4-hour timeframe

Amplitude of the last 5 days (high-low): 28p - 45p - 74p - 28p - 19p.

Average volatility over the past 5 days: 39p (low).

On the third trading day of the week, the EUR/USD currency pair resumed its downward movement after a low upward correction and continues to discourage its lethargy and apathy. If there was not any important macroeconomic information that was available to traders in the first two trading days of the week, which partially explained the low volatility of the pair, today there were important macroeconomic statistics, but all that the market participants were able to do was move down by "as much as 25 points" . How can one again not recall the paradoxical situation in which, from our point of view, the euro/dollar currency pair has recently been? We continue to believe that there are not enough statistical indicators for further strong and long-term sales of the European currency. The pair continues to be around 2-year lows. Thus, there are no reasons for buying the euro currency: data from overseas began to delight traders with their strength again, data from the European Union continue to disappoint; The Federal Reserve took a break in easing monetary policy. On the contrary, the ECB is preparing for various changes due to a change in the head of the regulator and, most likely, will lower its key rate again. Thus, we believe that it is precisely the new lowering of the ECB key rate that can help the bears perk up and start again large pairs in terms of volume of sales, which will lead to updating lows.

All macroeconomic data have been published today in the United States. The most important and significant report - orders for durable goods - showed a positive trend. The main indicator added 0.6% MOM in October, while forecasts predicted another decline in volumes by 0.8%. Orders excluding defense increased by 0.1% with forecasts of -0.3%. Orders for goods excluding transport increased by 0.6% with expert forecasts +0.1%. Orders excluding defense and aviation showed an increase of as much as 1.2% against the expectations of the Forex market -0.3%. In addition, annual data on GDP for the third quarter were released, which also turned out to be better than expectations of market participants and amounted to +2.1%. This, of course, is not the final value, but the increase in this indicator in itself is great news for investors in the US dollar. Also, the number of applications for unemployment benefits turned out to be lower than experts expected, and only data on personal incomes of the US population turned out to be slightly disappointing, showing a zero increase in October. Personal expenses of Americans increased by 0.3%, according to the forecast value. Thus, in general, we can say that the package of macroeconomic information from across the ocean turned out to be positive and was completely ignored by traders, since we could have expected a 20-point move down without such a large amount of important data.

In this situation, it remains only to ask when this pair's movement will end, with low volatility, which is very difficult to work out, and what will trigger the pair to return to the usual mode? We believe that this should be some extremely important event for traders of the euro/dollar currency pair. For example, lowering the ECB key rate. We currently don't see a reason as to why the pair will rise again. We also don't see why the European currency can begin to show growth against the US dollar if all macroeconomic statistics are in favor of the United States, and a trade war between China and the US, which could hypothetically cause a deterioration in US macroeconomic indicators, has no less negative impact on European ones. Thus, the euro's hope continues to be associated only with a serious deterioration in statistics in the United States or the resumption of the monetary policy easing in America on an equal footing, since the current state of the US economy clearly does not require such a regulatory step.

From a technical point of view, the euro/dollar pair has almost worked out the support level of 1.0990 and can rebound from it by making a call to a new round of upward correction. However, given the current value of volatility, it does not even matter much in which direction the pair is moving. To work out the movement during the day of 20 points is an extremely difficult and inconvenient task.

Trading recommendations:

The EUR/USD pair may begin a new round of correction against the downward trend, and the volatility in trading remains extremely low on Wednesday. Thus, it is now recommended to wait until the correction begins and ends and sell the euro/dollar pair again with targets at 1.0990 and 1.0963, or stay in shorts with the same goals, hoping that there will be no correction. It is recommended to consider buying the euro not earlier than the reverse consolidation of traders above the critical Kijun-sen line and the level of 1.1073 with the first goal being the resistance level of 1.1127.

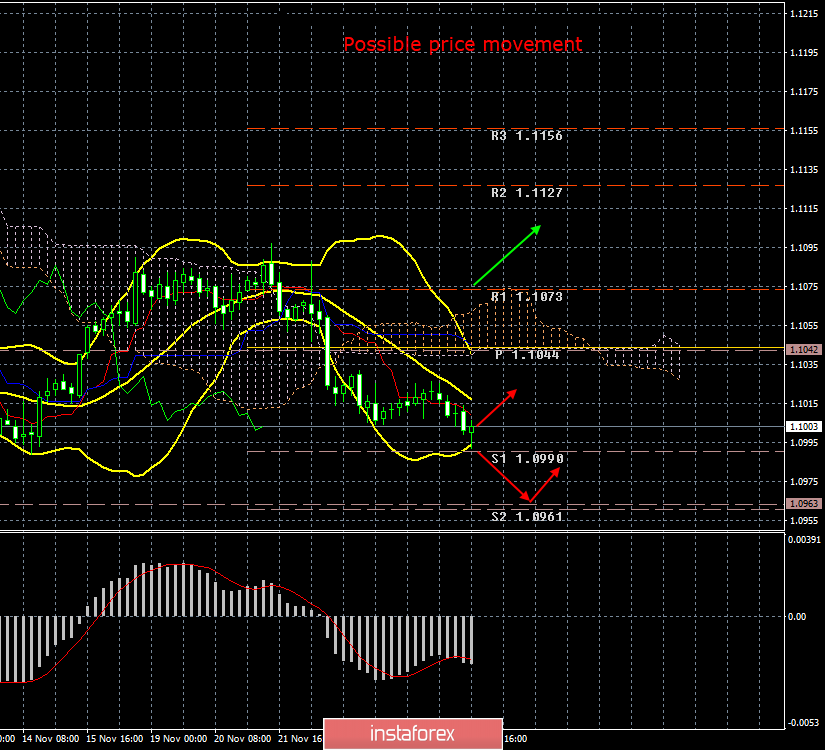

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.