Inflation data, which should have pleased the market, led only to another sell-off of risky assets. The reason for this is the fact that the growth of the consumer price index in the eurozone is the exception rather than the rule. By the end of the year, it is unlikely to be able to somehow seriously correct the situation with this indicator, but Friday's report gives little hope that the actions of the European Central Bank will bear fruit.

More important is the weak growth of the German economy and the eurozone. However, several economists predict that economies will improve in 2020. The European Central Bank's stimulus measures will begin to produce results early next year, and the signing of the first phase of the trade agreement between the US and China will also be a good sign for the global economy. German GDP is expected to grow by 0.4% in 2020, while eurozone GDP is expected to grow by 0.9%.

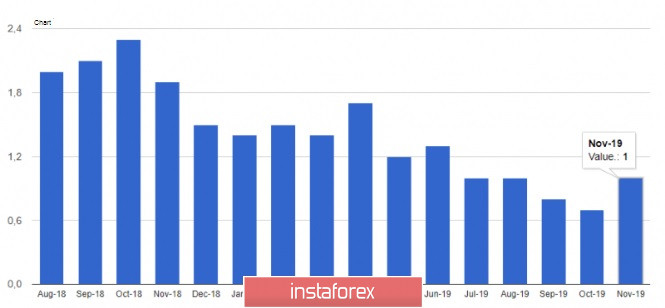

As noted above, the annual inflation in the eurozone in November this year showed growth after falling for two months in a row. However, this is not enough to reach the target level set by the European Central Bank in the area of 2.0%.

According to a report by the statistics agency Eurostat, compared with November last year, consumer prices in November rose by 1%, while economists had forecast a growth of 0.9%. Let me remind you that in October of this year, consumer prices increased by 0.7%. The main increase in the index was achieved due to a significant acceleration in prices for services, which rose by 1.9% in November. However, as noted above, the current rise in inflation is not enough for the European regulator, while the unemployment rate in the eurozone has fallen.

According to Eurostat data, the number of unemployed in the eurozone fell by 31,000 in October. The overall unemployment rate fell to 7.5% from 7.6% in September.

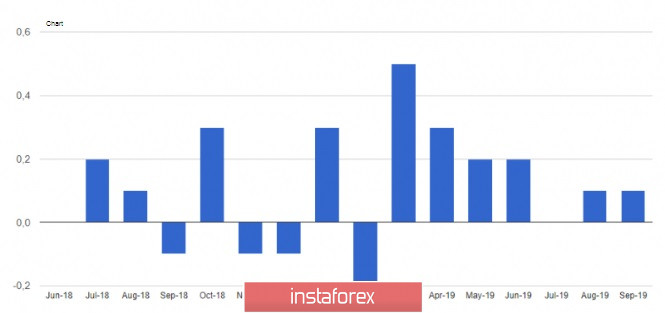

On Friday, a report on the preliminary monthly consumer price index of France was also released, which in November of this year increased by 0.1% compared to October. Economists had predicted the index would remain unchanged. As for the harmonized index according to EU standards, the annual growth was 1.2% compared to the same period in 2018. The 0.2% rise in consumer spending in October was in line with economists' expectations.

As for the technical picture of the EURUSD pair, the uncertain break below the support of 1.0980 led to a sharp rebound of risky assets up, but this does not indicate the formation of an upward trend. Most likely, the pair will remain in the side channel with the lower border of 1.0980 and the upper resistance level of 1.1040. Only going beyond this range will lead to the formation of a new market trend. Much today will depend on the report on the manufacturing sector of the eurozone, which is unlikely to show good results, as serious changes in the global economy have not yet occurred.

USDCAD

Although the growth rate of the Canadian economy slowed in the 3rd quarter of this year, this did not cause serious pressure on the Canadian dollar. On Friday, data came out that showed that the weakening of trade and a sharp reduction in inventories led to a decrease in the overall GDP for the 3rd quarter of this year. A report from the Canadian statistics agency indicated that Canada's GDP in the 3rd quarter of this year grew by 1.3% year on year to 2.099 trillion Canadian dollars. Economists had forecast an increase of 1.4%. According to the revised data, Canada's GDP grew by 3.5% in the 2nd quarter. The fiscal stimulus planned for 2020 should provide more substantial support for GDP growth.

But Canada's budget deficit narrowed in September this year. This was due to a good increase in tax revenues. According to the Ministry of Finance of Canada, the budget deficit in September amounted to 578 million Canadian dollars against 1.36 billion Canadian dollars in September 2018.

As for the current technical picture of the USDCAD pair, further growth is limited by the large resistance level of 1.3330, the breakthrough of which will provide a new powerful upward momentum with the update of highs in the area of 1.3390 and 1.3470. While trading is conducted inside the channel, the bears still have a big chance for a deeper downward correction, but for this, it is necessary to break below the support of 1.3260, which will push the trading instrument to the lows of 1.3220 and 1.3160.