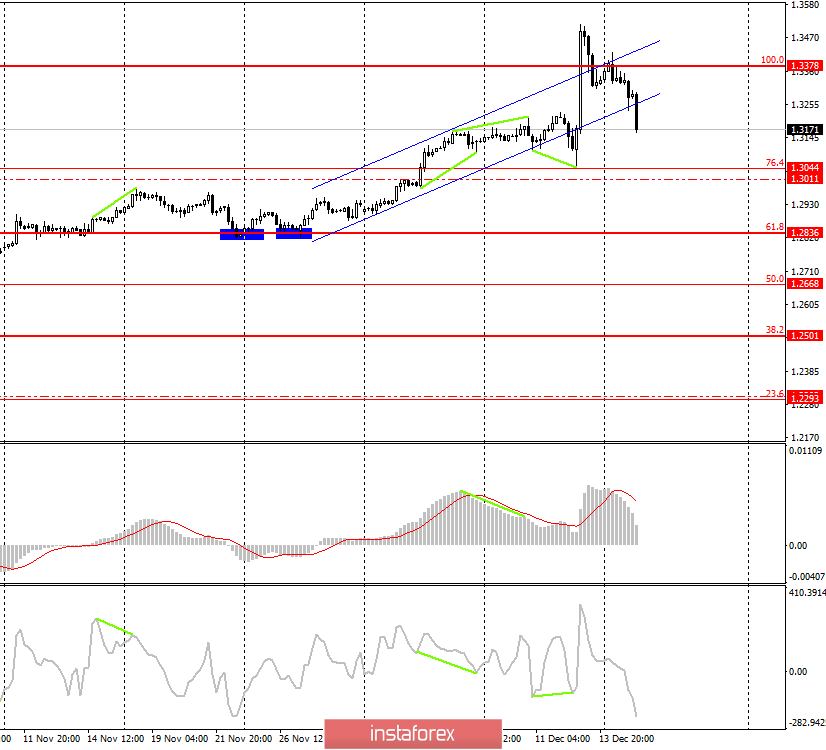

GBP/USD - 4H.

On December 17, the GBP/USD pair continues the process of falling in the direction of the Fibo level of 76.4% (1.3044) after fixing under the correction level of 100.0% (1.3378). Also, the pair performed a new fixation under the upward trend area, which significantly increases the probability of continuing the fall of the pair's quotes. The CCI indicator is already brewing bullish divergence, but it will be "corrective" in nature if at all formed. Just like the rebound from the Fibo level of 76.4%, which can only lead to a short-term increase in demand for the British currency. By and large, traders are now selling the pound, because all the significant events on which the pound has grown in recent months have either been left behind or have become completely clear. This refers to the election and Brexit.

I have repeatedly said that all the economic reports from the UK continue to disappoint traders. Saved the position of the pound in recent months, only the optimism of traders who believed in the victory of Boris Johnson in the elections and identified it with the completion of Brexit. However, the "Briton" will not be able to grow on one optimism forever. Now, I believe, the time has come when the pound can return to the more familiar rhythm of daily trading. Namely, in the rhythm of the fall. As the latest economic reports from the US show, the economy is showing plenty of signs of acceleration and growth. In the UK, yesterday, the indices of business activity in the sectors of production and services again came out with a "minus" sign concerning the previous month. Moreover, if the decline in business activity occurred above the mark of 50.0, perhaps there would be no such pessimism about the prospects of the UK economy. If Britain did not have to leave the EU soon, perhaps economic indicators would not decline at such a rate. If Britain and the government of Boris Johnson did not have long and difficult negotiations on trade relations with many countries and the EU after Brexit. However, since the harsh reality is what it is, pessimism about the pound is not groundless.

Today, the UK will release a report on unemployment, where it is expected to increase to 3.9%, the report on wages for October, which is expected to decline to 3.4%. In the US, the report on industrial production, where a solid increase of 0.8% is expected compared to October. Even at first glance, it is clear that the reports from the UK are likely to disappoint again, and the report from America will not matter much.

Forecast for GBP/USD and trading recommendations:

The pound-dollar pair performed consolidation under the Fibo level of 100.0% (1.3378). Since the election is over, the correction, which began on Friday, has every chance of continuing today. Thus, I recommend selling the pound-dollar pair with a target of 1.3044. I recommend buying a "Briton" no earlier than fixing quotes above the Fibo level of 100.0%.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.