4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - down.

CCI: -101.7675

After two months of almost continuous strengthening, the British pound continues to fall for the second day in a row. We have long said that the pound will sooner or later begin to fall, as there were no fundamental reasons for its strengthening. Yes, the British currency was in demand against the background of euphoria and optimism of market participants regarding the parliamentary elections, the victory of Boris Johnson. Yes, now the probability that Brexit will be implemented before the end of January is almost 100%. But what does this mean for the UK economy and its national currency? Something good? No. Any Brexit is a blow to the UK economy. Just a "hard" Brexit is a blow with the bat with all the force, and a "soft" Brexit is a push after which the economy can fall on one knee. But in any case, after the "divorce" between the EU and Britain, the economies of both participants in the process will again deteriorate and slow down. Only when London and Brussels manage to establish new trade ties and resolve all other issues that will determine relations between the Bloc and the Kingdom in the coming years, only then can it be stated that there will no longer be a negative impact on the economy. Thus, it is safe to say that nothing positive did happen for the UK economy from the fact that the election was won by the Conservative Party. Now Brexit will simply take place, rather than be postponed for another couple of months.

Today, December 18, the consumer price index for November will be published in the UK. Needless to say that the majority of traders and experts are waiting for the next deceleration of this indicator? Forecasts of experts say that inflation in November may slow to 1.4% yy. We believe that, given all the failed reports that have come from Albion to this day, it may cause even more weakening of inflation. That is, inflation is almost guaranteed to continue to slow down, all 4 indices of business activity in the UK are in the "red zone" - the zone of recession, all other macroeconomic indicators also leave much to be desired, GDP growth over the past three months was at best zero, at worst - there could be a reduction. And with all this, the British currency managed to rise in price. We believe it is time for a new downward trend for the British currency. Today, we also expect the pound to fall. By the way, in listing the reasons for the fall of the pound, we did not even add all the strong macroeconomic data from overseas, which should also put pressure on the pound/dollar pair.

Well, Boris Johnson, who triumphantly won the election and now has all the necessary power in the UK, is taking the first steps towards future negotiations with the EU on a trade agreement. He immediately declares that at the legislative level, he wants to abandon any prolongation of the "transition period". In practice, this means that if during 2020, London and Brussels do not agree on an agreement that will determine their future relationship, then Brexit will still take place, without an agreement. This brings us back to the original position where Boris Johnson is ready to implement a "hard" Brexit and is completely unafraid of the consequences. After all, it was under pressure from parliament that Johnson had to negotiate hastily with Brussels. Now, the parliament is not an obstacle to Johnson since most of the mandates are concentrated in his hands. So, theoretically, he can do whatever he wants. And we already saw the beginning of his actions. It seems that Johnson will now blackmail the European Union by not extending the "transition period". That is, the Europeans will need to reach an agreement with Johnson as quickly as possible, or break all agreements without concluding new ones. London is ready for this option, the European Union - is unknown. However, Michel Barnier has already stated that it may take several years to sign an agreement that will cover absolutely all aspects of the future relations between London and Brussels.

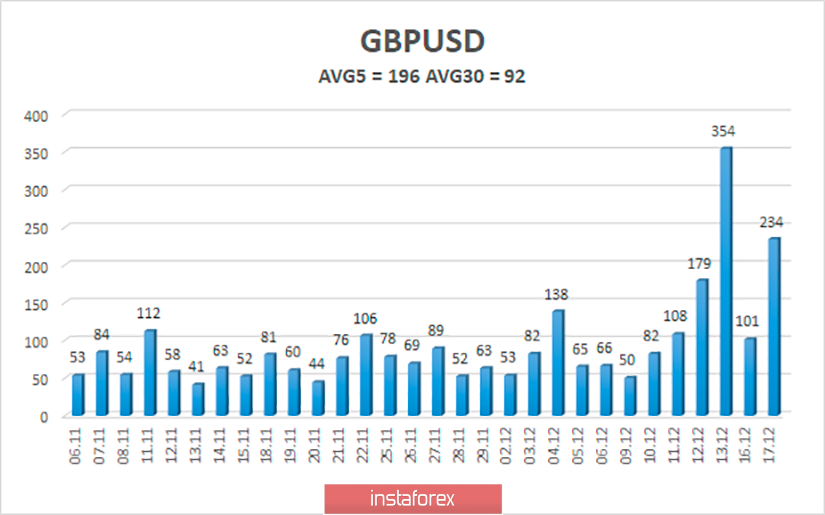

The average volatility of the pound/dollar pair over the past 5 days rose to 196 points, only now the pound shows high volatility due to its fall, not growth. Over the past 30 days, the average volatility has risen to 92 points. Thus, formally, the max and min levels today are 1.2930 and 1.3321. However, every day the pair cannot pass 200-300 points.

Nearest support levels:

S1 - 1.3062

S2 - 1.3000

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3184

R3 - 1.3245

Trading recommendations:

The GBP/USD pair continues a strong downward movement. Thus, traders are advised to consider selling the British currency with the nearest targets of 1.3062 and 1.3000 before the Heiken Ashi indicator turns upwards. It is recommended to return to the purchases of the pound/dollar pair not earlier than the reverse consolidation above the moving average line with the aim of the Murray level of "6/8" - 1.3306.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.