The US dollar completes a three-day trading marathon before Thanksgiving on a major note: US GDP growth data were better than expected. This fact was a strong argument in favor of maintaining a wait-and-see attitude from the Fed. However, there was a drawback today - inflation indicators disappointed traders, thereby offsetting the positive effect of the central release of the environment. However, first things first.

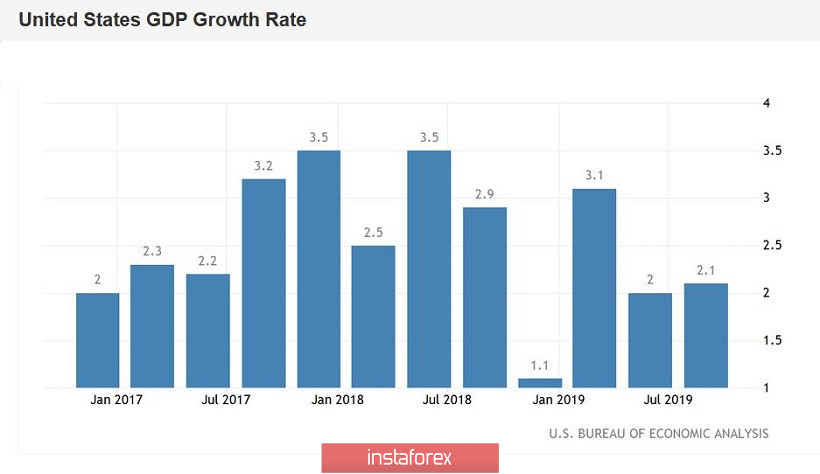

According to experts, the US economy should have slowed down to 1.8% in the third quarter. (with growth up to 3.1% in the first quarter and up to 2% in the second). In reality, the volume of GDP increased by 2.1%, and the component of personal consumption showed the highest growth from the second quarter of the year before last. The price index of GDP remained at the initial level of 1.7% (against the two percent forecast), while in the second quarter this indicator grew by 2.4%. Third quarter GDP was revised to show growth of 2.1% after more modest growth in the previous period.

In general, the figures published today suggest that the US economy is experiencing the negative impact of the global trade conflict, but nevertheless is in fairly good shape. The current situation fully fits into the outline of the intentions of the US regulator: judging by the latest statements of their representatives, the Federal Reserve is ready to maintain a wait-and-see attitude unless the trade war breaks out with renewed vigor (or if inflation does not slow down to critical levels).

In addition, the dollar was also supported by the data published today on the volume of orders for durable goods. This indicator (including transport equipment) left the negative area and reached 0.6%. The result is relatively modest, but the best since July. Without taking into account transport equipment, this indicator also reached the level of many-month highs, demonstrating positive dynamics. Strengthening investment intentions is an encouraging signal for both traders and Federal Reserve members - especially in terms of interest rate prospects next year. The mere fact of the growth of this indicator is not capable of giving decisiveness to the members of the regulator, however, if such dynamics will affect the country's GDP growth in the fourth quarter, then the likelihood of the Fed's expectation of a wait-and-see position throughout 2020 will increase.

As I said above, there was a drawback. To the disappointment of dollar bulls, inflation indicators continue to exit in the red zone. Thus, the index of personal consumption expenditures, which measures the core level of expenses and indirectly affects the dynamics of inflation in the United States, came out worse than forecasts - in monthly terms, it fell to 0.1%, continuing the negative trend. On an annualized basis, the indicator also decreased (to 1.6%), although experts expected it to remain at the previous level (1.7%). The level of population spending showed a slight increase (0.3%), although a consensus forecast indicated an increase to 0.5%.

In general, these data are consistent and consistent with the uncertain growth in the consumer price index, which was published earlier. It is believed that these inflation indicators are being monitored by members of the US regulator with particular care, so the optimism of dollar bulls seems to be premature. Let me remind you that the nonfarm inflation component also disappointed last month - on a monthly basis, salaries grew by only 0.2%, in annual terms - to 3.0%. A rather weak increase in the average hourly wage level again failed the dollar bulls, especially in light of the rest of the inflation releases.

Here it is worth noting that Fed Chief Jerome Powell has recently unambiguously hinted that the further steps of the US regulator will largely depend on the dynamics of inflation growth. This is not only about reducing, but also raising the rate. Speaking in Congress, Powell emphasized that the regulator will not even think about tightening monetary policy until key inflation indicators return to sustainable growth. Although the strong US labor market has traditionally supported the dollar, inflation continues to be the weak link in the US economy for many years. The indicators published today served as an additional confirmation of this fact.

Thus, despite the fact that the dollar today received support from key data on the growth of the American economy, the bulls of the EUR/USD pair are still fighting for the 10th figure. Weak inflation indicators did not allow the bears to develop a blitzkrieg, especially on the eve of tomorrow, when US trading floors will be closed. By and large, the pair remained at the same positions at the end of the day: traders were unable to pull the price below 1.0970 (the lower line of the Bollinger Bands indicator on the daily chart) to confirm the strength of the downward movement. Now EUR/USD traders are waiting for the next tests: data on the growth of German inflation will be published tomorrow, and pan-European consumer price index the day after tomorrow. In conditions of low liquidity, the pair may demonstrate impulsive movements, especially if the published figures do not coincide with the expectations of market participants.