4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: 57.2703

On Tuesday, December 17, the EUR/USD currency pair continues to show the desire to resume the upward movement. At least, the last bars of the Heiken Ashi indicator is painted in purple, which allows us to assume exactly this scenario. In previous articles, we have already reviewed macroeconomic reports on business activity in the eurozone and America. Thus, in our humble opinion, they were again not in favor of the European Union and the European currency. We still believe that the overall fundamental background (long-term) and short-term background remain, if not unambiguously in favor of the US currency, then certainly not in favor of the EU currency. Based on this, we still expect the beginning of a new downward trend. At the same time, all technical indicators continue to be directed upwards, so the technical picture of the euro/dollar pair must be considered. As long as the upward trend remains in technical terms, it is recommended not to try to guess the reversal and not to open short positions before the allotted time.

On Tuesday, December 17, only one more or less significant macroeconomic report is planned. We are talking about industrial production in the States for November. According to experts, the indicator will grow by 0.8%, which is much better than the previous month (-0.8% m/m). If the expectations of market participants come true, the US currency will get a new chance to strengthen, since industrial production is a fairly important indicator of the state of the economy. At the same time, we cannot but draw the attention of traders to the fact that the US dollar is now becoming more expensive somehow reluctantly. It seems that the general fundamental background is in its favor, and macroeconomic statistics allow traders to make purchases of the dollar, but the euro continues to rise in price. We are beginning to wonder whether the reluctance of traders to invest in the dollar is connected with the possible impeachment of US President Donald Trump?

Recall that the odious leader of the United States has a sufficient number of adherents of his policy, and outspoken opposition. Many, especially the Democratic Party of the United States and the most vulnerable segments of the population, believe that Trump needlessly provoked a trade war with China, which led to a slowdown in the world economy, the economies of many individual countries and generally harmed the world. Moreover, goods from China in America rose in price, and certain segments of the population, which were engaged in the production of products for further sale to China, also suffered from the trade war, because the PRC imposed retaliatory duties on imports from the States. As a result, as usual, ordinary citizens suffered, which are the electorate whose trust Trump needs to win if he wants to remain President of the United States after November 2020. Also, many in America believe that Trump unleashed a war with China, but cannot complete it. The agreements in the so-called "first phase" have not yet been sealed with any documents or signatures, and unresolved issues between China and the United States remain for several years of negotiations. Moreover, according to the absolute majority of experts, China still does not need to rush to sign a trade agreement, which is not very profitable for it. There are about 10 months until the US presidential election, and Joe Biden is likely to win them. Thus, it is China that can help ensure that Trump does not become the next president of the United States if he drags out negotiations and openly awaits elections in America.

Also, do not forget that Trump may well leave the office much earlier than November 2020. Recall that the US Congress has released legal confirmation of the charges against Donald Trump. The main articles are an abuse of power and obstruction of Congress. The Congressional Judiciary Committee said: "Collectively, all articles of the document claim that Donald Trump put his political interests above the national security of the country, our free and fair elections. He has committed a misdemeanor that will continue unless he is stopped." Now, the House of Representatives will vote on Wednesday, December 18, on articles of impeachment. Since the Democrats have a majority in this Chamber, there is no doubt that they approve of Trump's accusations. After that, the case will go to the Senate for consideration.

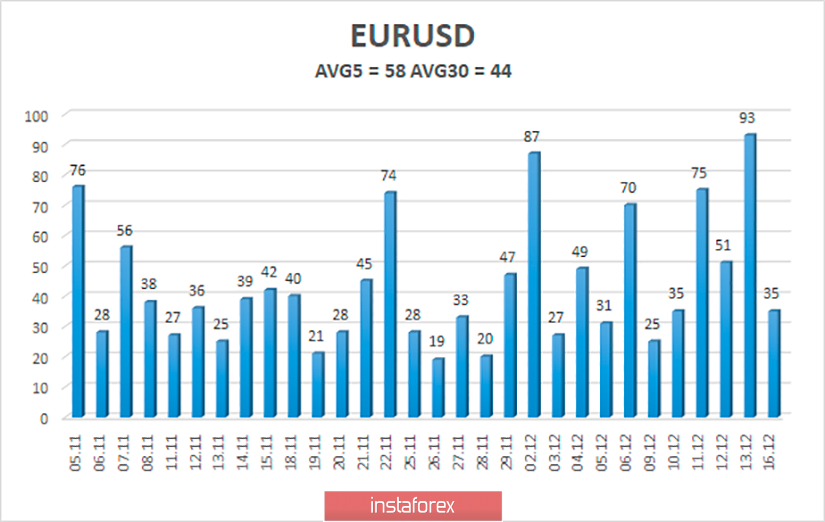

The average volatility of the euro/dollar currency pair continues to grow and is now 58 points per day, which is the average value for the pair. The average volatility for the last 30 days remained unchanged - 44 points. Thus, the channel in which the pair can move today is limited to the levels of 1.1086 and 1.1202. We still believe that around the level of 1.1183, the upward trend could have ended as traders failed to overcome the area around this level on October 21, October 31 and November 4.

Nearest support levels:

S1 - 1.1139

S2 - 1.1108

S3 - 1.1078

Nearest resistance levels:

R1 - 1.1169

R2 - 1.1200

R3 - 1.1230

Trading recommendations:

The euro/dollar pair is trying to resume its upward movement. Thus, it is now relevant to buy the euro currency with the targets of 1.1169 and 1,200, which can be maintained until the reversal of the Heiken Ashi indicator down. The general fundamental background is not on the side of the euro, but until the pair's quotes consolidate below the moving average line, it is not recommended to buy the US currency.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.