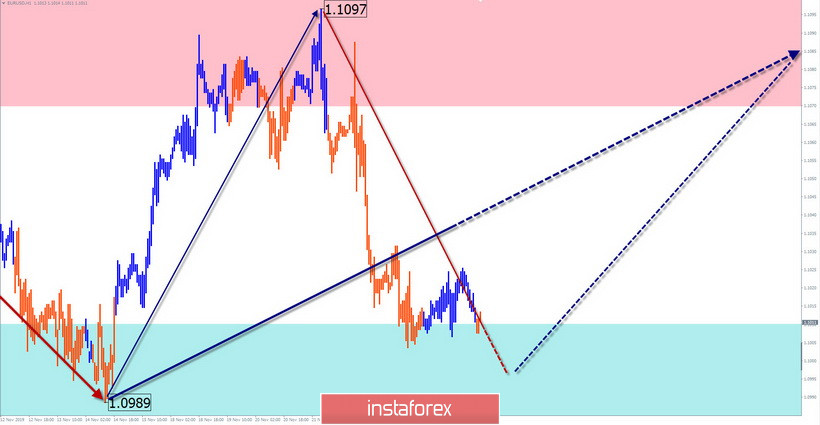

EUR/USD

Analysis:

The euro chart is dominated by a downward trend for most of the year. Since the beginning of September, the price forms a corrective wave in the form of a stretched plane. The structure lacks an ascending section. Since November 14, a bullish wave model has been formed, in which the middle part (B) is nearing completion.

Forecast:

Over the next day, the pair is expected to complete its decline, form a reversal and start an upward movement.

Potential reversal zones

Resistance:

- 1.1070/1.1100

Support:

- 1.1010/1.0980

Recommendations:

Euro sales today are unpromising. It is recommended to monitor the pair reversal signals to find entry points into long positions.

AUD/USD

Analysis:

On the Aussie chart, the bearish wave of September 12 sets the trend direction. It is fully completed in the first 2 parts. The final part of the wave has been forming for the past month. In the last 2 weeks within this movement, the price forms an intermediate correction.

Forecast:

Today, the most likely scenario will be the continuation of the flat mood of price movements. At the European session, there may be pressure on the support zone. By the end of the day, an upward vector is more likely. After the completion of the current correction, the price is expected to turn and decline.

Potential reversal zones

Resistance:

- 0.6820/0.6850

Support:

- 0.6760/0.6730

Recommendations:

Trading in the pair market today is shown only in intraday style, according to the expected sequence. Before entering the transaction, you need confirmation in the form of a reversal signal of your vehicle.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement.

Attention: The wave algorithm does not take into account the duration of the tool movements in time!