To open long positions on GBP/USD you need:

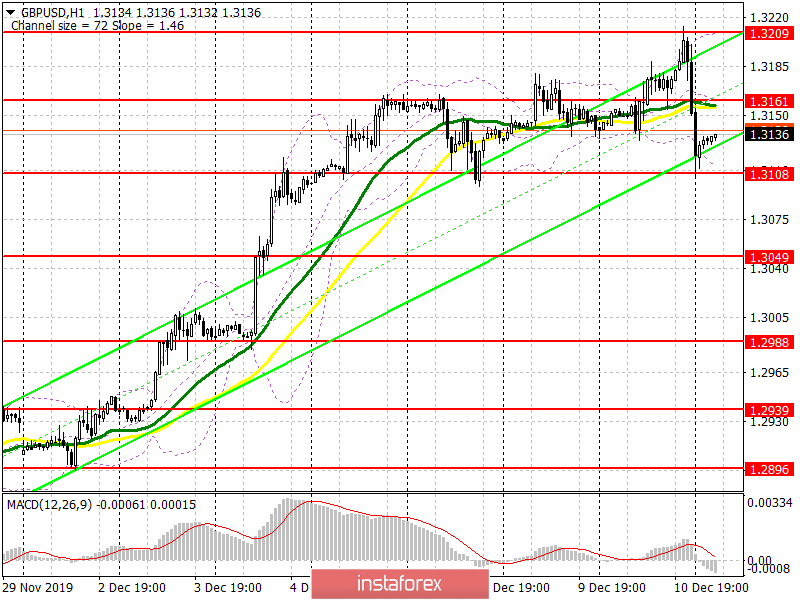

The British pound fell after regular polls in which it was indicated that the leadership of the Conservative Party of Great Britain significantly decreased the day before the general election, which makes the result even more unpredictable. Of course, it's still very early to talk about a turning point in the upward trend, but the bulls will be more careful about the market. I advise you to pay attention to the support level of 1.3108, since only the formation of a false breakout on it will be a signal to buy GBP/USD. More acceptable levels for opening long positions can be seen a little lower around 1.3049 and 1.2988, from where you can immediately buy for a rebound. The main task of the bulls in the first half of the day will be to return and consolidate above the middle of the channel of 1.3161, which may lead to re-updating the high of this month at 1.3209, where I recommend taking profits.

To open short positions on GBP/USD you need:

The sharp drop in the pound does not mean that sellers are returning to the market, but only indicates the uneasiness of the situation that is now observed in the market. Bears need to keep the pair below the resistance of 1.3161 today, and the formation of a false breakout there in the first half of the day will return the support of 1.3108, on which the further downward correction of GBP/USD will depend. Only good data on inflation in the US can force large players to open short positions below 1.3108, which will gradually push the pound to the lows of 1.3049 and 1.2988, where I recommend taking profits. It is hardly worth counting on a more powerful decline in the pair before the publication of election results in the UK. In the scenario of a pound growth above the resistance of 1.3161, one can look for short positions from this month's high near 1.3209, and I recommend that you immediately sell for a rebound from the resistance of 1.3265.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market.

Bollinger bands

A break of the lower boundary of the indicator at 1.3108 will lead to a further downward correction of the pound, while growth will be limited by the upper level of the indicator at 1.3209.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20