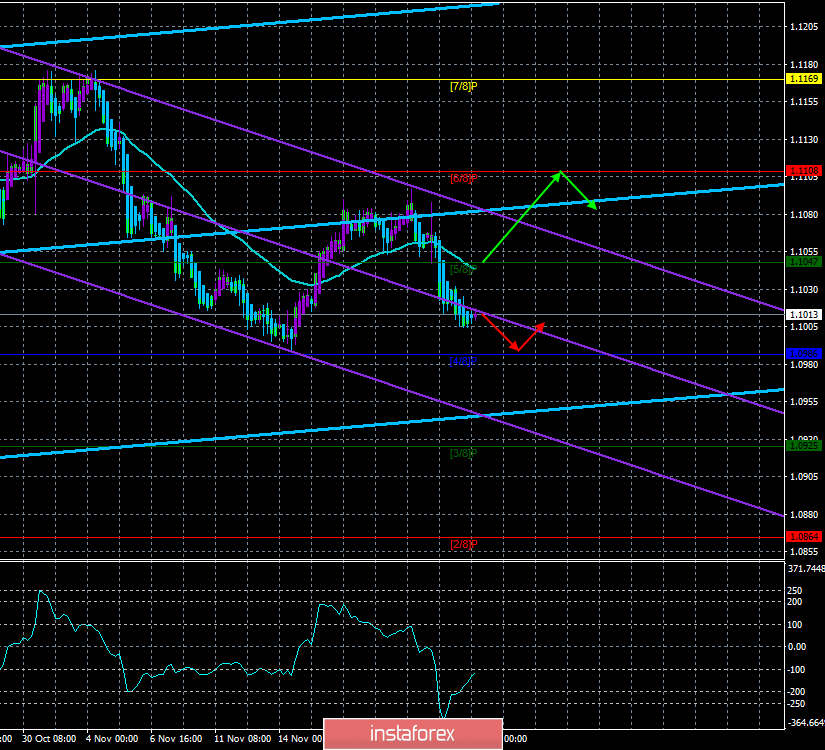

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - down.

CCI: -115.4698

Boring Monday for the EUR/USD currency pair ended the same as it began, with the continuation of the downward movement. No important news or macroeconomic reports were available to traders on November 25, so the volatility of the pair remained at its previous low level. The pair still has a certain fundamental background. For example, this is the same inexhaustible theme of the trade war between the United States and China, which acquires more new details and receives unexpected vectors of development, as well as Brexit in the UK. However, the news on this topic does not have a direct impact on the dollar and the euro, although, as we have said in previous articles, the growth of geopolitical tensions primarily affects the European currency, not the American one.

Meanwhile, one unnamed Chinese official explained what policy China has in trade talks with the US and what it expects. First, given the manner of the States to negotiate in the style of "either you sign an agreement that is beneficial to us, or new duties", cannot be called a priori constructive. That is why the parties have not agreed even in the "first phase" of the deal to date. Thus, the Chinese authorities do not expect to conclude this agreement soon and make concessions to Trump. Second, negotiations on the "second phase" of the deal could be delayed by one year altogether. China wants to wait for the presidential elections in America and see if Donald Trump, with whom it is extremely difficult to negotiate, can hold his post. Also in China, Washington's constant pressure on Beijing is highlighted, for example, through the Hong Kong situation. A Chinese official said it is Donald Trump who wants to sign the deal as quickly as possible and not Beijing, obviously hinting that without ending the trade war with China, Trump would not win the 2020 presidential election. What do we have in the end after Trump named Chinese President Xi Jinping as his friend, whom he supports? We have a situation in which the signing of the agreement in the "first phase" can be postponed to 2020, as the parties still cannot agree on several cornerstone issues. The agreement in the "second phase" is not clear when it will be signed, even the negotiations have not yet started. And at any moment, the US President may find that Beijing is deliberately delaying time, and impose new duties and financial sanctions that will further slow down global economic growth.

Based on the above, we believe that the parties are far from signing an agreement, the world economy will continue to be affected by the trade conflict in the near future, respectively, the US and EU economies will continue to slow down, which, as we found out yesterday, is more dangerous for the euro currency. On Tuesday, November 26, several speeches by representatives of the ECB, De Guindos, Mersch and Lane are scheduled, as well as several minor macroeconomic publications in the States. Night speech by Jerome Powell, judging by the unchanged volatility of the euro/dollar pair, did not cause any interest among forex market participants. Thus, today, we can pay attention only to the speeches of officials of the European Central Bank. Low volatility is likely to continue today. From a technical point of view, the downward movement may continue, since the Heiken Ashi indicator does not indicate the beginning of an upward correction. The lower channel of linear regression supports the downward trend and bears, who still doubt the advisability of further sell-offs of the pair.

Nearest support levels:

S1 - 1.0986

S2 - 1.0925

S3 - 1.0864

Nearest resistance levels:

R1 - 1.1047

R2 - 1.1108

R3 - 1.1169

Trading recommendations:

The euro/dollar pair continues a slight downward movement. Thus, it is now recommended to trade the pair lower with the first target of 1.0986. Volatility on the pair rose slightly on Friday but already managed to fall on Monday. Overcoming the first target will open the way for traders to new lows. It is recommended to buy the euro currency not earlier than the consolidation of traders above the moving average line with the first target of 1.1108.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.