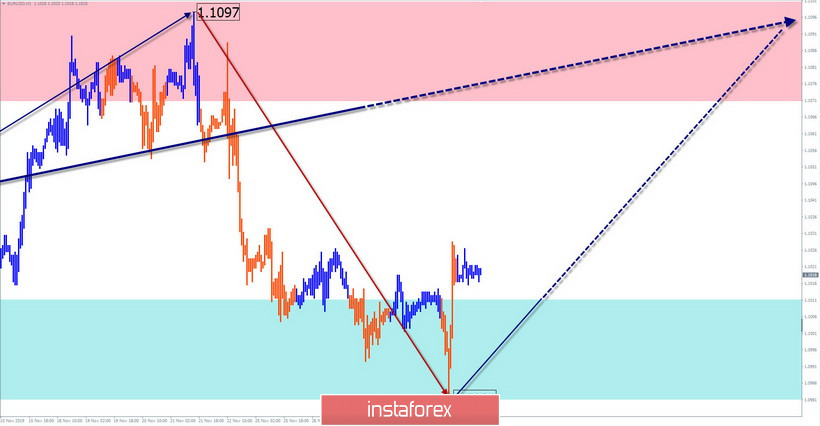

EUR/USD

Analysis:

The main trend of the euro in the last 2 years is directed to the "south" of the chart. The last counter wave counts from the beginning of September. It has the form of a stretched plane. It lacks a final lift. The plot section on November 14 formed a reversal structure.

Forecast:

The next day is expected to complete the current decline and the beginning of the price rise. By the end of the day, the volatility of the instrument is likely to increase.

Potential reversal zones

Resistance:

- 1.1070/1.1100

Support:

- 1.1010/1.0980

Recommendations:

Sales of the euro today is not very promising. It is recommended to focus on finding entry points to long positions.

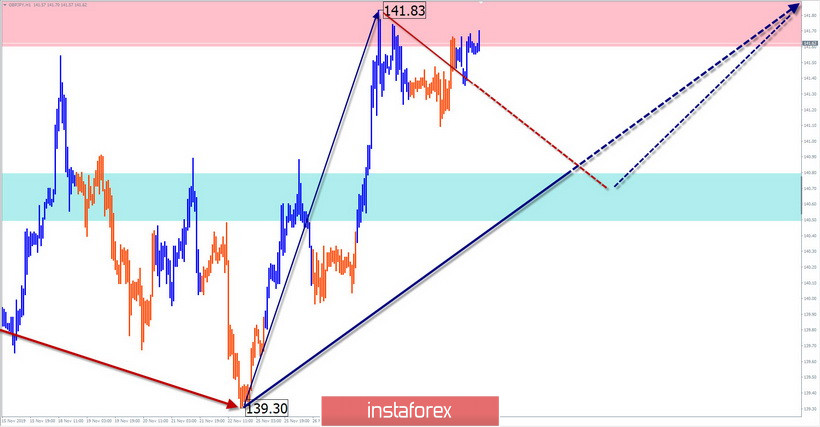

GBP/JPY

Analysis:

Since August, cross quotes form an upward wave. In the larger wave model, this section took the place of the final part (C). The price of the cross spent most of last month in a sideways flat along with the strong resistance. From November 22, an upward reversal structure is formed.

Forecast:

Today, the pair is expected to decline. The probable level of its completion is shown by the calculated support zone. Before the reversal, a short-term puncture of the upper resistance boundary is not excluded.

Potential reversal zones

Resistance:

- 141.60/141.90

Support:

- 140.80/140.50

Recommendations:

Trading on the pair market today is justified only in the intra-session style. Until the downside rollback is complete, purchases are premature. When selling a lot, it is wiser to reduce the lot.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement.

Attention: The wave algorithm does not take into account the duration of the tool movements in time!