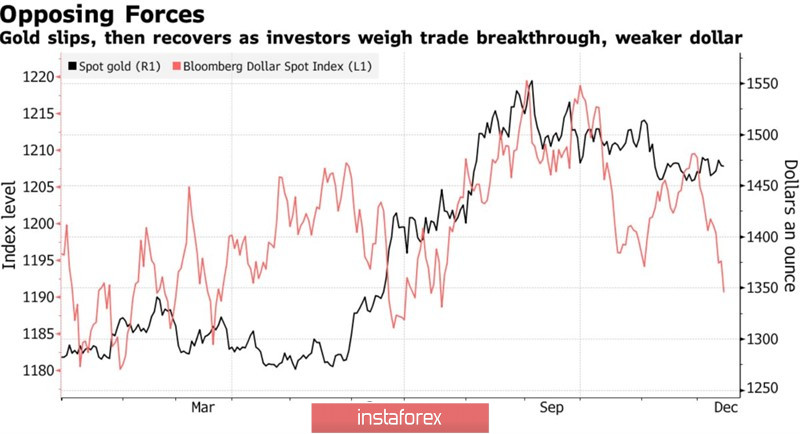

If someone expected that in response to the news about the imminent conclusion of a trade agreement between the US and China, gold would fall down with a stone, then he was deeply mistaken. The precious metal has remained stable for at least three reasons. First, the market was set to a positive outcome of the negotiations, therefore this factor was already taken into account in XAU / USD quotes in many respects. Second, the parties did not clarify all the details of the transaction, and maintaining uncertainty is a "bullish" factor for safe-haven assets. And finally, support for gold is provided by the weakening US dollar.

If in September-November, the US currency moved in the same direction as the S&P 500 which created serious difficulties for the precious metal, the situation changed slightly after the White House announced a deal with Beijing. The stock index has been growing for five consecutive trading days which is its best monthly dynamics the dollar, on the contrary, froze. Neither strong statistics on industrial production, new vacancies and the construction sector, nor the Fed's willingness to keep the federal funds rate at 1.75% throughout 2020 can move the EUR / USD pair out of place. As a result, gold froze near the lower limit of the range of the previous consolidation of $ 1475-1515 per ounce.

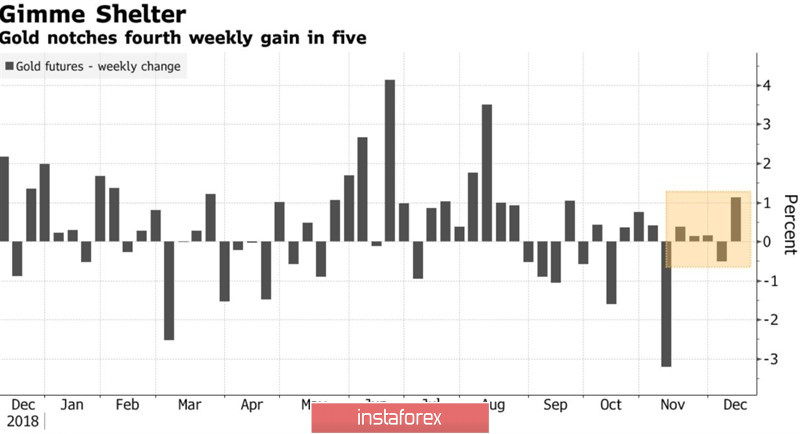

Weekly gold dynamics

The dynamics of gold and the US dollar

Obviously, next year, factors such as changes in the global risk appetite and the behavior of the USD index will affect the fate of XAU / USD. In this regard, a BofA Merrill Lynch survey of 247 global investors who manage $ 750 billion, and a Bloomberg study of the views of large banks on EUR / USD prospects can clarify the situation. About 50% of managers said they expect strong growth in the global economy in 2020, 22% talk about weak growth. The net number of optimists increased by 66 percentage points compared with the previous October study, which is the most serious positive leap for the entire time of such polls. If so, the rally of global stock indices will continue. Not good news for precious metals.

Bloomberg experts, on the contrary, delight his fans. They expect that thanks to the recovery of the eurozone economy, the euro will grow to $ 1.16. The US dollar will lose ground due to the return to the market of the recession of the US economy, which will increase the risks of lowering the Fed rate on federal funds.

Thus, polls paint a mixed picture for gold. But in my opinion, there are other factors that can support it. We are talking about impeachment and presidential elections in the United States, which heat up political risks and create the prerequisites for the correction of stock indices, as well as a trade war between the States and the EU. Encouraged by the successes of his policy, Donald Trump is already looking towards the Old World.

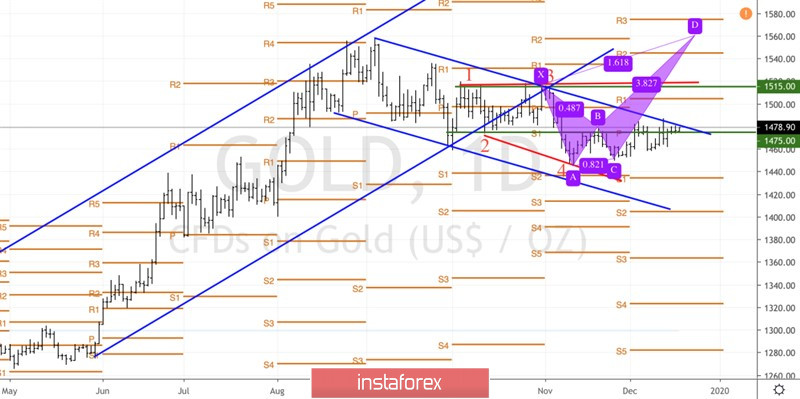

Technically, gold quotes going beyond the descending trading channel and fixing them within the previous consolidation of $ 1475-1515 per ounce will give the bulls hope for the activation of the Expanding Wedge pattern, for the completion of the correction and for the implementation of the 161.8% target for the "Crab model".

Gold daily chart