Hello, dear colleagues!

I will start this article with the fact that the pound/dollar currency pair has recently been trading without a pronounced direction. Such dynamics of the pair are influenced by the events around Brexit, the election campaign that takes place in the UK, as well as trade contradictions between the US and China.

We should not ignore the macroeconomic statistics that come from the Albion and the United States of America. Before proceeding to the technical part of the review, I will highlight the main events that can affect the price dynamics of the pound/dollar currency pair.

Across the UK, these are approved mortgage applications. There are no other significant reports this week. Releases from the United States will be much more saturated: consumer confidence indicator, revised GDP data for the 3rd quarter, applications for durable goods. It is planned to release other indicators from the United States, the date, time and forecasts for which can be seen in the economic calendar.

And now it's time to move on to the charts of the GBP/USD currency pair, and I'll start with the weekly timeframe.

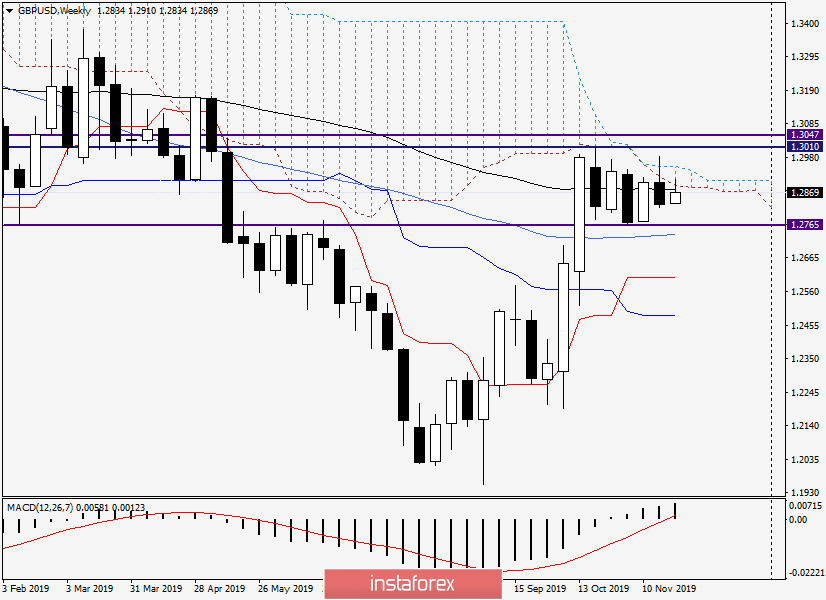

Weekly

At this time interval, the range 1.2765-1.3013 is visible, in which the quote has been staying for quite a long time. The alternate formation of bullish and bearish candlesticks just indicates the uncertainty that prevails for this currency pair.

In my opinion, until there is a true breakdown of the support 1.2765 or resistance 1.3010, it is not possible to judge the prospects of the instrument.

At the same time, a strong technical and historical level of 1.3047 passes above 1.3010. To confirm their intention of ascending, the pair needs to consolidate above this major resistance level.

Also, it is not so simple for bears. Along with the support at 1.2765, it will be necessary to break through the 50-simple moving average, which passes at 1.2740.

The current resistance on the weekly chart has 89 EMA and the lower border of the Ichimoku indicator cloud. Looking at the weekly chart, it is difficult to conclude the further direction of the quote, so let's move to a smaller period.

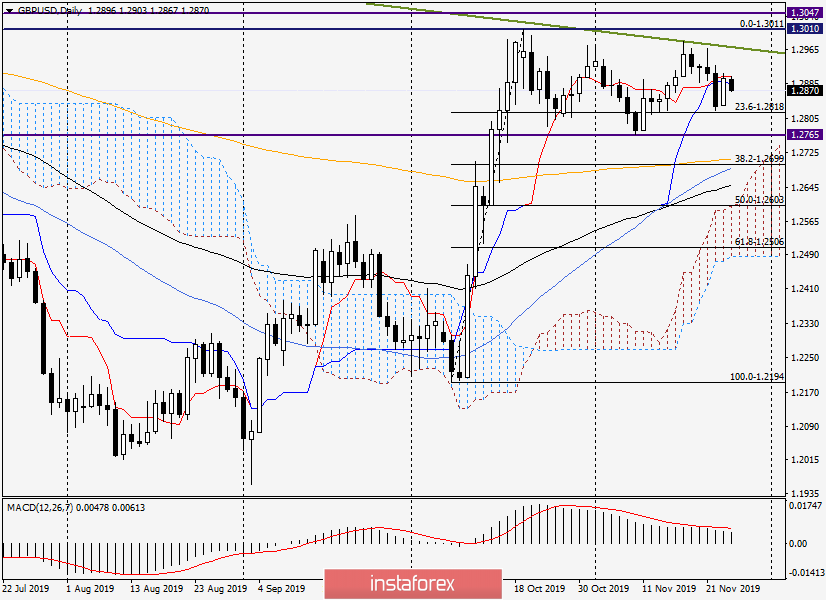

Daily

As a result of the strong decline that took place on November 22, it would be possible to assume a further weakening of the exchange rate. However, yesterday, against the background of the UK Conservative Party's advantage in the election race, the pound (largely unexpectedly) received support and strengthened against the US dollar.

Thus, the pair closed Monday's trading above the Kijun line broken on Friday. Tenkan, in turn, continues to resist attempts to grow, and at the time of completion of this article, it is from this line that the decline occurs.

If the pressure on GBP/USD continues, the next targets for sellers will be yesterday's lows at 1.2834, and then one of the key levels of 1.2800. In case of a change of market sentiment and return to growth, I expect the pair at 1.2910, 1.2927 and 1.2940.

In such an uncertain situation, trading the British pound is quite risky. Those who want to open positions on GBP/USD, I recommend to look closely at the purchases from the price zone 1.2775-1.2745 and try to sell from current prices or attempts to rise to the area 1.2910-1.2940. In both cases, before entering the market, it is better to see the confirmation in the form of the corresponding Japanese candlestick patterns.

Good luck!