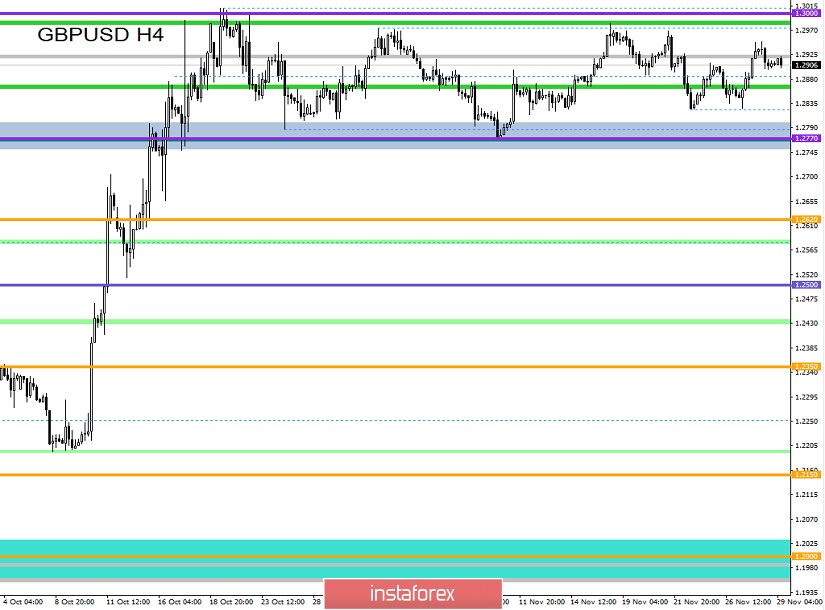

From the point of view of a comprehensive technical analysis, we see that against the background of inertial jumps of the past days, the quotation locally touched the high pressure area of 1.2950 / 1.3000, which led to a slowdown and partial return. Whether this is a conditional mining of the upper border of the flat or we have something else, this question worries many traders, so we will try to analyze it. Now, let's start with the fact that yesterday's movement could be triggered by several factors: local overbought amid a jump in quotes, as well as the massive fixation of long positions, which, due to the risk of further pressure from the 1.2950 / 1.3000 area, decided to leave trade deals. At the same time, no one forgot about such a factor as repetition, which was repeatedly confirmed in the flat structure, thereby slowing down relative to the upper frame maybe

In terms of volatility, there is a slowdown, which may be due to the recent rally, but in terms of the emotional component of market participants, the same speculative interest is seen.

As discussed in the previous review, many speculators left their long positions at the time of rapprochement with the 1.2950 / 1.3000 area and started to work on recovery, which also turned out to be profitable.

Considering the trading chart in general terms [the daily period], we see that the movement within the flat has been going on for as long as a month and a half, and the key boundaries of 1.2770 / 1.3000 have not been broken even in terms of the test. This suggests that the indecision in terms of the main moves exceeds expectations, although they expect very strong jumps in case of breakdown.

The news background of the past day did not have statistics, in addition to everything, the United States did not work, which was expressed in reduced trading volumes.

The information background is still sorting through the news related to the election race of the two leading parties in Britain, and this is understandable, since the outcome of the elections will depend on whether the country leaves the EU or not.

Therefore, the noise caused by the allegedly secret sale of the national health service [NHS] to US companies reached its peak. Prime Minister Boris Johnson officially replied that no one is going to sell our NHS service, and if such a question arises in the trade negotiations between England and Washington, then I will say "Goodbye" to Trump.

Only time will tell how sincere is Johnson. Thus, it is worth understanding that the goal is to defeat the elections, and after the action can be radically different.

In turn, his key opponent, Jeremy Corbyin, continues to work for the public, posting videos on his Twitter page with doctors and nurses who express problems with the existing system.

Moreover, the leader of the Labor Party does not stop there, and during yesterday's debate on climate change, he announced Johnson's attitude to global issues, emphasizing that he did not attend the broadcast.

"Boris Johnson demonstrated a lack of leadership in solving the biggest problems facing our planet today. What else can you hope for from someone who is funded by major polluters? ", - twitter @jeremycorbyn

As you know, this whole show is built for only one thing - to lure voters and distract everyone from key issues.

Today, in terms of the economic calendar, we only have data on lending in Britain, where the number of approved mortgage loans is reduced from 65.92K to 65.50K, and the volume of consumer lending by the Bank of England is growing from 0.828B to 0.900B. In turn, there is a shorter working day in the United States today, thereby trading volumes can be reduced.

The upcoming trading week in terms of the economic calendar is expected to be filled. We have the ADP report and the subsequent report of the United States Department of Labor, which will interest market participants. At the same time, we have a conditionally finishing week ahead of the snap parliamentary elections, where again there will be a lot of noise and emotions.

The most interesting events displayed below --->

Monday, December 2

Great Britain 9:30 Universal time - Manufacturing PMI (November): Prev 48.3 ---> Forecast 48.1

USA 18:00 Moscow time - Manufacturing PMI from ISM (Nov): Prev 48.3 ---> Forecast 49.4

Tuesday December 3rd

Great Britain 9:30 Universal time - Index of business activity in the construction sector (November): Prev 44.2 ---> Forecast 44.0

Wednesday, December 4

Great Britain 9:30 Universal time - Composite PMI Index (Nov)

Great Britain 9:30 Universal time - Index of business activity in the services sector (November): Prev 48.6 ---> Forecast 49.7

USA 13:15 Universal time - Change in the number of people employed in the non-agricultural sector from ADP (Nov): Prev 125K ---> Forecast 138K

