Economic calendar (Universal time)

The main news in today's economic calendar is expected from the Eurozone:

9:30 from the UK - GDP and manufacturing output;

10:00 from Germany - an economic sentiment index.

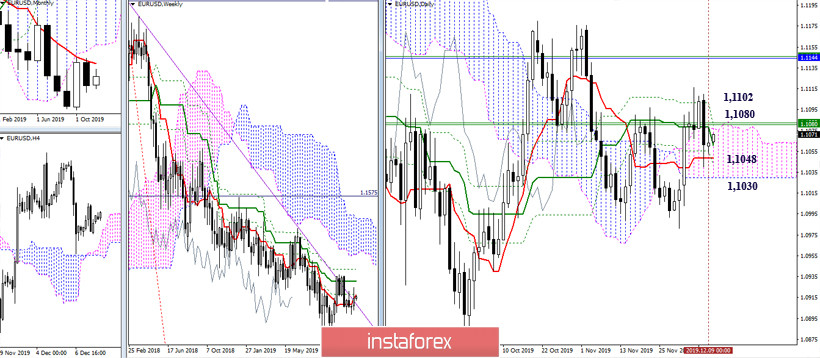

EUR / USD

The movement of the pair did not add certainty over the past day. Uncertainty and consolidation persist. The previously indicated levels of support and resistance continue to guard the development of the situation. For players to increase, resistance of 1.1080 (weekly Tenkan + weekly Fibo Kijun + daily Kijun) and 1.1102 (daily Fibo Kijun) are still important. For players on the downside, the key support remains the lower boundary of the daily cloud (1.1030), while an intermediate short-term trend is the daily short-term trend (1.1048).

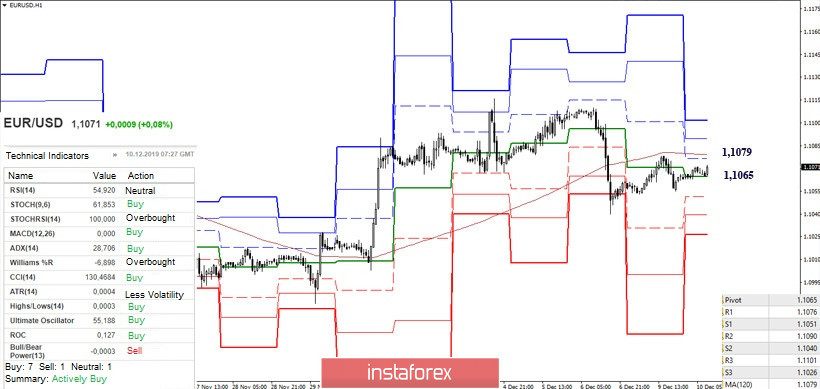

In the lower halves, the pair is in the zone of attraction of key levels, which have slightly expanded their zone of influence of 1.1079 (weekly long-term trend) - 1.1065 (central Pivot level) today. Now, developing above these levels will change the current balance of forces in favor of players to increase, but it will not be easy to achieve a significant advantage in this situation. Thus, the task of players on the upside will be to form a new global maximum (above 1.1116). Meanwhile, consolidating below the key supports at H1 (1.1065) will strengthen the positions of the bears for them. In this case, the main reference point will be the minimum extremum (1.1040) and support for high halves (area 1.1030).

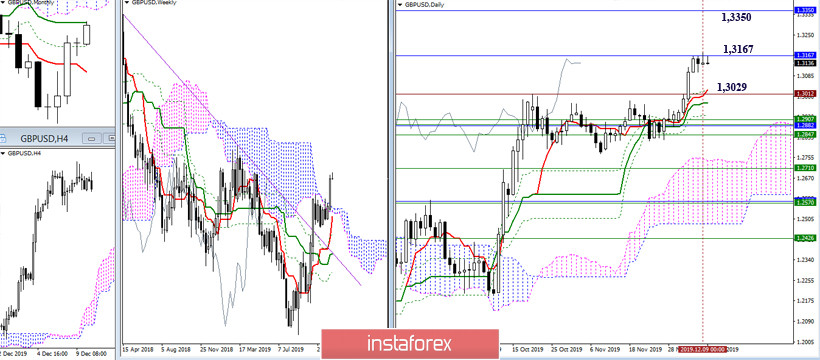

GBP / USD

Despite yesterday's move, the players on the downside were able not only to maintain inhibition, but also to form the prerequisites for the development of a full downward correction. Now the only question is whether this will perhaps allow the pound to make other plans for the market. If the players on the upside still manage to limit themselves in the near future to only braking and consolidation, then after breaking through 1.3167 (a monthly medium-term trend), the direction will open to the next resistance of this section - a monthly cloud . The lower boundary of which is now located at 1.3350. In the case of a downward correction, the first reference from the higher halves today is the daily Tenkan which is at 1.3029.

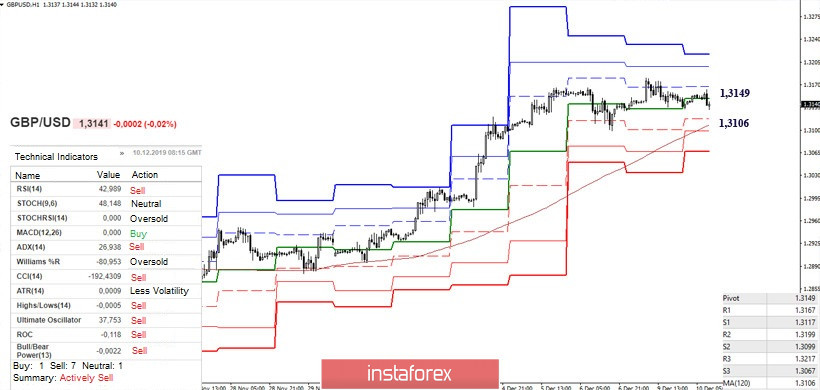

In the lower halves, the players on the downside are busy developing a corrective decline. Conquering the central Pivot level (1.3149) and supporting technical indicators is a good start. On the other hand, further interest is the weekly long-term trend, which is now located at 1.3106. Thus, consolidating below will allow us to consider the formation of a full correction in the upper halves. Today, resistances can be noted at 1.3180 (maximum extreme) - 1.3199 (R2) - 1.3221 (R3), while the supports are located at 1.3106-17 (weekly long-term trend + S1) - 1.3099 (S2) - 1.3067 (S3 )

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)