4-hour timeframe

Technical data:

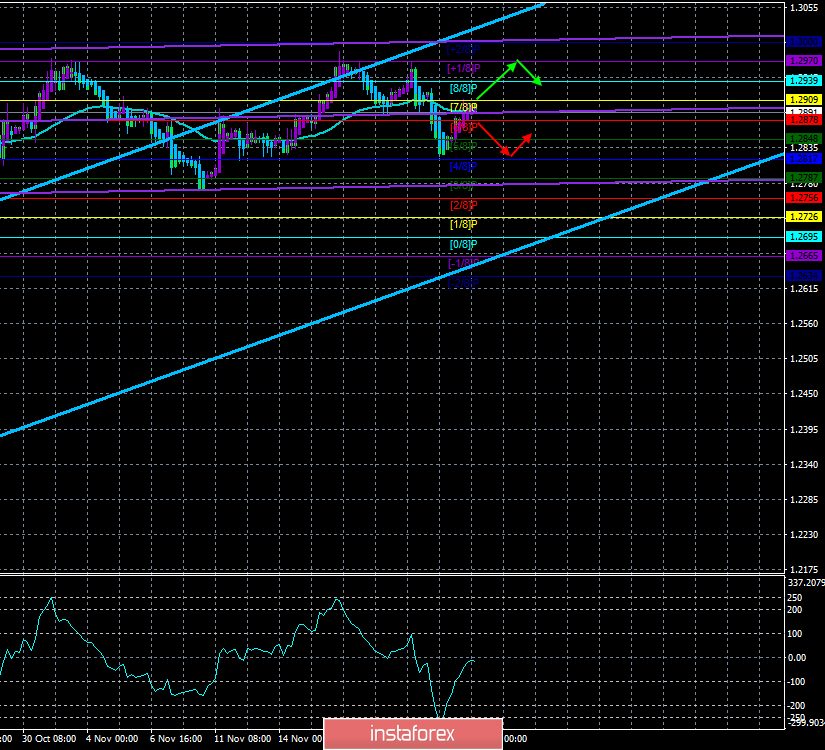

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - sideways.

CCI: -26.6231

The British pound paired with the US dollar has remained in a broad, 200-point side-channel since October 21, limited by the Murray levels of 1.2970 and 1.2787. It cannot be said that for more than a month there was no reason to break out of this range. For example, there was a sufficient amount of macroeconomic information from the UK, which could trigger a new fall in the British pound. However, traders are determined to wait for the results of the parliamentary elections and frankly do not want to force events and risk unnecessarily until December 12. A month ago, we pointed out the dubiousness of such a scenario, but now it becomes clear that traders will be able to wait another two and a half weeks completely painless. Thus, the current return of quotes of the pound/dollar pair to the moving average line does not mean anything. A rebound from the moving average - and the pair will fall by 100 points, overcome it - and rise by a maximum of 70 points. No macroeconomic report (important) to date is planned either in the UK or in the US, but it does not matter since traders still do not react to any statistical information. Even the data on the increase in the ratings of the Conservative Party does not provide much support to the pound. Ratings, according to many studies, continue to grow, but the pound cannot consolidate above the level of 1.2970. Therefore, we are even inclined to believe that all the increases of the British pound, from October 21, were just part of the flat movement and in no way even connected with reports about the Brexit party's readiness not to compete with the conservatives and about the growing popularity of the party of Boris Johnson. The pair is just flat and waiting for the election results.

Even the whole next month, the flat on the pair may remain, as the parliament in the new composition will go to work and hold its first meeting on November 17, and on November 25, the Christmas and New Year holidays will begin. Thus, Boris Johnson, if he remains Prime Minister, will need to initiate a new vote within a week on his draft agreement with the European Union, and parliament should approve it. And whether the parliament approves it or rejects it will depend only on the number of seats the tories get after the parliamentary elections. In principle, as we all know, in the last composition of the parliament, the tories were initially represented by 317 deputies, but since even some conservatives voted against a "hard" Brexit, against Theresa May's "deal", and then against Boris Johnson's "deal", their almost 50% presence in parliament did not allow the conservatives to implement their plans. That is why we believe that even a Conservative victory by a serious margin over Labor does not guarantee them the implementation of Brexit. The whole vote count boils down to whether the two parties - Conservative and Brexit - will gain more than 50% in total since they can support the Johnson deal in the next vote. If these parties do not collect more than 50% of parliamentary seats (at the moment, the Brexit party is supported by no more than 4-5% of the electorate), then there will be serious doubts that Boris Johnson will be able to push his deal through the new composition of parliament.

What will happen if Brexit is rejected by the British Parliament again? Throughout the process, it will be possible to set the seal with the inscription "pun." Based on all of the above, only one conclusion can be drawn. The pound/dollar pair remains in a wide flat channel and there is no reason for it to leave it yet. Accordingly, we do not expect the pair to rise above 1.2970 and fall below 1.2787. These goals can be used in trading, however, as we can see, the pair does not always reach them within the framework of the upward and downward movements.

Nearest support levels:

S1 - 1.2817

S2 - 1.2787

S3 - 1.2756

Nearest resistance levels:

R1 - 1.2848

R2 - 1.2878

R3 - 1.2909

Trading recommendations:

The GBP/USD currency pair remains inside the side channel. The area of 1.2970-1.3010 has remained unstoppable, so we do not expect the formation of a new upward trend. It will be possible to sell the pound/dollar pair with the target of 1.2787 if there is a rebound from the moving average line, but even in this case, we recommend trading small lots or not trading at all until the flat is completed.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.