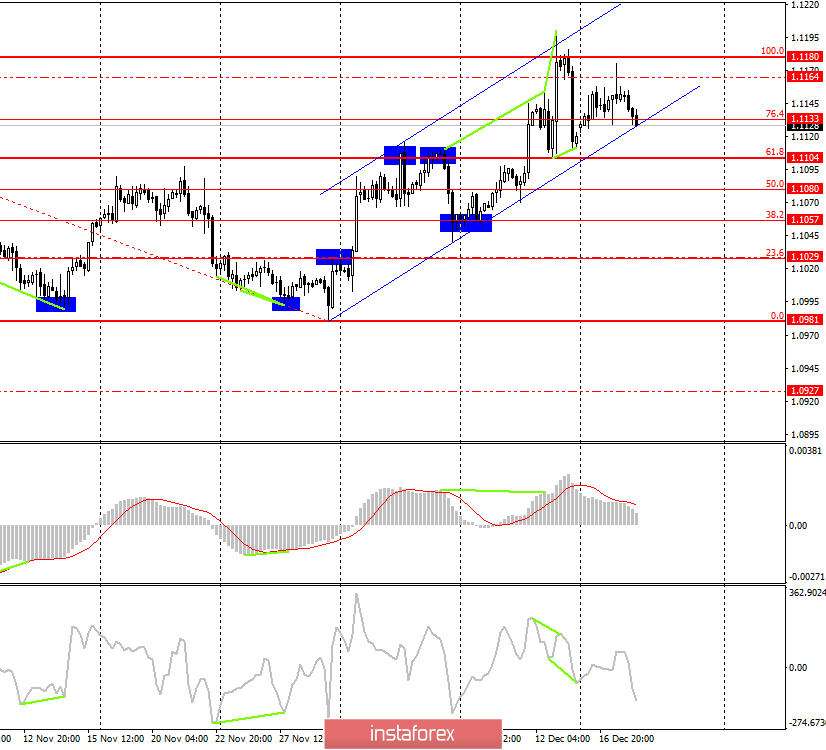

EUR/USD - 4H.

On December 16, the EUR/USD pair made a new fall to the correction level of 76.4% (1.1133), which lies near the bottom line of the upward trend range. Thus, immediately, a double rebound will allow traders to count on a reversal in favor of the European currency and the resumption of the growth process in the direction of the correction level of 100.0% (1.1180) within the trend range, which will remain in force. But the most likely option is to close the quotes of the euro-dollar pair under the level of 76.4%, which will work in favor of changing the "bullish" mood of most traders to "bearish", in favor of the US dollar and further fall in the direction of the Fibo levels of 61.8% (1.1104) and 50.0% (1.1080). Today, the divergence is not observed in any indicator.

Industrial production in America at the end of November showed a positive trend and increased by 0.8%. Traders positively perceived this information but did not rush to buy the US currency. It seems that the deterrent for bear traders is now the case for the impeachment of Donald Trump, which has been considered by various congressional legal committees for several weeks and is now referred to the House of Representatives for voting. The vote will be held today, and there is no doubt what results we will see. Most of the House of Representatives are Democrats.

Donald Trump himself, in his usual manner, managed to accuse everyone involved in the impeachment case of an attempted coup. The President of the United States wrote a six-page letter to Speaker of the House of Representatives Nancy Pelosi, in which he protested to the Democrats because of impeachment. From a legislative point of view, Democrats have the right to begin the impeachment process, they have the right to investigate the activities of the US President, who himself wanted to investigate the activities of his main rival in the 2020 elections, Democrat Joe Biden. Therefore, all attempts to bring charges against Democrats look completely unconvincing. According to Trump, the impeachment investigation is "an unprecedented and unconstitutional abuse of power" by Democrats. "This is nothing but an illegal coup attempt that will fail during a vote in both houses of Congress," Trump said. Unfortunately for all of Donald Trump's opponents, the US President is most likely right. The Lower House is likely to approve the impeachment, but the Upper House, consisting of Republicans, is likely to refuse. Moreover, in the 250-year history of the United States, it has never happened that a President has been dismissed. Two times, under the pressure of impeachment proceedings, presidents themselves left the office. Something tells us that Trump will not resign himself. In any case, this is a very interesting topic, but the dollar has not yet fully responded to it. We need to wait for the development of events. If it comes to the Senate, then various options will be possible.

Forecast for EUR/USD and trading recommendations:

On December 18, traders will try to continue the fall of the euro-dollar pair. The latest reports from the eurozone showed weakness again. Today, this list can complement the inflation report. Thus, soon, we should expect a close under the trend range, which will allow bear traders to sell the pair again with the targets of 1.1080 and 1.1057.

The Fibo grid is based on the extremes of October 21, 2019, and November 29, 2019.