Today's speech by Federal Reserve Chairman Jerome Powell and statements that rates may remain unchanged by the end of the year did not provide significant support to the US dollar, as traders are now more concerned about the trade differences between the US and China. On the other hand, unless the Fed cuts rates again this December, demand for the US dollar will persist.

Fed Chairman Powell said the rate cut seen throughout this year reflected a reassessment of underlying momentum in the economy and was done to support a strong labor market and stable inflation. Powell also noted that current monetary policy will remain appropriate if economic growth continues in line with expectations, as conditions in the economy are generally good.

The head of the committee also said that any changes in the Fed's policy are aimed at ensuring a favorable outlook for the economy, but the lowering of estimates of the neutral level of interest rates indicates that the Fed's policy provides less support than previously thought. The revaluation of the economy did not lead to a change in the Fed's policy, but gave another reason for slightly lower interest rates, as weakness in foreign countries and trade uncertainty constrain growth in the US. As for inflation, Powell expects it to return to the target of about 2.00% soon and is ready to do everything to prevent its unhealthy decline.

As noted above, the statements did not support the US dollar, although there are even fewer buyers of risky assets. As for the fundamental data, yesterday's reports were not important.

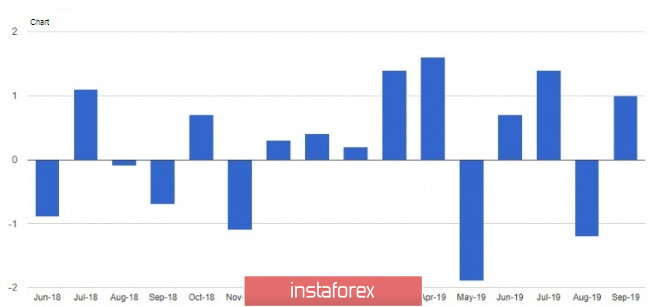

The Fed-Chicago report pointed to the national activity index, which fell to -0.71 points in October this year from -0.45 points in September, and the 3-month moving average of the national activity index fell to -0.31 points.

The Fed-Dallas report pointed to a decline in the manufacturing index in November this year to -2.4 points versus 4.5 points in October. But the PMI recovered slightly in November to -1.3 points against -5.1 points in October.

Yesterday, it also became known that the Federal Reserve Bank of New York has made another injection of liquidity into financial markets in the amount of 93.5 billion US dollars. All applications of banks were satisfied.

As for the current technical picture of the EURUSD pair, despite all the active actions of buyers, it was not possible to get beyond the resistance of 1.1040. The breakthrough of the support of 1.1005 will lead to the renewal of this month's lows in the area of 1.0989 and the area of 1.0950. Worsening US-China trade relations will be an important component in the bearish movement of risky assets. The upward trend is limited to the upper level of 1.1040, the breakout of which will lead to the return of risky assets to the area of the maximum of 1.1060 and 1.1090.

The Canadian dollar failed to recover after a report that wholesale trade in Canada rose in September this year. The growth was due to increased sales of equipment.

According to Statistics Canada, wholesale trade increased by 1.0% compared to the previous month to 65.09 billion Canadian dollars. Compared to the same period the previous year, wholesale trade in Canada increased by 4.0%.