EUR/USD

Analysis:

The euro chart has been dominated by a bearish trend for the last 2 years. The last, unfinished bearish wave for today counts down from September 3. Wave correction, in the form of a stretched plane. It lacks the final part. Since November 14, the reversal structure is formed upwards.

Forecast:

Today, the completion of the downward pullback of the last days is expected. A change of the rate is likely within the framework of settlement support. The beginning of the rise can be expected by the end of the day.

Potential reversal zones

Resistance:

- 1.1100/1.1130

Support:

- 1.1030/1.1000

Recommendations:

In the coming trading sessions, euro sales will be irrelevant. It is recommended to monitor the reversal signals to find the best points to buy the pair.

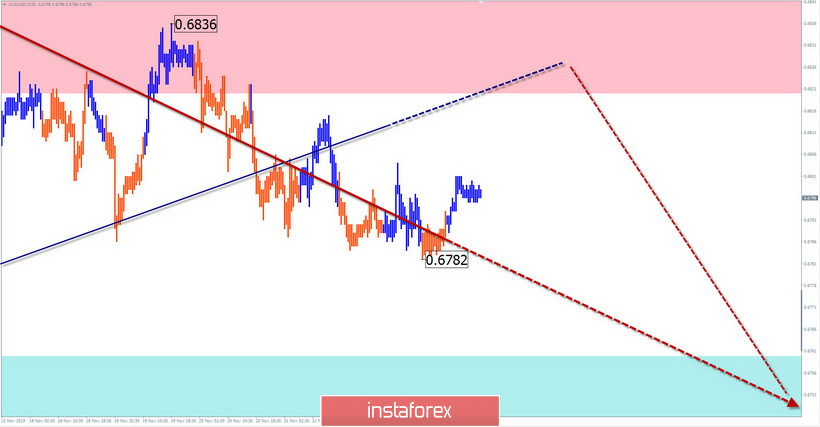

AUD/USD

Analysis:

In the short-term scale of the Aussie chart, the last wave of September 12 is bearish. The structure formed the first 2 parts (A+B). In the final part (C), over the past week, an intermediate rollback has been formed in the lateral plane.

Forecast:

Today, the general flat sentiment is expected to continue. In the first half of the day, the upward mood of the movement is likely. A short-term puncture of the upper boundary of the resistance zone is not excluded.

Potential reversal zones

Resistance:

- 0.6820/0.6850

Support:

- 0.6760/0.6730

Recommendations:

The pair's purchases are relevant today only in the framework of intra-session trading. At the same time, it is necessary to reduce the trading lot. In the area of the resistance zone, it is recommended to monitor the reversal signals to find entry points to short positions on this instrument.

GBP/JPY

Analysis:

The main vector of movement of the cross in the last month and a half was "sideways". In the main upward wave, the price forms an intermediate correction. The wave entered its final phase. The price once again rebounded from the strong support level.

Forecast:

Today, the upward mood of the movement is expected. The target zone is the outer border of the price corridor. Given the incompleteness of the bearish wave, then we should expect a return to the bearish rate. The reversal is likely by the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 140.60/140.90

Support:

- 139.80/139.50

Recommendations:

In the next day, trading is possible only within the day. The main emphasis in cross trading is recommended to be paid to purchases. When the price reaches the resistance zone, the transaction should be closed at the first sign of a change of course. Next, you should change the vector of trade.

Explanations: in simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. Solid background arrows are shown formed in the structure for determining the expected movement.

Attention: the wave algorithm does not take into account the duration of the tool movements in time!