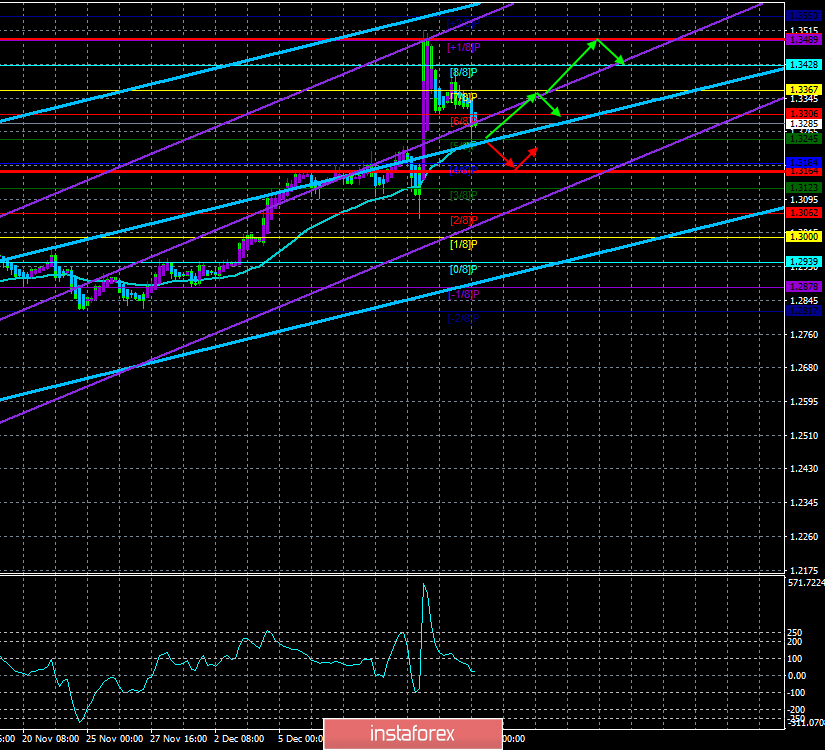

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: 17.3000

The British pound continues to adjust against the upward trend in which it has been for more than two months. Since the elections in the UK have already left behind, now the pound no longer has the only reason to rise in price, no matter what, which has been in recent times. Now, it is clear to everyone that before the New Year, Boris Johnson will submit to Parliament a bill on the agreement with the European Union, which will be approved, and before the end of January 2020, the long-awaited "divorce" will take place. Thus, at the moment, the quotes of the pound/dollar pair have fallen to the moving average line and can continue to move down. To be able to trade the downward movement, it is recommended to wait for the consolidation of traders under the moving average line, as above it the probability of resuming the upward trend remains. Also, do not forget that all trend indicators are directed upwards, so the picture for the GBP/USD pair is approximately the same as for the EUR/USD pair.

Meanwhile, the government of Boris Johnson, according to unconfirmed official information, intends to change some points of the bill on Brexit. Of course, now that Johnson has sufficient support in Parliament, he can afford to make any amendments and bills without fear of opposition. The UK Prime Minister wants to legislate to exclude the possibility of extending the Brexit transition period, which is due to end on December 31, 2020. That is, according to Johnson, the transition period will have to end in any case in 2020, even if London and Brussels will not be able to agree on the terms of a trade agreement during this time. Johnson's motivation is clear and understandable. The Prime Minister has wanted from day one to rule out any postponement of Brexit altogether. Now that the issue of the Brexit date seems to have been resolved, only the issue of the "transition period" remains unresolved, which implies that during this time the EU and Britain will agree on all trade aspects. However, the parties may not have time to agree in such a short time (11 months). According to many political analysts, during this period, you can have time to conclude only a "superficial" agreement, which is called "hastily". For example, the free trade agreement between the EU and Canada was discussed for 7 years. Johnson wants no new transfers, even if the UK economy suffers. However, the British economy and the consequences of Brexit never worried the Prime Minister. Initially, he generally wanted to leave the alliance on the "hard" scenario, without any agreements. Such a move by Boris Johnson could speed up negotiations with the EU on a trade agreement. Although, according to many experts, the legislative rejection of new postponements of the date of the final exit from the EU and the completion of the "transition period" is nothing more than a symbolic gesture. In the Conservative Party's election manifesto, it was said that trade relations with the EU will be fully agreed in 2020 and Johnson is trying to keep his promises. However, any law or bill can be amended, so there is nothing to prevent Parliament from voting in the future to extend the "transition period". Michel Barnier, the EU's chief Brexit negotiator, has previously said that some aspects of the future relationship will need to be agreed in two to three years. At the same time, until the transition period is officially completed, the UK will continue to pay contributions to the EU budget, bear other financial obligations, but will not have the right to vote. Under the agreement adopted in October, the "transition period" can be extended once for no more than two years. It is this disadvantage for the UK that Boris Johnson wants to correct by completing negotiations with the EU as quickly as possible and with any consequences.

From a technical point of view, the downward correction continues. If the bulls manage to keep the pair above the moving average line, the upward movement may still resume, but the fundamental background does not imply such a development. Tonight will be the speech of the head of the Bank of England Mark Carney. If Carney touches on the topic of monetary policy, his speech becomes potentially very interesting, as many believe that the British regulator will go for a rate cut soon and will not be able, unlike traders, to ignore the failed macroeconomic statistics of recent months.

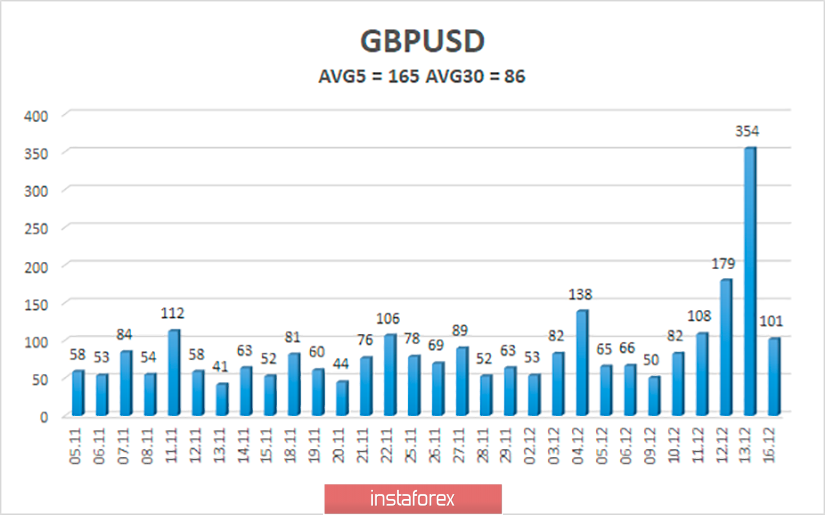

The average volatility of the pound/dollar pair over the past 5 days rose to 165 points mainly due to the last two days of last week. Over the past 30 days, the average volatility has risen to 86 points. Thus, formally, the max and min levels today are 1.3164 and 1.3490. However, it is unlikely that any of them will be worked out. We expect more subdued movement with targets near Murray's immediate levels.

Nearest support levels:

S1 - 1.3245

S2 - 1.3184

S3 - 1.3123

Nearest resistance levels:

R1 - 1.3306

R2 - 1.3367

R3 - 1.3428

Trading recommendations:

The GBP/USD pair continues to be adjusted. Thus, traders are advised to consider buying the British currency after a new reversal of the indicator Heiken Ashi upward with the nearest targets of 1.3306 and 1.3367. It is recommended to return to sales not earlier than the crossing of the moving average line by traders with the aim of Murray's level of "4/8" - 1.3184.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.