Economic calendar (Universal time)

Today is a fairly productive day for the maintenance of the economic calendar. In the first half of the day, among the European reporting, data from the UK (9:30) deserve special attention - the average level of wages including premiums and the change in the number of applications for unemployment benefits. After lunch - time indicators from the United States. At the same time, statistics on building permits will be published At 13:30, and the number of open vacancies in the labor market at 15:00. Toward the close of the day (19:15), the performance of the head of the Bank of England is expected.

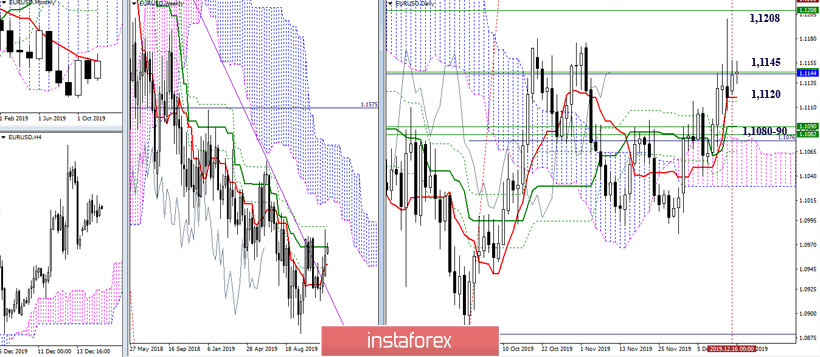

EUR / USD

During the previous day, the pair spent in the range between the support of the daily short-term trend (1.1120) and the attraction of the weekly Kijun and the monthly Tenkan, who combined their efforts at 1.1145. Today, the resistance zone remains the same and maintains its location in a fairly wide range of 1.1208 (weekly Fibo Kijun) - 1.1234-73 (target for the breakdown of the daily cloud) - 1.1253 (lower boundary of the monthly cloud) - 1.1283 (lower weekly cloud boundary). In case of breakdown of support for the daily Tenkan (1.1120), the next strengthened support line is at 1.1090-80 (weekly + daily levels).

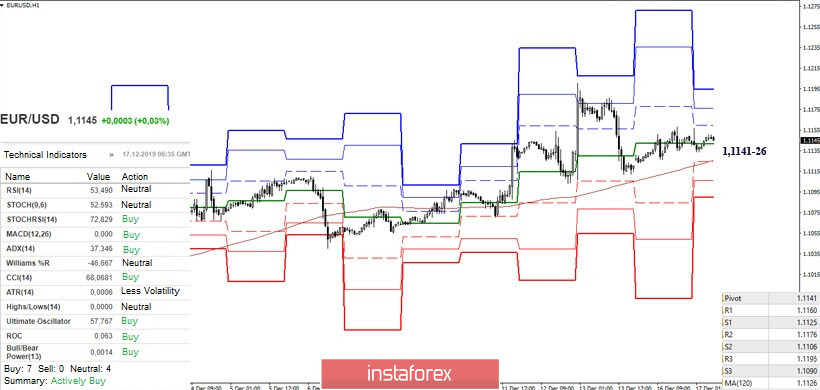

In the lower halves, the movement of the previous day can be characterized as uncertainty, the pair twisted around the central pivot level. Currently, the trend remains. Now, breaking through and firmly consolidating below key supports (1.1141-26 central pivot level + weekly long-term trend) will help strengthen bearish sentiment and create new prospects for decline. Within the day, the following pivot levels S2 (1.1106) and S3 (1.1090) may turn out to be the next supports, and R1 (1.1160) - R2 (1.1176) - R3 (1.1195) to act as resistance.

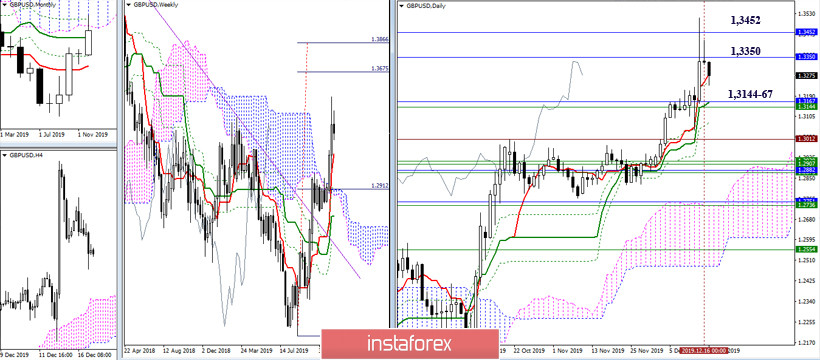

GBP / USD

The pound with the beginning of the new week continued the development of a correctional decline. The prospects of which were identified when testing the monthly resistance at the end of last week of 1.3350 (the lower boundary of the cloud) and 1.3452 (the final boundary of the dead cross). Currently, players on the downside are trying to take hold of the daily short-term trend (1.3281). The following support is concentrated in the area of 1.3144-67 (daily Kijun + weekly Tenkan + monthly Kijun).

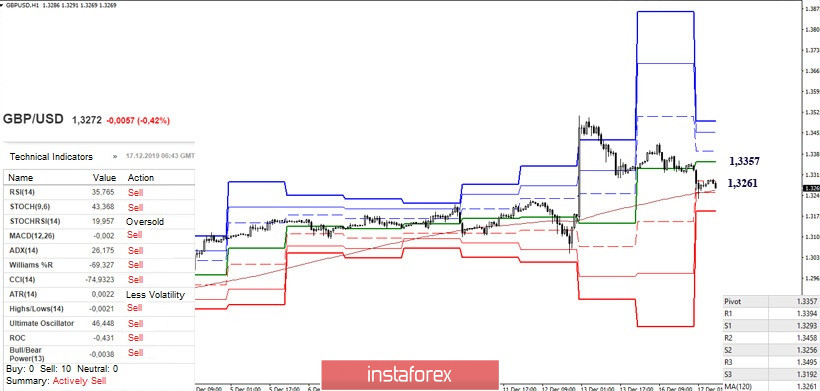

In the lower halves, there is now a struggle for a weekly long-term trend (1.3261). Now, breaking through the moving and its reversal will change the current balance of forces. Today, the next support can be the final pivot level (1.3192). At the same time, the most significant resistance in this situation is located at 1.3357 (central Pivot level).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)