The new week began with a confident rise of the British currency. Pound's efforts to conquer the next peaks were not in vain. Analysts expect a further round of sterling growth, and their expectations are justified.

Last week's finale, the victory of the Conservative Party of Great Britain in the last election, which won an absolute majority in Parliament, brought the world market euphoria. Experts initially debated that a second referendum on Brexit will not take place, and the party leader, Boris Johnson, will withdraw the EU country on January 31, 2020, as planned. Now, however, they believe that it's up to the terms of the agreement, although some of them still believe that the UK could leave the Euroblock without a deal if trade talks with Brussels do not prove to be successful. According to analysts, by the end of 2020, B. Johnson will be able to conclude a trade deal with the leadership of the Euroblock to gain access to the single market of the European Union.

The victory of the Conservative Party was a powerful driver of growth to the British currency. The pound went up sharply, showing the best dynamics in the last few decades. Last Friday, it exceeded the maximum for 19 months, first reaching the level of 1.3516, and then falling to 1.3333.

According to experts, the "Briton" also turned out to be on top against the euro, showing a maximum since the 2016 referendum, when the epic with Brexit started. Experts believe that the pound has more opportunities for growth against the US currency than the European one, and that the GBP / USD pair will always win, which can not be said about the GBP / EUR.

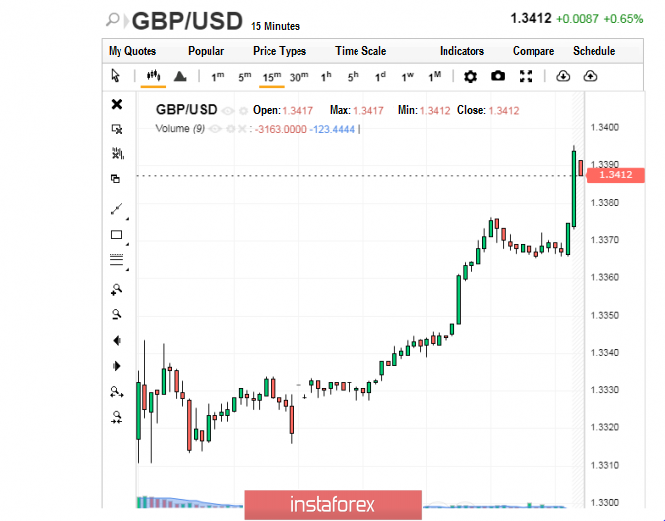

On Monday morning, December 16, the GBP / USD pair started quite cheerfully, without losing the fervor of the past week. It was trading between 1.3389 and 1.3390, seeking to move higher.

The efforts of the pair were not in vain. GBP / USD has managed to overcome this level and started moving in the range of 1.3412-1.3413, giving hope of an increase.

At the moment, the GBP / USD pair fell to 1.3398, but later sought to get out of these narrow frames, overcoming the pull of the recession.

The dizzying rally of the pound, as well as the victory of the conservatives, cheered the market, symbolizing the way out of a long political deadlock. According to experts, this could return investments to the country and stop the slowdown of the British economy. The period of uncertainty is over, and the probability of implementing fiscal stimulus has increased. This could conclude the recovery of the UK economy in the coming year. However, experts warn that there is still a risk of prolonging the transition period which can limit economic growth, and emphasize that this may negatively affect the dynamics of the pound.

Some experts admit that the rise of the British currency may not be that long, and decline should be expected after. Most likely, the decline will be short-lived and not very tangible to shake the pound's position. Now, however, the "Briton" rightly feels like a winner, and this situation gives confidence to the market.