USA 15:00 Universal time - ISM index of business activity in the services sector (Nov): Prev 54.7 ---> Forecast 54.5

Thursday December 5th

USA 13:30 Universal time - applications for unemployment benefits

Friday December 6th

USA 13:30 Universal time - Number of new jobs created outside of agricultural (Nov): Prev 128K ---> Forecast 183K

USA 13:30 Universal time - Unemployment Rate: Prev 3.6%

USA 13:30 Universal time - Average hourly wage (m / m) (November)

USA 13:30 Universal time - Average workweek (Nov)

Further development

Analyzing the current trading chart, we see that the activity, ith the arrival of Europeans on the market, rose again after a nightly slowdown, where there was actually consolidation. Thus, the downward interest set by market participants yesterday, remains, displaying local candles in this direction. The focus is just yesterday's minimum 1.2898, which could give a kind of strengthening downward position. In terms of volatility, there is still weakness, but speculators are still on the market, which confirms the structure of the existing candles.

By detailing the per-minute movement, we see that the Pacific and Asian trading sessions displayed consolidation from the candlesticks, and only during the period 05: 00-06:00 [UTC+00 time on the trading terminal] did the price jump.

In turn, speculators plan to continue to work on the decline, as soon as the minimum of 1.2898 is broken yesterday.

Given the overall picture of actions, it can be assumed that the 1.2950 / 1.3000 area will continue to exert pressure on the quotation, which over time may affect the increase in the volume of short positions. Thus, even in the case of repetition of plots of past periods relative to the side channel and decline, downward interest may prevail at one time or another, which will help direct the quotation again to the lower frame of 1.2770.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in the case of a repeat of the amplitude fluctuation along the upper border of the flat, where you can consider local deals above 1.2950, but the prospect is small, from 15 to 35 points. The main purchase transactions are already considered in the case of a clear passage of the level of 1.3000, but this requires something more than just grazing, perhaps the election background or their results.

- Sales positions are considered in terms of long-term recovery, where if the price is fixed lower than 1.2898, the quotation will go to the mirror level of 1.2885, and then it's worth looking at the fixing points to make a correct forecast.

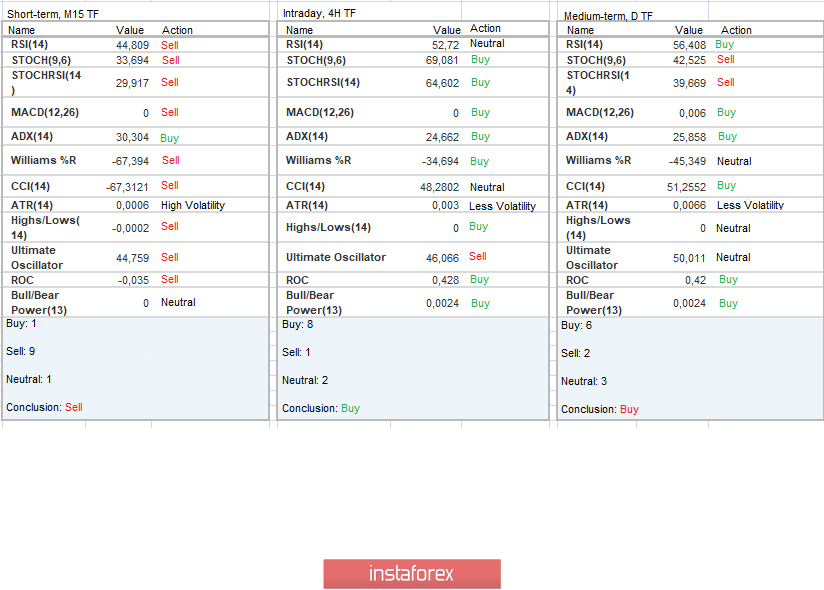

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that due to the return of the price back to the upper border of the flat, indicators on most periods changed the downward mood to the upward one. Short-term periods are working on recovery, signaling sales.

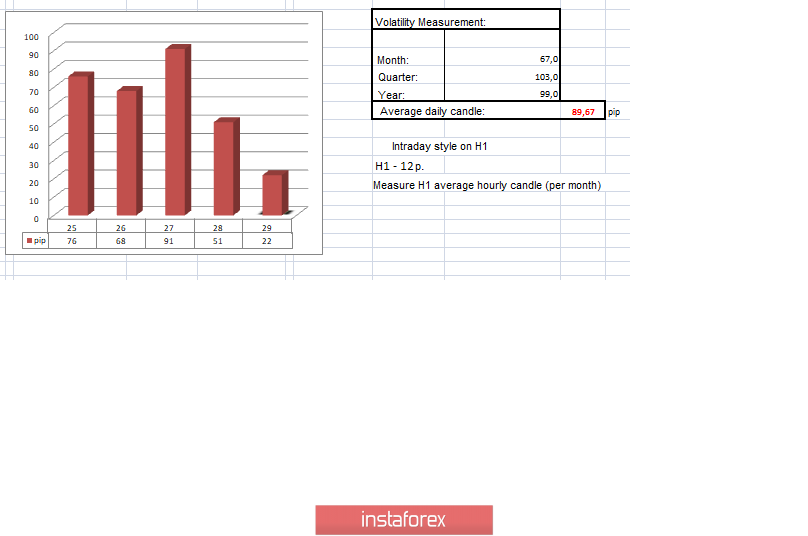

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(November 28 was built taking into account the time of publication of the article)

The current time volatility is 22 points, which is low for this time interval. It is likely to assume that volatility due to reduced trading volumes and freezing quotes will go within the framework of the average indicator.

Key levels

Resistance Zones: 1.3000; 1.3170 **; 1.3300 **.

Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustments