The Euro lost ground against the US dollar and other global currencies after the release of a report indicating a recession in German industry, which will continue to worsen.

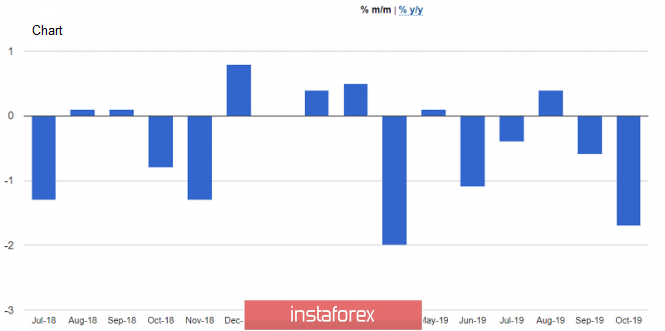

According to the Federal Statistical Agency, in October of this year, compared to September, while economists had predicted its growth by 0.2%, the industrial production fell by 1.7%. The data further confirmed fears that Germany could experience a recession in the coming quarters. The main decline was noted in the construction sector, where the index fell by 2.8%. In manufacturing, the decline in industrial production was 1.7%. Compared to October 2018, the indicator decreased by 5.3%

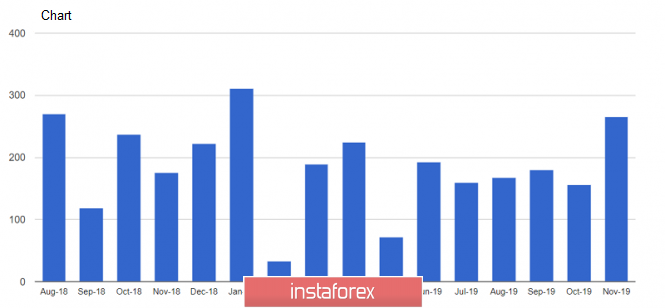

If trading was still conducted within the side channel in the first half of the day, indicating the preservation of the advantage of buyers of risky assets, then the data on the state of the US labor market will collapse the Euro. According to a report by the US Department of Labor, US employers created 266,000 jobs in November this year, which was much higher than economists' forecasts, confirming that the US economy will continue to show steady growth even against the backdrop of a slowing global economy . The unemployment rate fell back to historic lows to 3.5%.

The rise in the average hourly earnings will also have a positive effect on Americans' spending, which will support the country economy in the future. According to the data, earnings in November this year increased by 3.1% compared to the same period on the previous year. However, this is slightly below the growth rate seen in October this year.

US consumer sentiment also rose. The report is preliminary, but it is already clear that Americans' assessment of the national economy in December has changed for the better. However, if you look at the report more closely, you can see how improvements were observed only among high-income households.

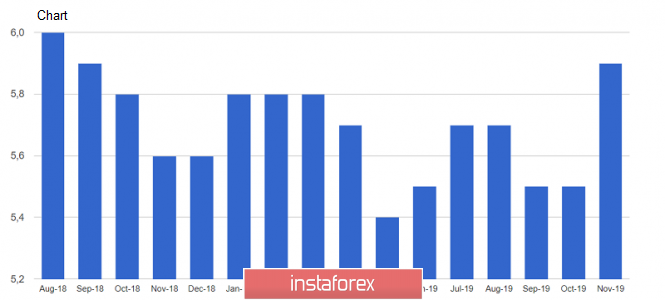

According to the University of Michigan, while economists had expected it to be 96.5 points, the preliminary consumer sentiment index in December 2019 rose to 99.2 points. Let me remind you that in November, the index was at 96.8 points. Consumers' assessment of their financial situation has also increased. The index of current economic conditions in early December was 115.2 points against 111.6 points at the end of November.

The data on the growth of stocks in the wholesale trade of the United States, however, did not much worried traders after the above reports. Thus, stocks rose in October by only 0.1% after a decline in September this year. The inventory / sales ratio rose to 1.37 versus 1.36.

As for the current technical picture of the EUR / USD pair, a lot will depend today on how buyers behave around the 1.1070 level. Its breakdown will clearly increase the demand for risky assets and return the trading instrument to last week's highs in the areas of 1.1115 and 1.1160. If the pressure on risky assets continue further even after the release of weak reports on the state of the German economy, a breakthrough of 1.1040 will lead to a further downward correction in the area of lows 1.1000 and 1.0960.

USD / CAD

The Canadian dollar also fell against the US dollar amidst a good report on the state of the US labor market, but additional pressure was also formed after the report on the number of jobs in Canada.

According to the data, the unemployment rate rose to the highest level in more than a year. The Bureau of Statistics noted that the number of jobs in November fell by 71,200, while economists had expected an increase of 10,000. Compared to the same period on the previous year, the number of jobs increased by 292,000. As I noted above, the overall unemployment rate rose to 5.9% in November, while it was expected that it will remain unchanged, at 5.5%.

A partially leveled negative report was a good indicator of the growth in average hourly earnings, which increased by 4.5% compared to the same period in 2018.

As for the technical picture of the USD / CAD pair, Friday's growth allowed us to win back almost all the decline that we saw on Thursday after the decision of the Bank of Canada to leave rates unchanged. Apparently, this decision can be reconsidered if the data on the labor market continue to indicate a slowdown of activity in the economy. USD / CAD buyers only have to break above the resistance of 1.3280, which will lead to a complete overlap of the downward movement and return the trading instrument to the highs of 1.3300 and 1.3340.