To open long positions on GBP/USD, you need:

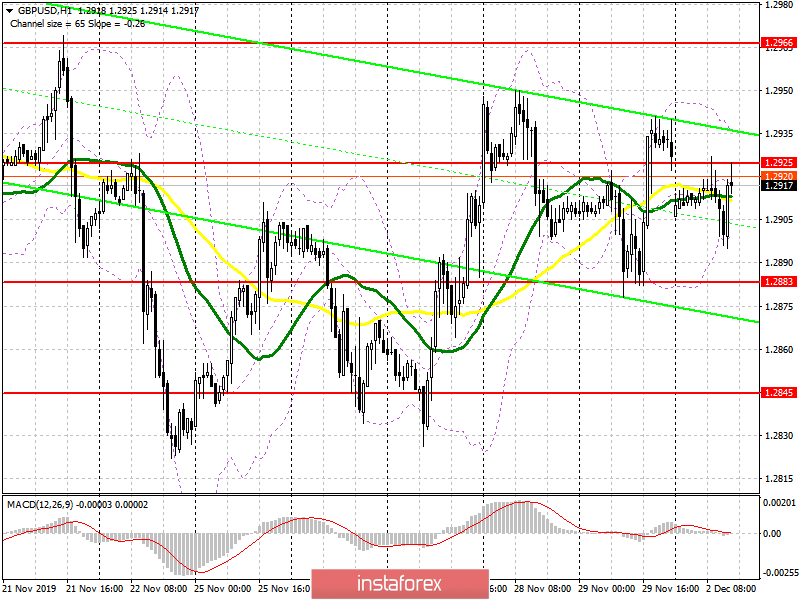

From a technical point of view, the situation has not changed. A weak report on the manufacturing sector, where activity declined in November this year, put very little pressure on the pound, which did not lead to a change in the overall picture of the market. At the moment, the bulls need to return to the resistance of 1.2925, which will be the first signal to open new positions in the expectation of updating the highs in the area of 1.2966 and 1.3017, where I recommend taking the profits. In the case of a strong report on the US manufacturing sector in the second half of the day, it will be possible to observe the repeated decline of the pound to the support area of 1.2883, but it is best to open long positions after the formation of a false breakdown. I recommend buying GBP/USD immediately for a rebound only after a test of a minimum of 1.2845.

To open short positions on GBP/USD, you need:

Sellers continue to hold the pair below the resistance of 1.2925, but fewer people are willing to continue to open short positions on the pound than before the report on activity in the manufacturing sector. Most likely, everything will depend on data on a similar indicator in the United States. The formation of a false breakdown in the resistance area of 1.2925 will be the first signal to open short positions. However, the main goal of the bears will be a repeat test of the level of 1.2883, consolidation below which will quickly push GBP/USD into the support area of 1.2845, where I recommend taking the profits. In the scenario of the pair's growth in the second half of the day above the resistance of 1.2925, it is best to return to short positions only on the rebound from the maximum of 1.2966. But the main movement in the market will be formed only after the publication of the next opinion polls on the topic of the general election in the UK.

Indicator signals:

Moving Averages

Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market.

Bollinger Bands

If the pound rises in the second half of the day, the upward correction will be limited to the upper level of the indicator around 1.2935.

Description of indicators

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. The chart is marked in yellow.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. The chart is marked in green.

- MACD indicator (Moving Average Convergence / Divergence-convergence/divergence of moving averages) - EMA period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20