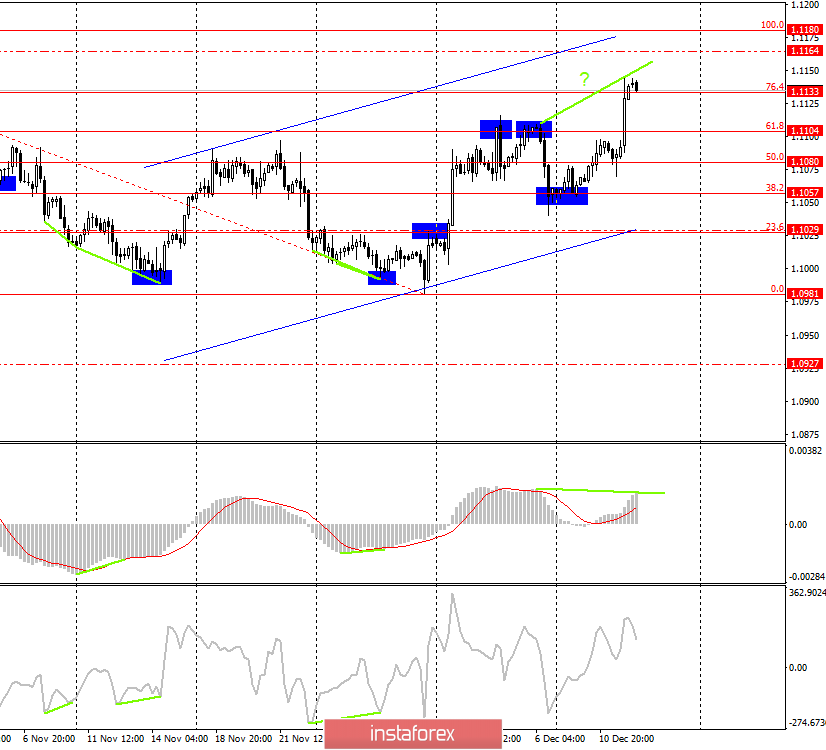

EUR/USD - 4H.

On December 11, the EUR/USD pair performed a reversal in favor of the European currency after rebounding from the correction level of 38.2% (1.1057) and resumed the growth process within the upward trend area. As a result, the closing above the Fibo level of 76.4% (1.1133) was performed, which allows traders to count on the continuation of growth in the direction of the next correction level of 100.0% (1.1180). At the same time, a bearish divergence is brewing in the MACD indicator, which also allows us to expect a reversal in favor of the US dollar and some drop in the quotes. Until the closing of the euro-dollar pair under the Fibo level of 76.4%, the upward mood among traders is likely to remain.

The key events of the day, of course, were the meeting of the Fed and the speech of Jerome Powell. However, it is safe to say that the traders were waiting for disappointment. The president of the Fed didn't tell the markets anything supernatural. Jerome Powell's usual rhetoric on duty, in which he continued to pay attention to inflation, the labor market, unemployment, and the threat of trade conflicts, which could further slow down the global economy. Of the really interesting messages from Powell, we can only highlight the words about inflation, which the Fed expects "about 2%" in the next few years. Thus, although yesterday the US inflation report for November showed 2.1% y/y, the Fed still does not believe that such inflation levels will be able to keep in the long term. The Fed also believes that in the long term, GDP growth will slow. We are talking about no more than 0.1% per year, but it is a decline. Most likely, this is due to the trade conflicts in which Donald Trump got involved in America. And if so, the Central Bank does not expect them to end any time soon.

Jerome Powell also made it clear to traders that there will be no new cuts in key rates in the coming months. However, the Fed is also completely not looking in the direction of raising rates. In principle, this is the kind of rhetoric that traders expected from Powell. It is unlikely that anyone expected that after three consecutive rate cuts, the Fed would suddenly announce that it was preparing to raise it. Powell has called those three rates cuts corrective. Now, accordingly, the rate correction has been completed and a period of stability has come. Also, Jerome Powell said that "now is not the situation to buy short-term coupon securities." Let me remind you that a few months ago, some Federal Reserve banks began to buy short-term securities, which gave rise to a lot of speculation about the resumption of the Fed's QE program. However, this stage of buying securities had a short-term character, and now it was confirmed by Powell himself.

Today, the next meeting of the European Central Bank and summing up its results. I believe that the ECB will also leave the rate unchanged, so the most interesting thing will happen at the press conference with Christine Lagarde. The probability that her speech will be "dovish" is very high. In the coming months, the ECB may go for a new cut in key rates.

Forecast for EUR/USD and trading recommendations:

On December 11, traders will closely monitor economic data from the European Union. Depending on the rhetoric of Christine Lagarde, as well as the strength of industrial production in the EU, the euro will continue to grow today or begin to fall. Closing below the Fibo level of 76.4% will work in favor of the US currency and the resumption of the fall and may coincide with the nature of the information background today.

The Fibo grid is based on the extremes of October 21, 2019, and November 29, 2019.