GBP/USD

Analysis:

The main direction of the short-term trend of the pound in the last six months is directed along with the upward wave. In a larger wave model, this section corrects the last movement on the main course. After a sharp rise at the end of last week, a downward section with a reversal potential was formed on the chart.

Forecast:

Today, it is expected to complete the downward segment of the chart and return to the bullish rate. In the next session, a flat between the nearest counter zones is likely. Until the end of the day, the probability of a short-term re-decline in the price remains.

Potential reversal zones

Resistance:

- 1.3410/1.3440

Support:

- 1.3320/1.3290

Recommendations:

Until the full completion of the decline, trading on the pound market can only be carried out within the framework of intra-session transactions with a reduced lot. It is recommended that you focus on searching for signals to buy a pair.

USD/JPY

Analysis:

The upward wave of the Japanese yen since August sets the main direction of the major price movement. On the daily TF, this wave completes a larger upward zigzag. The wave structure does not show completeness but the price is within the strong resistance of a large scale.

Forecast:

From the reached price levels, the pair's price should start a corrective decline soon. Probably, it will be in the form of a "sideways" but the option of a more aggressive depreciation is not excluded.

Potential reversal zones

Resistance:

- 109.60/109.90

Support:

- 109.00/109.30

Recommendations:

The pair's purchases are premature. It is necessary to wait for the completion of the upcoming move down. In the coming sessions, short-term sales are possible. At the first signs of a reversal, it is recommended to change the vector of trade.

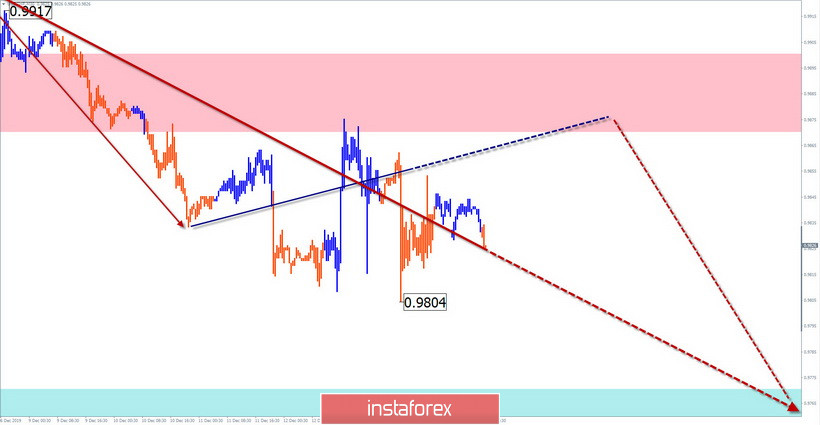

USD/CHF

Analysis:

On the Swiss franc chart, the ascending plane, which has been counting since June, is not completed for the current day. In its framework, since the beginning of December, the price is reduced. Last week, an intermediate correction was formed.

Forecast:

Today, the most likely price movement in the lateral plane. Short-term growth of the rate, no further than the calculated resistance, is not excluded. At the end of the day, it is expected to return to the main direction.

Potential reversal zones

Resistance:

- 0.9850/0. 9880

Support:

- 0.9770/0. 9740

Recommendations:

Franc purchases today are unpromising due to the small potential of the expected rise. At the end of the upward pullbacks, it is recommended to look for sell signals of the pair.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement.

Attention: The wave algorithm does not take into account the duration of the tool movements in time!