The mood of the market remains positive. On Tuesday, all three major US stock indexes updated record highs, and Asian indices generally rising after. The positivity is supported, among other things, by the absence of significant macroeconomic publications, as well as signals from negotiators from the USA and China that the parties are getting near to concluding the trade agreement as the December 15 date approaches, when new higher tariff plans can be put into effect.

Yesterday, US President Trump said that "phase one" negotiations are in their final stages, confirming a message from the Chinese side earlier this week.

These expectations are supported primarily by the dollar, and secondly by commodity currencies and, in general, commodity prices.

Today, a package of important data for the United States will be released. The orders for durable goods will help to understand the dynamics of investments in the manufacturing sector. However, capital investments were significantly lower than expected this year.

The second most important report is the growth of private consumption and the dynamics of core inflation in October. The steady state of retail suggests that consumption also grew in October, and the data may ultimately support the dollar. A second estimate for GDP for the 3rd quarter will also be published; it is expected that the adjustment will be 0.1% upward.

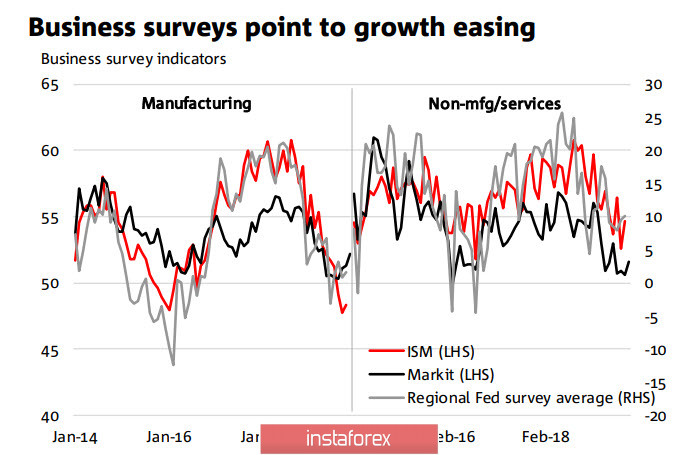

At the same time, business surveys indicate a slowdown in the US economy, primarily in the manufacturing sector, but the threat of a recession is moving into the future. The forecasts for GDP for the 4th quarter look mixed, a number of banks forecast a slight slowdown to 1.4-1.5%, while the GDPNow model from the Federal Reserve Bank of Atlanta currently shows an increase of only 0.4%.

The dollar, in turn, looks confident before the publication of data and is able to strengthen its leadership at the end of the day.

NZD/USD

The New Zealand dollar is still feeling confident as macroeconomic indicators of the country's economy are stable. PMI indices, unlike most G10 countries, hold above 50p. Moreover, the quarterly report on retail sales, published on Monday, turned out to be better than expected and contributes to higher inflation expectations as well as the trade balance of both export and import grew in October which are also better than expected.

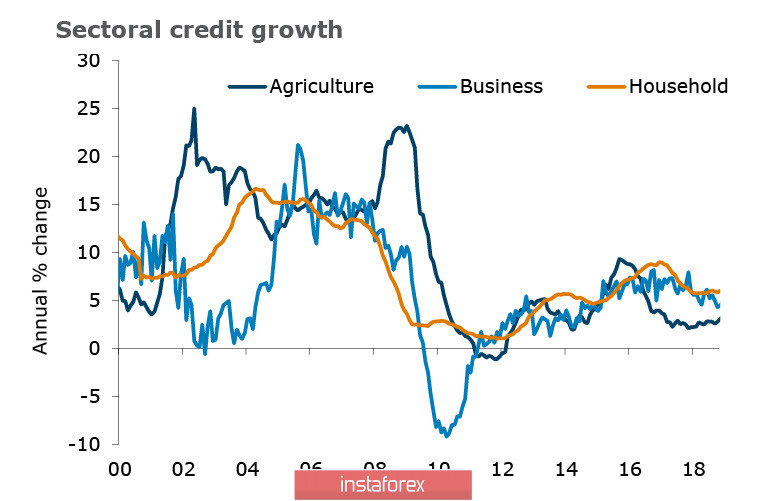

In the November report on financial stability, conducted after a regular check of the state of the financial system of New Zealand and published on Tuesday, RBNZ draws attention to key risks, which are primarily associated with a high level of dependence on offshore financing. Tensions in world trade and a general global slowdown dictate the need for a sharp increase in banking capital requirements. The indebtedness of the economy and households is high, but not threatening, interest rates remain low, and the threat can come only from a shock drop in income if the external situation drastically worsens.

In general, the RBNZ report does not contain surprises and looks like preparation for the main event of the winter - a decision on the amount of the bank's capital, which will be adopted in a week, on December 5th.

On the other hand, Kiwi froze in the range since it was not able to overcome the resistance of 0.6435, but attempts will continue. It is also one of the few who resist the strengthening of the dollar, and in crosses against protective currencies retains an upward momentum.

AUD/USD

The Australian dollar is gradually falling, responding to the increased threat of recession. PNMI indexes fell below 50p, the Aussie reacts to the threat of a slowdown in the Chinese economy and the danger that the US and China will not be able to come to a trade agreement. Thus, it can be said that Aussie looks worse relative to the Kiwi, and if on Saturday, November 30, Chinese PMIs in manufacturing and services for November show a further decline, Australian currency are likely to continue to fall.

"Aussie" approached the support zone of 0.6760 / 70 again and its fall looks likely in the next day, which will be able to open the direction to 0.6710 / 20.