Weak statistics on sales of new homes in the US and the decline in consumer confidence did not allow the US dollar to continue growing against several world currencies at the North American session on Tuesday, November 26. News that the first phase of the trade agreement between the United States and China may be signed soon and this probability has increased significantly after yesterday's telephone conversation of trade representatives, provided little support to risky assets. However, the demand for them is still quite low.

As noted above, Chinese Vice Premier Liu He had a telephone conversation with US trade representative Robert Lighthizer and US Treasury Secretary Steven Mnuchin. Immediately after that, the Ministry of trade of the PRC reported that the parties had reached a consensus. First of all, we are talking about the protection of intellectual property, which is so sought by the American side.

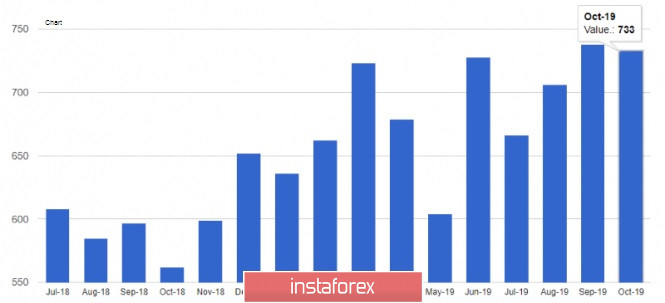

Concerning fundamental statistics, it failed to please the traders. Sales of new homes in the United States in October of this year decreased compared to the previous month. According to the US Department of Commerce, sales in the primary housing market in October 2019 fell by 0.7% from the previous month to 733,000 homes per year. Economists had expected sales to reach 705,000 homes a year. The average price for a new home was 316,700.

According to S&P-CoreLogic/Case-Shiller, the pace of growth in US house prices accelerated in September this year after a serious downturn. The growth is driven by demand, which is directly related to lower interest rates in the United States. The average US home price rose by 3.2% in September from the same period the previous year. Sales in the US secondary housing market also rose.

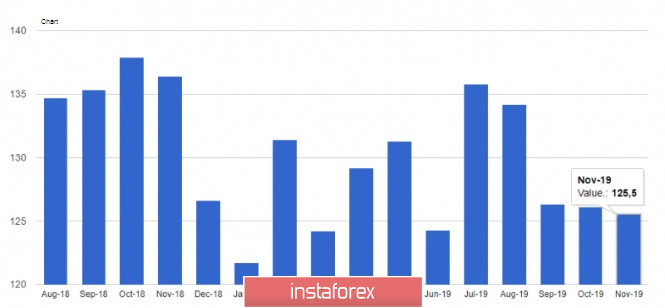

The US consumer confidence indicator also failed to please traders, as it declined in November. The fall was due to a deterioration in US consumer sentiment, as the slowdown in the global economy and the trade war with China negatively affect the overall US GDP growth for this year.

According to the Conference Board research group, the US consumer confidence index fell to 125.5 points in November 2019 from 126.1 points in October. Economists had expected the index to rise to 126.8 points.

The data from the Redbook retail sales did not bother traders much. According to the report, US retail sales for the first 3 weeks of November decreased by 0.4% but increased by 4.4% for the same period in 2018. For the week of November 17-23, sales increased by 4.3%. The report by the Retail Economist and Goldman Sachs shows that the US retail sales index for the week of November 17-23 rose by 1.6% and 4.5% year-on-year.

Another speech by Federal Reserve representative Lael Brainard did not differ much from the views of other Fed chairmen. According to Brainard, the Fed has taken significant steps to level the risks to the economy, and it will take time to assess the impact of the three rate cuts. As for the future outlook, the Fed will continue to watch closely for signs that would cause a reassessment of the outlook for rates, as risks to the economy, are still skewed to the downside. Brainard expects inflation to rise gradually to 2%.

As for the technical picture of the EURUSD pair, it remained unchanged. The breakout of the support of 1.1005 will lead to an update of this month's lows around 1.0989 and around 1.0950. The upward trend is limited to the upper level of 1.1040, the breakout of which will lead to the return of risky assets to the area of the maximum of 1.1060 and 1.1090.