.

On Friday, the first speech of the new president of the European Central Bank, Christine Lagarde, remained unattended by traders and did not affect the euro. Lagarde avoided monetary policy issues, which made the markets quite skeptical, as many expected her to make more symbolic statements about a new chapter in the history of the eurozone.

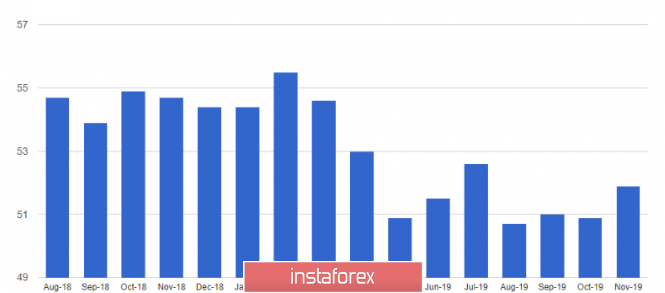

As for the fundamental statistics on the US economy, it just provided additional support to the dollar, which allowed it to strengthen against a number of world currencies. According to the IHS Markit report, business growth in the US private sector accelerated in November. The preliminary composite PMI for Purchasing Managers rose to 51.9 points from 50.9 points in October. If taken separately, the preliminary manufacturing PMI for the reporting period increased to 52.2 points from 51.3 points. PMI for the service sector was 51.6 points versus 50.6 points in October. However, Markit economists noted that overall growth rates were below the trend.

At the same time, assessment of the prospects for the US economy by American consumers improved in November this year, which also supported the dollar. According to a report from the University of Michigan, the final consumer sentiment index was 96.8 points at the end of November against the forecast of economists, who expected it to decline to 95.5 points. Let me remind you that the indicator was 95.5 points in October. The main driver was the growth of American incomes and lower interest rates, which pulled down mortgage rates.

After such good data, traders ignored the report on a decrease in production activity in the area of responsibility of the Federal Reserve Bank of Kansas City. According to the data, the composite index of the Fed-Kansas City amounted to -3 points in November this year and remained unchanged compared to October.

As for the technical picture of the EUR/USD pair, the downward trend may continue in risky assets, but for this, the bears need to stay below the resistance of 1.1040, which will lead to the formation of a new impulse.The breakdown of support 1.1005 at the beginning of the week will lead to an update of the minimums of this month around 1.0989. Meanwhile, the worsening of trade relations between the USA and China will be an important component in the bearish movement of risky assets.

USD/CAD

The Canadian dollar missed the opportunity to strengthen against the US dollar after the release of the report, which indicated a decrease in retail sales in Canada. According to the National Bureau of Statistics Canada, retail sales in September declined by 0.1% compared with August and amounted to 51.58 billion Canadian dollars. Compared to the same period of the previous year, which is in September, retail sales grew by 1.0%.