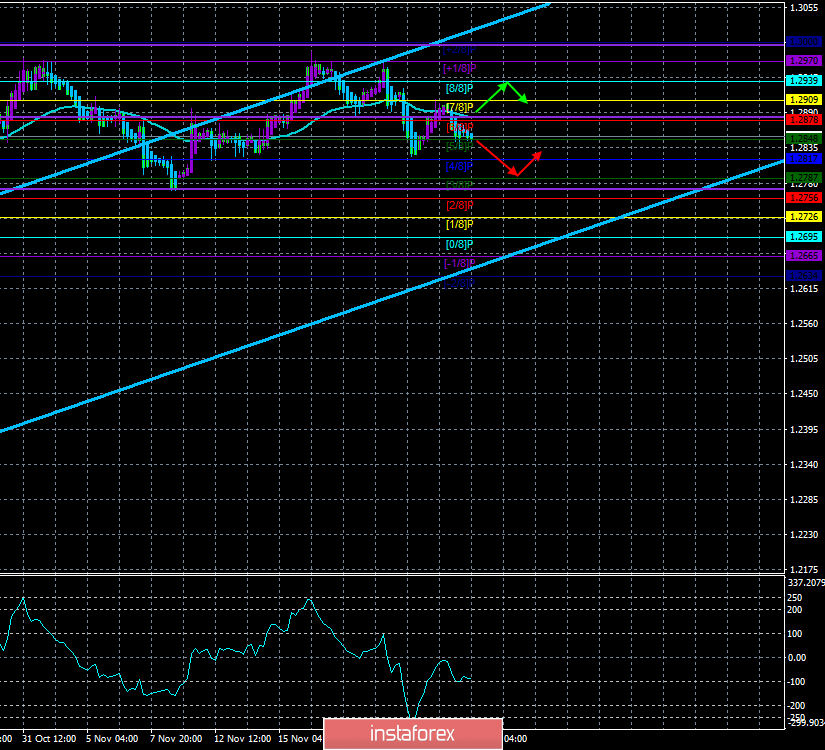

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - sideways.

The moving average (20; smoothed) - sideways.

CCI: -96.3636

The British pound paired with the US dollar continues to trade in the 200-point side channel, limited by the Murray levels of 1.2970 and 1.2787. The calendar of macroeconomic events in the UK remains empty. In the first two days, macroeconomic publications were absent in America, but at least an interesting speech by Jerome Powell took place overseas, which once again convinced traders that the Fed is not going to interfere in monetary policy again in the coming months. However, for the pound, the whole fundamental background remains uninteresting. The currency pair did not show any signs of wanting to leave the channel indicated above, even when the economic data were at the disposal of traders. From our point of view, since October 21, the pound/dollar pair has simply gone into a waiting mode for the parliamentary elections in the UK, and traders are not ready to form longer-term and large positions until December 12, when the results of these elections will be known. Thus, the situation on the pound/dollar pair does not change at all, macroeconomic publications in the Kingdom this week are not planned at all, the hope today is only on data from overseas, among which there will be several important reports that we have already reviewed in the article on EUR/USD.

From a technical point of view, the quotes of the pound/dollar pair rebounded from the moving average line and can now continue to move down to the Murray level of "3/8" - 1.2787, which is also the lower boundary of the side channel. From a general fundamental point of view, we continue to believe that all factors are in favor of resuming the long-term downward trend. However, the persistent reluctance of traders to work out the failed macroeconomic statistics from Albion does not allow the pound to resume falling against the dollar. The US currency itself now does not have enough of the necessary factors for growth, but if you compare the general state of the US and UK economies, the monetary policies of these two countries, the mood of the leaders of their central banks, it is obvious in whose favor the comparison will be. Thus, market participants now can only continue to wonder what will end the elections on December 12, but rather whether the conservatives will get the necessary advantage in the elections or whether a "suspended parliament" will be formed again, and the whole process of Brexit will be delayed for many years. After all, even if the conservatives do not gain the required number of seats, this does not mean that the Labor Party will be able to push through its idea of a second referendum. That is, there may be a situation in which Brexit will not take place, and a second referendum will not be held, and we will have to postpone again the date of leaving the European Union, and together with this date, the date of completion of the transition period, which is designed to adapt the alliance and the UK to life without each other, and which expires at the end of 2020.

As long as traders have not left the channel indicated above, it is recommended to conduct extremely cautious trading or not to open positions at all, waiting for the resumption of the trend movement. Since within each turn of the upward or downward movement, the pair does not necessarily work out the upper or lower border of the channel.

Nearest support levels:

S1 - 1.2817

S2 - 1.2787

S3 - 1.2756

Nearest resistance levels:

R1 - 1.2848

R2 - 1.2878

R3 - 1.2909

Trading recommendations:

The GBP/USD currency pair remains inside the side channel. The area of 1.2970-1.3010 has remained unstoppable, so we are not waiting for the formation of a new upward trend. You can sell the pound/dollar pair now with the target of 1.2787, as there was a rebound from the moving average line, but even in this case, we recommend trading small lots or not trading at all until the flat is completed.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance – the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.