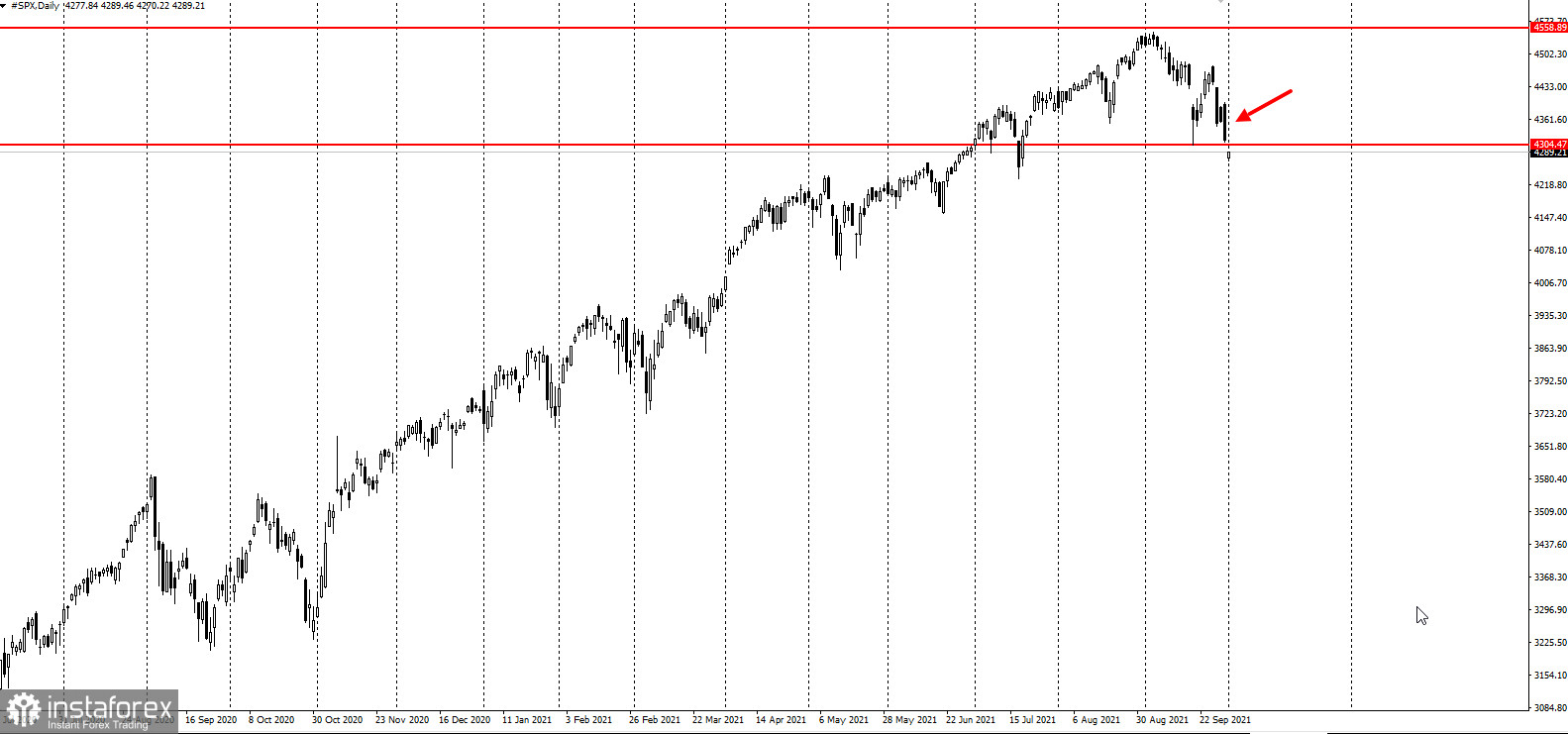

Volatility remains high for risk assets with US stock indices posting their biggest monthly drop on Thursday since March 2020. By the end of the US session, S&P500 Index fell by 1.10%.

Even though the House of Representatives approved a nine-week spending bill to avoid the US government shutdown, the stock market still declined on Thursday. This was just another market risk for traders. Investors also brace for the Federal Reserve to roll back its stimulus program amid increased worries over a slowdown in the economic growth and accelerated inflation. Besides, there are worries about disruption to supply chains, global energy crisis, and regulatory risks from China.

The political debate in Washington has the potential to push the United States into default and force President Joe Biden to reduce the spending agenda. Democratic Senator Joe Manchin wants to cut the social spending package by more than half to $1.5 trillion. House Speaker Nancy Pelosi pressed ahead with plans for a vote on a bipartisan infrastructure bill, even though progressive Democrats said they had the numbers to stall it until the Senate agrees on a more expansive tax and spending package.

Tom Mantione, Managing Director at UBS Private Wealth Management, said, "We have not forgotten the old saying that the market climbs the wall of worry. Worries about China, the pandemic, debt ceiling and tax legislation are currently putting pressure on investors, but it's important to understand what issues may cause structural changes and what causes short-term volatility that investors can take advantage of."

Meanwhile, Beijing is said to have ordered the country's leading state-owned energy companies - from coal and electricity to oil - to secure energy supplies at all costs. Recently, the country has been gripped by a severe energy crisis: several regions had to cut energy supplies to the industrial sector, and there were even sudden power outages in some residential areas.

Today markets will focus on the following key events:

- GDP and the number of initial jobless claims in the United States;

- consumer price index in the EU;

- Germany's Manufacturing PMI;

- The University of Michigan Consumer Sentiment Index, US Manufacturing Employment Index, US Construction Costs, US Personal Income and Spending.