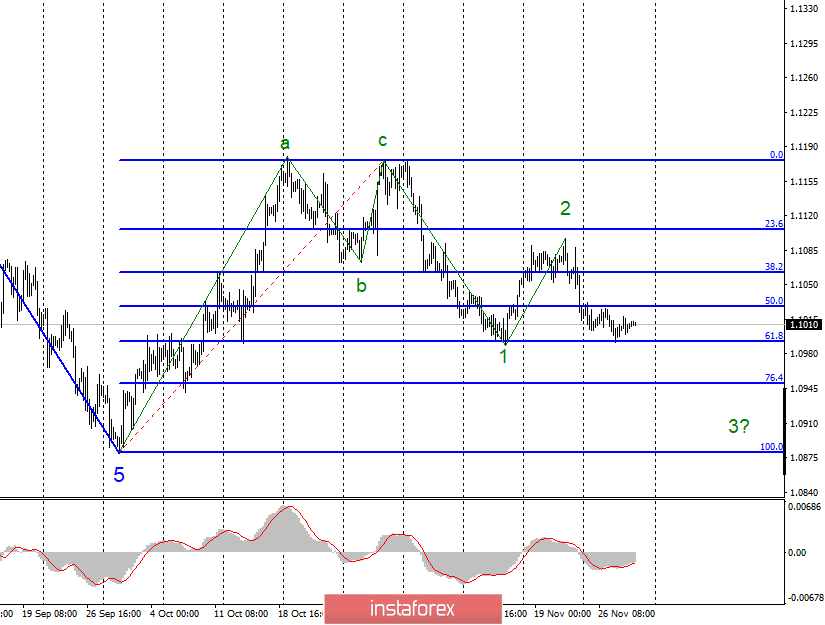

EUR / USD

On November 28, the EUR / USD pair completed with an increase of 5 basis points. Thus, the instrument continues to move away from previously reached lows after an unsuccessful attempt to break through the 61.8% Fibonacci level if a 5-point movement can be called a "movement". One way or another, an unsuccessful attempt to break through the low of wave 1 indicates that the market is not ready for further sales of the euro-dollar instrument. Since the current wave marking implies the construction of a bearish wave 3, only a successful attempt to break through the level of 61.8% can lead to continued decline in the instrument.

Fundamental component:

On Thursday, the news background for the euro-dollar instrument was much weaker than the day before. There is nothing I can highlight in the calendar of economic news but the preliminary inflation rate in Germany for November. However, even the inflation in Germany, which completely did not meet the expectations of the currency market, did not affect the activity of the instrument. On Friday, you can pay attention to inflation again, but only in the European Union. But the value, in Germany, will only be preliminary so I would not have expected that the activity of the market would increase due to one report, which is intermediate in nature. Today, the only conclusion that can be made during the day is the significance of inflation in the European Union by the end of the month - an approximate, of course. Thus, the amplitude of the EUR / USD pair remains today, which is most likely weak. At the same time, the markets will have to follow the news from China again, as Donald Trump has signed the laws relating to Hong Kong, and Beijing said it will definitely take measures in response to Washington's direct intervention in China's internal affairs. Moreover, the situation with Hong Kong could lead to a serious deterioration of relations between the countries and complicate negotiations on a trade agreement, which are already being moving "creakily".

General conclusions and recommendations:

The euro-dollar pair, presumably, continues to build wave 3. Thus, I now recommend selling the instrument again with targets located near the calculated levels of 1.0951 and 1.0880, which equates to 76.4% and 100.0% Fibonacci, but after a successful attempt to break through the 61.8% Fibonacci level.

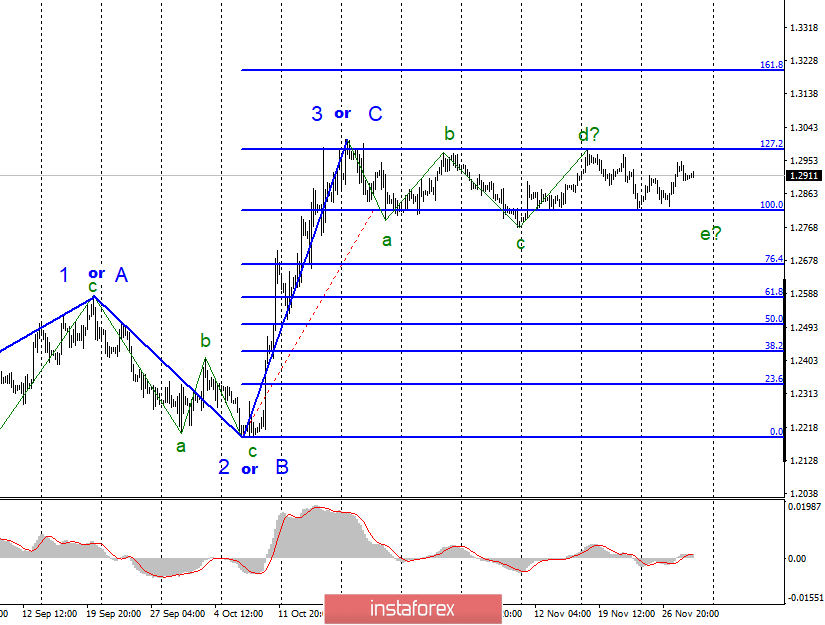

GBP / USD

On November 28, the GBP/USD pair lost about 5 basis points, and the construction of the alleged wave of e continues to be in doubt. At the same time, the resumption of the construction of the upward trend section remains in even greater doubt until the successful attempt to break through the Fibonacci level of 127.2%. The entire trend section, originating on October 21, can transform into an even more complex horizontal wave structure.

Fundamental component:

On Thursday, the news background for the GBP/USD instrument remains quite weak. Thus, markets continue to pay attention to preliminary polls regarding voting in future elections. However, as we can see, the results of these sociological studies are not reflected in the chart of the movement of the instrument. In addition, there were no economic reports yesterday and there will also not be any today. Based on this, I believe that the wave pattern will not change for either the euro or the pound today. The markets, in turn, will continue to wait for new information about relations between China and the United States and they will wait for new information about the course of the election campaign in the UK, but all this news is unlikely to lead to strong movements. In December, meetings of the ECB and the Fed will be held, elections will be held in the UK, and Donald Trump will have to decide on the introduction of new duties on imports from China. Thus, it will be clearly more interesting than November. In the next few months, I expect more active trading, a stronger movement of each currency pair.

General conclusions and recommendations:

The pound / dollar instrument continues to build a horizontal trend section. Thus, now, I still expect the pair quotes to decline to around 1.2770 after the MACD signal "down", after which the wave pattern may require adjustments and additions. It is not recommended not to buy a pair not earlier than a successful attempt to break through the 127.2% Fibonacci level, which will indicate the willingness of the markets to build a new impulsive rising wave.