It seems that Boris Johnson's stunning victory made such a strong impression on market participants that the celebration lasted all weekend. Thus, on Monday, investors were not able to perceive any macroeconomic data there. After all, the publication of preliminary data on business activity indices both in Europe and in the United States did not make any impression on traders. Although it can be said that some still got rid of by the end of the day, a little stunned by what they saw, started to frantically buy dollars.

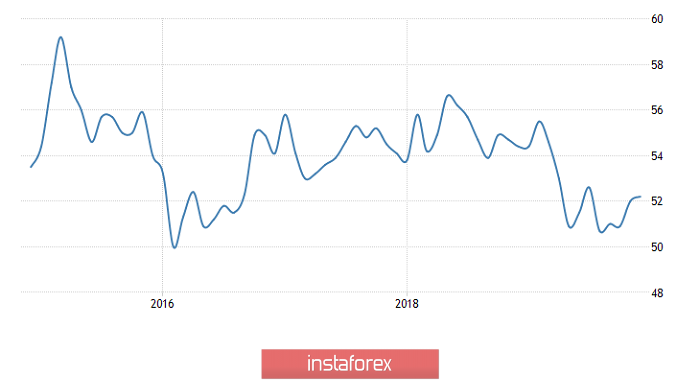

Meanwhile, these very preliminary data turned out to be quite curious. Thus, the index of business activity in the services sector in Europe grew from 51.9 to 52.4, while a decrease to 51.5. At the same time, the index of business activity in the manufacturing sector decreased from 46.9 to 45.9, instead of growing to 47.5. The funny thing is that the composite index of business activity has remained unchanged as a result of all these extremely unexpected somersaults, although they initially predicted its growth of 50.7. Therefore, as a bottomline, the data turned out to be a little worse than expected. Now, if you look at the context of individual countries in the euro area, the picture is similar. In particular, the index of business activity in the services sector in Germany grew from 51.7 to 52.0, which generally coincided with forecasts. At the same time, the index of business activity in the manufacturing sector dropped to 43.4 instead of growing from 44.1 to 44.5. As a result, the composite index of business activity remained unchanged with the forecast of its growth from 49.4 to 49.9. In France, the second eurozone economy and the business activity index in the service sector increased from 52.2 to 52.4, which is expected to decline to 52.1. However, the index of business activity in the manufacturing sector, as expected, declined, but not only from 51.7 to 51.5, but to 50.3. As a result, this led to the fact that the composite index of business activity decreased from 52.1 to 52.0. In addition, inflation data were published in Italy, which make the picture even sadder, since inflation did not increase from 0.2% to 0.4%, but remained unchanged. The picture would be incomplete without salary data in Europe, the growth rate of which slowed down from 2.8% to 2.6%.

Composite Business Activity Index (Europe):

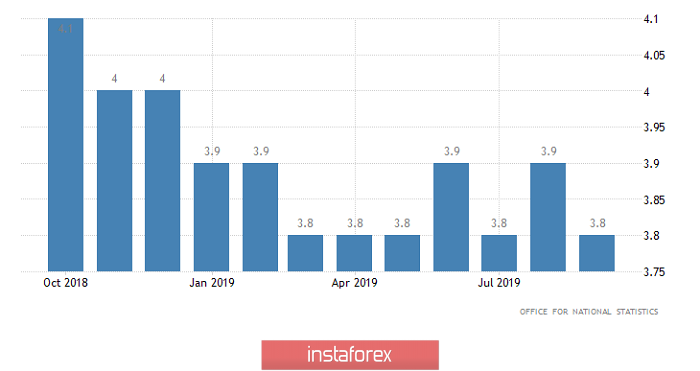

A little later, preliminary data were published on the business activity index of the United Kingdom, which turned out to be even worse. Thus, the index of business activity in the service sector, which was supposed to grow from 49.3 to 49.6, fell to 49.0. The index of business activity in the manufacturing sector decreased from 48.9 to 47.4, while they expected it to grow to 49.6. As a result, the composite index of business activity, which was supposed to grow from 49.3 to 49.6, declined to 48.5. But as mentioned above, all these data did not produce any serious effect. Rather, they were simply ignored, as the pound and the single European currency were slowly growing.

Composite Business Activity Index (UK):

At least some meaningful reaction to what happened happened only after the publication of preliminary data on business activity indices in the United States, which turned out to be slightly better than forecasts. For example, the index of business activity in the service sector grew from 51.6 to 52.2, while it was supposed to grow to 51.9. The index of business activity in the manufacturing sector decreased from 52.6 to 52.5, which fully coincided with the forecast. Nevertheless, due to a more significant increase in the index of business activity in the services sector, the composite index of business activity grew from 52.0 to 52.2. However, they were waiting for its decline to 51.9. Thus, the data is really good.

