Crypto Industry News:

The Commodity Futures Trading Commission (CFTC) has accused 12 New York City crypto options firms of allegedly failing to register with a regulatory body.

In a press release yesterday, the CFTC indicated that it is charging 14 entities in total, with 12 cryptocurrency-focused companies "on the board" due to failing to register as a Futures Commission (FCM) seller. All companies were "allegedly based in New York." The other two allegedly posted misleading information regarding their National Futures Association (NFA) membership and CFTC registration.

The crypto option providers listed include relatively unknown entities such as Bitfxprofit, Star FX Pro, Smarter Signals, and BinanceFx Trade, the latter of which is not affiliated with the major global exchange Binance despite its name.

Companies that offer exposure to commodities through futures must register as FCM with the CFTC. The commission regulates the scope of the derivatives markets, which includes futures, options and swaps, but does not oversee the spot markets for regular traders.

The derivatives market regulator had a busy week after it ordered Kraken to pay civil penalties worth $ 1.25 million on Tuesday on allegations of violating the Commodity Exchange Act.

Last month, the cryptocurrency exchange BitMEX agreed to pay the CFTC and FinCEN a civil penalty of $ 100 million for "illegally operating a cryptocurrency trading platform and anti-money laundering violation."

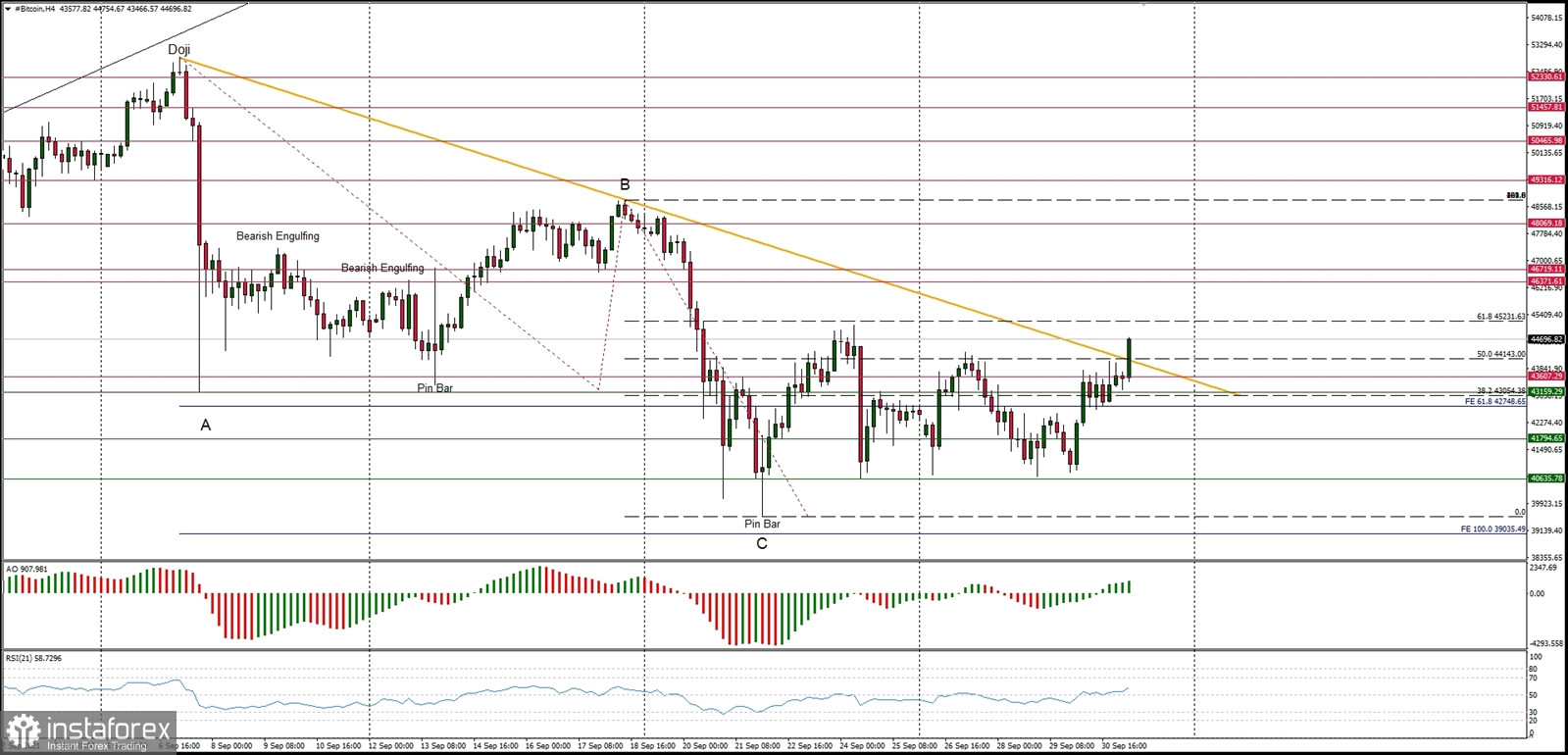

Technical Market Outlook

The BTC/USD pair has broken above the key short-term trend line resistance and is heading towards the level of $45,213, which is a 61% Fibonacci retracement of the last wave down. The momentum is strong and positive, so after the breakout and the Fibonacci level violation, another wave to the upside is possible with a target seen at $46,371. The immediate intraday technical support is located at $44,333.

Weekly Pivot Points:

WR3 - $55,572

WR2 - $51,601

WR1 - $47,548

Weekly Pivot - $43,366

WS1 - $39,311

WS2 - $35,303

WS3 - $31,312

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. The next mid-term target is seen at the level of $59,506. This scenario is valid as long as the level of $30,000 is clearly broken on the daily time frame chart (daily candle close below $30k).