Economic calendar (Universal time)

There are no important events in today's economic calendar.

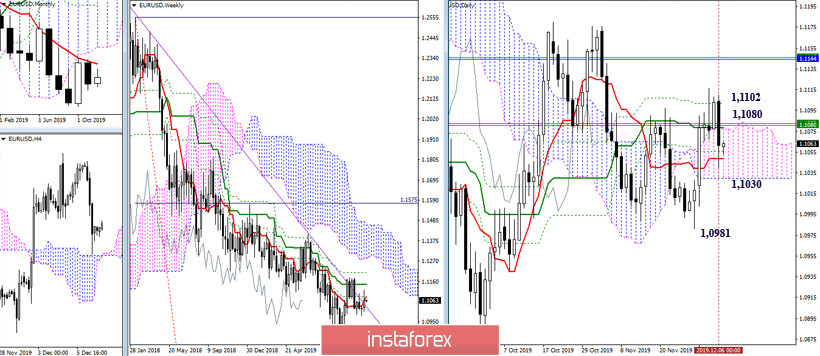

EUR / USD

As expected, there is no consistency in the modes, this trend is likely to continue in the near future. After a bullish Thursday, next came a bearish Friday. Currently, the pair is in a wide zone of attraction, the daytime cloud. Several weekly levels (1.1080 Tenkan + 1.1083 Fibo Kijun), as well as the final borders of the daily dead cross (Kijun 1.1079 + Fibo Kijun 1.1102), are now joining the upper border of the cloud. Fixation above 1.1080 - 1.1102 will allow you to consider new advantages and prospects for players to increase. Entering the bearish zone relative to the daily cloud (Senkou Span B 1.1030) will serve as a signal of strengthening the bearish positions. The next reference, in this case, will be the restoration of the daily downtrend which is the minimum extremum 1.0981.

The key levels of the junior halves now protect the interests of lowering players on H1, uniting around 1,1070-80. Rising higher, the bulls will regain their initial advantage. The main task after this will be updating the maximum which is 1.1116 and overcoming the resistance of the higher halves at 1.1102. When descending to the minimum which is 1.1040 and overcoming the support S1 at 1.1031, strengthened by the daily cloud at 1.1030, the following bearish reference points within the day today will support the classic Pivot levels at 1.1000 (S2) and 1.0961 (S3).

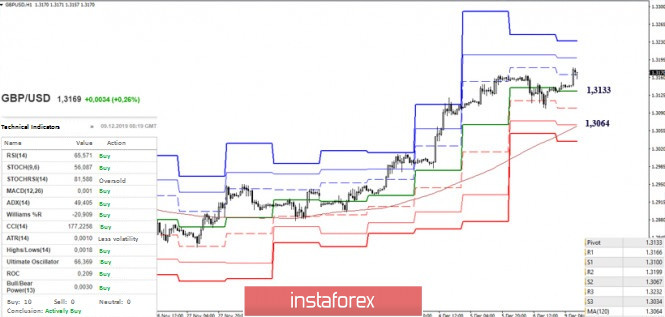

GBP / USD

The pair reached a monthly medium-term trend of 1.3167. Long rise and a strong level of resistance have high chances to make adjustments to the movement. In the near future, a reaction to interaction with the monthly Kijun of 1.3167, will be formed. Among the supports, it is now possible to distinguish zones 1.2975 - 1.3012 (main levels of the daily cross + historical level) and 1.2907 - 1.2848 (weekly cloud + weekly short-term trend + monthly Fibo Kijun).

Advantages in the lower halves are completely owned by the players to increase, they are supported by all the analyzed technical tools. The following intraday resistances are R2 which is 1.3199 and R3 at 1.3232. At the moment, there is a slowdown. The key junior support today is located at 1.3313 (central Pivot level) and 1.3064 (weekly long-term trend), intermediate support can be noted at 1.3100 (S1).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)