GBP/USD

Analysis:

The main trend of the British pound is upward. Over the past month and a half, a correction plane has been forming on the chart. By the current day, the wave structure looks complete. The price rise that began at the end of last week has a reversal potential.

Forecast:

Today, the general upward mood of the price movement is expected. In the next session, pressure on support is possible. A short-term puncture of the lower boundary of the zone is not excluded. The beginning of the active phase of growth can be expected by the end of the day.

Potential reversal zones

Resistance:

- 1.2950/1.2980

Support:

- 1.2880/1.2850

Recommendations:

The sale of the pound today is not very promising. The main attention should be paid to finding entry points into long positions on this pair.

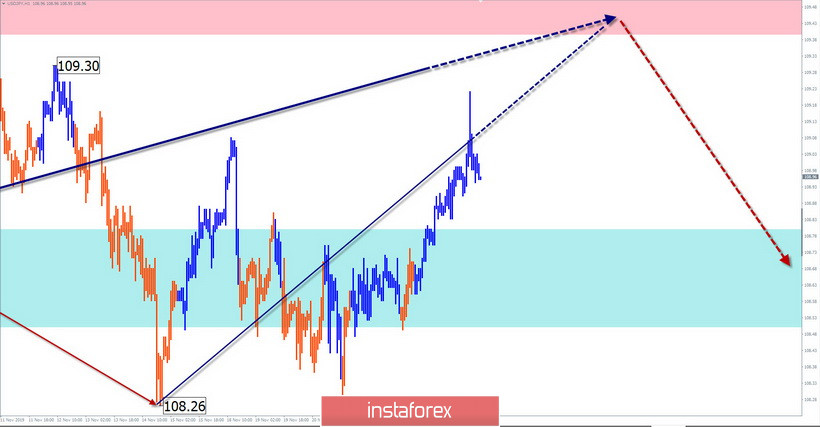

USD/JPY

Analysis:

Since the beginning of the year, an upward wave of the wrong kind has been developing on the yen chart. The final section (C) has been counting since August and is now approaching its lowest possible level of upward elongation. The calculated resistance passes along the lower boundary of a powerful reversal zone of a large scale.

Forecast:

Today, the general flat sentiment of price fluctuations is expected. In the first half of the day, an upward course is likely. After contact with the resistance zone, you can wait for a reversal and the beginning of the decline.

Potential reversal zones

Resistance:

- 109.40/109.80

Support:

- 108.80/108.50

Recommendations:

Trading on the yen market today is possible within intraday movements. Relevant purchases. By the end of the day, you should pay attention to the signals of the exchange rate change to find points of sale of the pair.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement.

Attention: The wave algorithm does not take into account the duration of the tool movements in time!