Composite Business Activity Index (United States):

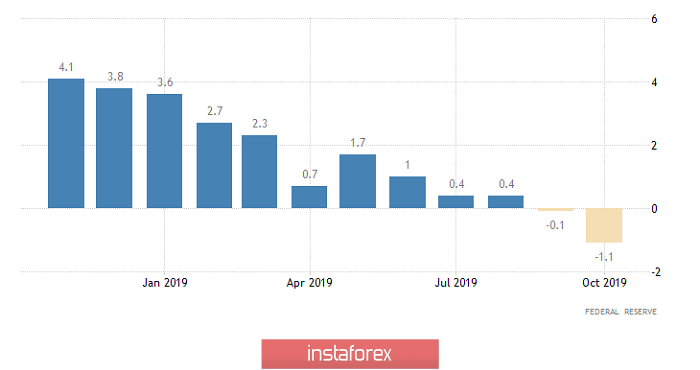

Today, a significant decline in the pound has already begun in the morning, which may be due to a belated awareness of yesterday's data, as well as preparation for today's labor market data in the UK. The forecast on them drive into melancholy. Thus, the unemployment rate should increase from 3.8% to 3.9%. This should happen due to a decrease in employment by 10 thousand. In addition, the number of applications for unemployment benefits may increase by 29 thousand. Moreover, the growth rate of the average wage, both taking into account premiums and without them, should slow down from 3, 6% to 3.4%. It turns out that the work is getting smaller, but they are also paying less for it. As we can see, such a picture can plunge anyone into darkness.

Unemployment Rate (UK):

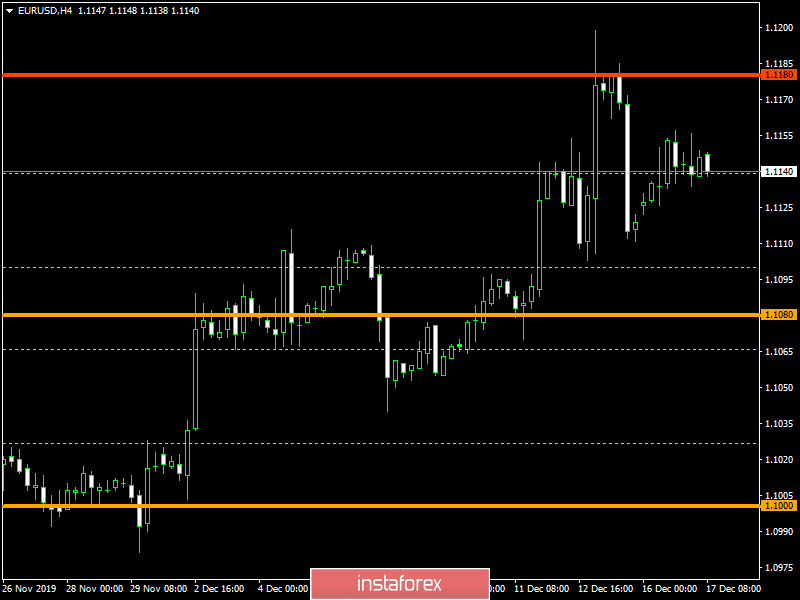

Nevertheless, there is every reason to believe that the dollar will begin to fall in price under the influence of American statistics by the evening since investors began to pay attention to macroeconomic statistics again. On the one hand, the number of construction projects launched should increase by 2.5%. However, the number of construction permits issued may be reduced by 3.2%, which indicates that the volume of construction should be noticeably reduced in the near future. In addition, the growth rate of industrial production, or rather its decline, may increase from -1.1% to -1.6%. Therefore, forecasts on American statistics are also not optimistic.

Industrial Production (United States):

The euro / dollar currency pair conditionally depended on the value of 1.1145, where it formed a slight stagnation within 1.1133 / 1.1155, where the movement is currently taking place. Thus, it is likely to assume that the characteristic fluctuation still persists in the market, but not for long. Moreover, it is worth analyzing the existing borders and working according to the breakdown method 1.1133 / 1.1155.

The pound/dollar currency pair continues to shape the recovery process, fixing itself below the level of 1.3300. Thus, it is likely to assume that the downward movement will continue to form towards the values of 1.3190-1.311 in case of price fixing lower than 1.3230.