Investors focused their attention to publishing economic statistics from the United States while the situation around the Washington-Beijing trade negotiations did not go through the so-called "phase 1".

The importance of the output data must be taken into account, since the Fed has held the last two meetings on monetary policy, as well as its leader J. Powell, have repeatedly made it clear that measures related to changes in the level of interest rates will depend on the published data on the American economy. Therefore, on Tuesday, keeping the topic of US-Chinese negotiations on a pausel, the attention of the market was drawn to the presented values of Conference Board consumer confidence indices for November and figures for new home sales for the month of October.

According to published data, the Conference Board consumer confidence index in November fell to 125.5 points from the revised upward value to 126.1 points from the previous value with a growth forecast of 127.0 points. However, at the same time, sales in October increased by 733,000 against the expected value of 709,000. Also, what is still important, is a revision of previous data upward to 738,000.

Ambiguous data stimulated a slightly weaker increase in US stock indices and exerted little pressure on the dollar. But already in the Asian trading session, the ICE dollar index, which demonstrates the ratio of the US currency to a basket of major currencies, receives support, adding 0.10%. The reason for this reversal is the statement made by Fed representative L. Brainard yesterday, who criticized the need to lower interest rates, believing that this decision was too early and even wrong, based on a potentially incorrect understanding of the relationship between inflation and unemployment.

Today, the attention of the players in the market will be focused on the publication of important inflation indicators in the United States - the basic price index for personal consumption, which is expected to significantly increase in October to 0.2% against a decline of 0.4% over the previous period. If the data does not disappoint, and the output values of the quarterly GDP do not fall below the forecast, this may support the continuation of the local strengthening of the American currency on the night of Thanksgiving.

Forecast of the day:

The EUR/USD remains under pressure amid generally positive data on the US economy. If the statistical data from the United States does not turn out to be worse than expected today, this may lead to a fall in the pair to 1.0975 after it declines below 1.1000.

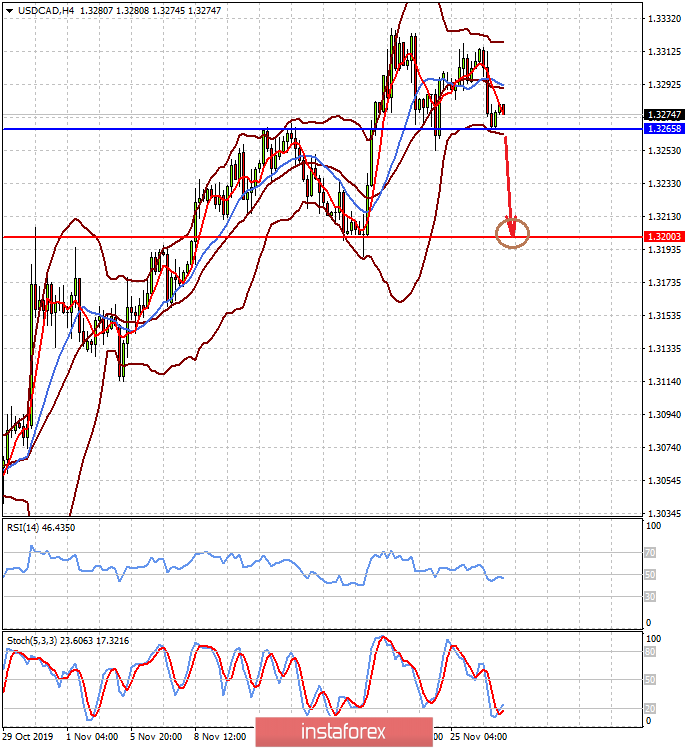

The USD/CAD pair is consolidating above the level of 1.3265 on the wave of lateral dynamics of crude oil prices, which, in turn, are supported by the expectation of a trade deal between the US and China. We believe that if oil prices continue the upward trend, the pair may move quickly to 1.3200, but for this to happen, it needs to technically drop below 1.3265.