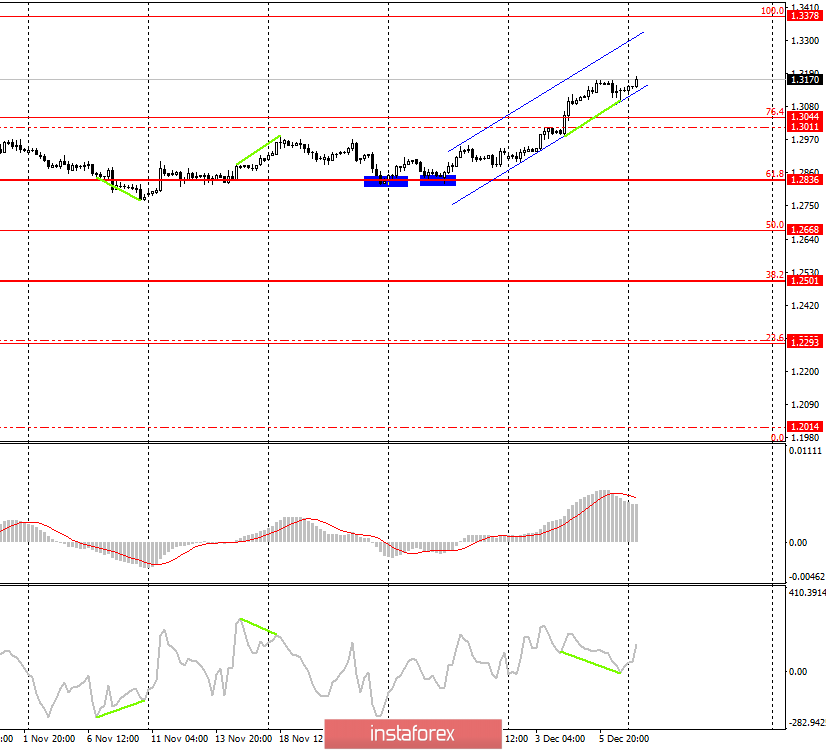

GBP/USD - 4H.

On December 6, the GBP/USD pair continued the growth process in the direction of the correction level of 100.0% (1.3378) after fixing quotes above the Fibo level of 76.4% (1.3044). The pound-dollar pair is growing every day and is likely to maintain a similar mood until December 12-13, when the results of the vote will be known. The new trend corridor is quite narrow, however, it best reflects the mood of traders who now only want to buy the pound. The bullish divergence of the CCI indicator also worked in favor of the British currency and the resumption of the growth of quotes.

As a preview to the current trading week, one could write about the Fed meeting or the US inflation report, however, all these events have absolutely no meaning for the pound now. Traders have been waiting almost two months for this day, and parliamentary elections will finally be held this week. And by the end of this week, we will know how many parliamentary seats the conservatives will occupy and whether this number will be enough for them to withdraw the country from the European Union by the end of January 2020. All other news will not matter. One gets the impression that even if the Fed raises the rate by 0.5%, this will not affect the demand for the US currency in any way. The situation is similar to trade conflicts and wars. Negotiations between China and America continue, and by December 15, the parties must either sign a first-stage agreement or Donald Trump will impose new duties on imports from China for another $160 billion. It is unlikely that such a move by the American President will contribute to increasing the productivity of negotiations. However, this news now does not find any reflection on the charts of the currency pair.

Thus, it remains only to return to the topic of parliamentary elections and once again assume that the conservatives will still win and that the number of votes won will be enough to complete Brexit. In this case, the UK will leave the European Union in January and the next act of the "Marleson Ballet" will begin. After all, now Britain will have to re-establish ties with the European Union, under new conditions, under new treaties. Re-enter into trade agreements with any country in the world, negotiate immigration issues with the EU. Meanwhile, it is unclear how things will be on the border between Ireland and Northern Ireland, as, according to the latest information from Labor leader Jeremy Corbyn, Boris Johnson's plan implies that there will be a border between states, it is just that the conservatives do not call it a "border". There will be customs control points, there will be checks, which, means the border regime. Thus, after Brexit itself, if it does happen, the UK can wait for many more shocks before it gets on the path of stable economic growth.

After Brexit, traders are likely to again begin to pay attention to the economic reports, and this factor is again not in favor of the British currency, as economic indicators now continue to fall in the UK, and after Brexit, it is reasonable to expect even greater deterioration.

Forecast for GBP/USD and trading recommendations:

The pound-dollar pair continues the growth process. Thus, now I advise buying "Briton" with a target of 1.3378. The informational background does not prevent the pound from growing at all, as traders continue to pay no attention to it, although news from America could cause high demand for the dollar.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.